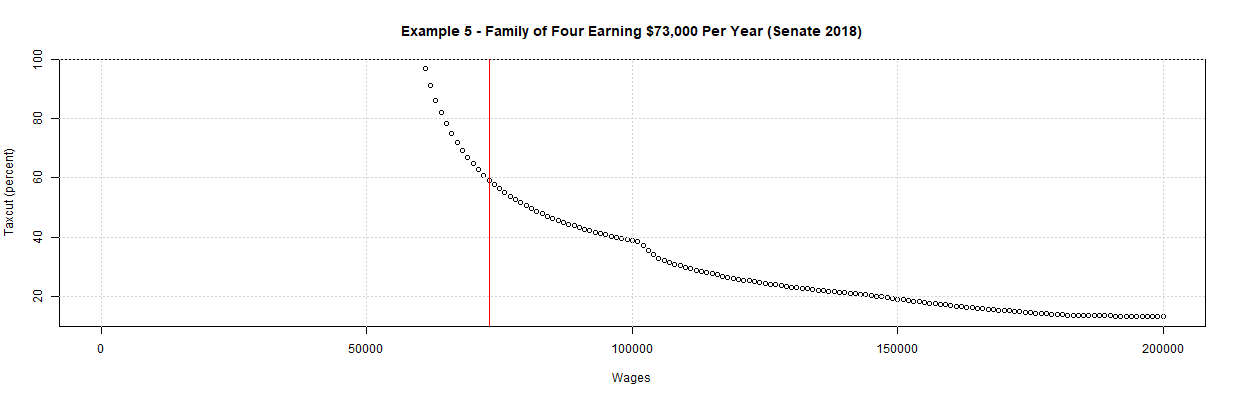

Selecting "Example 5 - Family of Four (Senate)" in the "Tax Examples" select list causes the following table and plot to be output:

Example 5 - Family of Four Earning $73,000 Per Year

Names Taxes Released

1 Current 2017 3682.50000 3683

2 Senate 2018 1499.00000 1499

3 Change -2183.50000 -2184

4 % Change -59.29396 nearly 60 percent

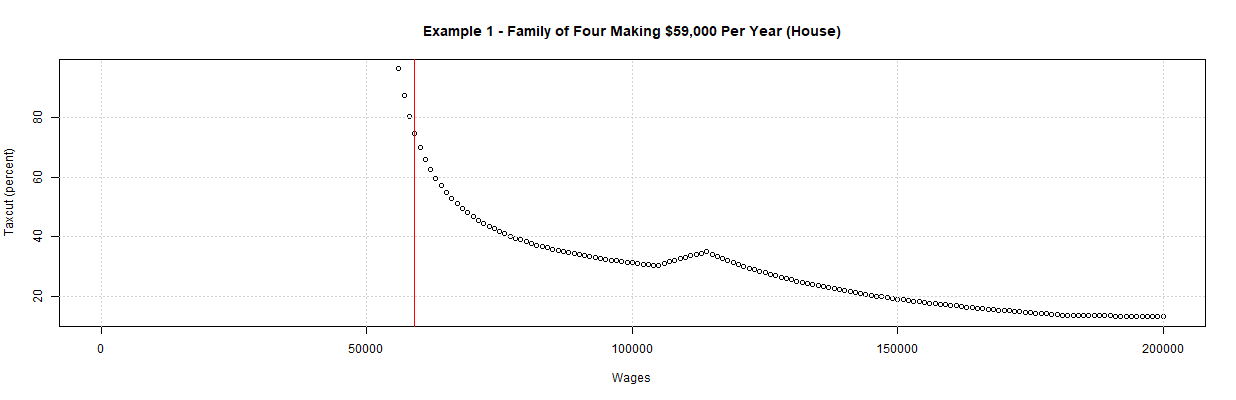

The "Taxes" column are the numbers calculated by the application and the "Released" column are the numbers released by the Senate committee for their first example. As can be seen, the numbers are identical (when rounded to the nearest dollar). The plot shows the calculated percent tax cut for this example for all incomes up to $200,000 which have tax cuts up to 100 percent. As can be seen, the tax cut is about 100 percent at about $60,000 (actually $60,509) but is still positive at $200,000 (at about 13 percent). The vertical red line is at $73,000, relatively close to the income with the maximum tax cut shown in the plot.

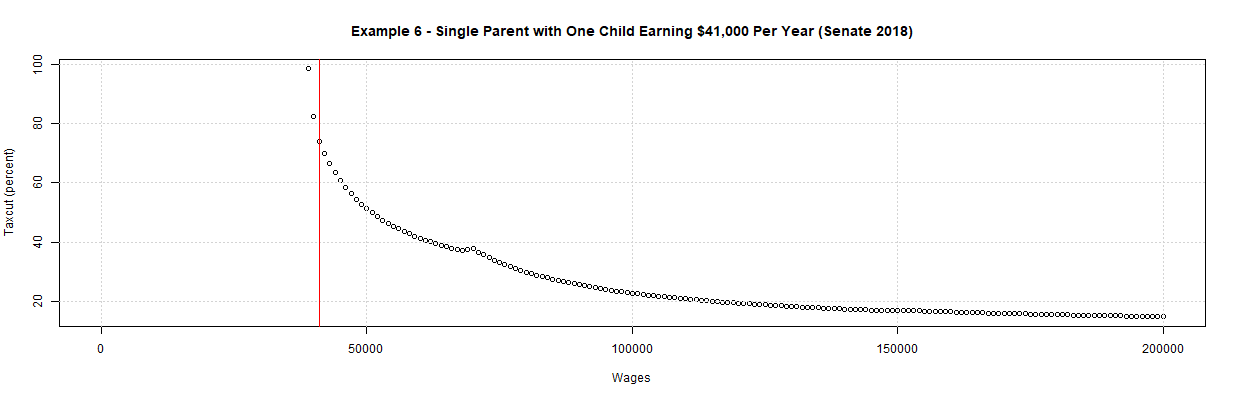

Selecting "Example 6 - Single Parent, One Child (Senate)" in the "Tax Examples" select list causes the following table and plot to be output:

Example 6 - Single Parent with One Child Earning $41,000 Per Year

Names Taxes Released

1 Current 2017 1865.00000 1865

2 Senate 2018 488.00000 488

3 Change -1377.00000 -1377

4 % Change -73.83378 nearly 75 percent

The columns are the same as before but now are for the Senate committee's second example. As can be seen, the calculated and released numbers in the table are identical. As before, the plot shows the calculated percent tax cut for this example for all incomes up to $200,000 which have tax cuts up to 100 percent. As can be seen, the tax cut is about 100 percent at about $40,000 (actually $38,915) but is still positive at $200,000 (at about 15 percent). The vertical red line is at $41,000, very close to the income with the maximum tax cut shown on the plot.

There's a problem with the above two examples, however. They are comparing the taxes in 2017 under current law with the taxes in 2018 under the Senate plan. Because certain items like the tax brackets and the standard deduction increase with inflation, taxes tend to go down on a salary which does not increase with inflation. For example, comparing taxes for the above two examples for 2017 and 2018 under current law results in an apparent tax cut of 3.39 and 3.89 percent respectively. This is relatively small but should be accounted for. Hence, following are the results for the two example comparing the taxes in 2018 under current law with the taxes in 2018 under the Senate plan.

Married, 2 children, 0 dependents, 73000 in wages Household, 1 children, 0 dependents, 41000 in wages

Names Taxes Released Names Taxes Released

1 Current 2018 3557.50000 3683 1 Current 2018 1792.50000 1865

2 Senate 2018 1499.00000 1499 2 Senate 2018 488.00000 488

3 Change -2058.50000 -2184 3 Change -1304.50000 -1377

4 % Change -57.86367 nearly 60 percent 4 % Change -72.77545 nearly 75 percent

As can be seen, the change is not great but does make a difference. In any event, the above two plots show a problem with discrete taxpayer examples. Such examples don't show the variation of a tax cut across incomes, even when all of the other parameters are the same. Still, both of these two examples did seem to show tax cuts across incomes, even if the size of the tax cut may vary. Are there examples in which taxpayers don't get a tax cut?

To answer this question, it helps to look at exactly which changes in the law lead to the tax cuts. The "Calculation of Taxes" tab shows the actual calculation of taxes under the different plans. Following is the output for the two examples:

Example 5 - Family of Four Earning $73,000 Per Year Example 6 - Single Parent with One Child Earning $41,000 Per Year

Tax Plan 2018 Senate 2018 Change Tax Plan 2018 Senate 2018 Change

1 --------------------------- -------- -------- -------- 1 --------------------------- -------- -------- --------

2 Wages, salaries, tips, etc. 73000 73000 0 2 Wages, salaries, tips, etc. 41000 41000 0

3 Exemptions -16600 0 16600 3 Exemptions -8300 0 8300

4 Standard deductions -13000 -24000 -11000 4 Standard deductions -9550 -18000 -8450

5 Itemized deductions 0 0 0 5 Itemized deductions 0 0 0

6 --------------------------- -------- -------- -------- 6 --------------------------- -------- -------- --------

7 Medical 0 0 0 7 Medical 0 0 0

8 State and local taxes 0 0 0 8 State and local taxes 0 0 0

9 Real estate taxes 0 0 0 9 Real estate taxes 0 0 0

10 Home mortgage interest 0 0 0 10 Home mortgage interest 0 0 0

11 Charity 0 0 0 11 Charity 0 0 0

12 Misc. repealed deductions 0 0 0 12 Misc. repealed deductions 0 0 0

13 --------------------------- -------- -------- -------- 13 --------------------------- -------- -------- --------

14 Taxable income 43400 49000 5600 14 Taxable income 23150 23000 -150

15 --------------------------- -------- -------- -------- 15 --------------------------- -------- -------- --------

16 Tax on taxable income 5557.5 5499 -58.5 16 Tax on taxable income 2792.5 2488 -304.5

17 Child credit -2000 -4000 -2000 17 Child credit -1000 -2000 -1000

18 Other dependent credit 0 0 0 18 Other dependent credit 0 0 0

19 Parent credit 0 0 0 19 Parent credit 0 0 0

20 Earned income tax credit 0 0 0 20 Earned income tax credit 0 0 0

21 --------------------------- -------- -------- -------- 21 --------------------------- -------- -------- --------

22 Amount owed 3557.5 1499 -2058.5 22 Amount owed 1792.5 488 -1304.5

As can be seen, the one increase in taxes is Exemptions. This is because the Senate bill eliminates the deduction for exemptions. The exemption amount in current 2018 law is $4,150. Hence, a family of four loses $16,600 (4 * $4,150) and a single parent with one child loses $8,300 (2 * $4,150) from the elimination of this deduction.

The two major decreases in taxes is Standardized deductions and the Child credit. This is because the former almost doubles and the latter does double. This leads naturally to the question of how taxpayers who don't benefit from these two changes in the tax law would do. The latter would obviously be taxpayers who have no eligible children and the former would be taxpayers who itemize deductions. In addition, taxpayers who have many non-child exemptions would seem to be worse off by the new tax law.

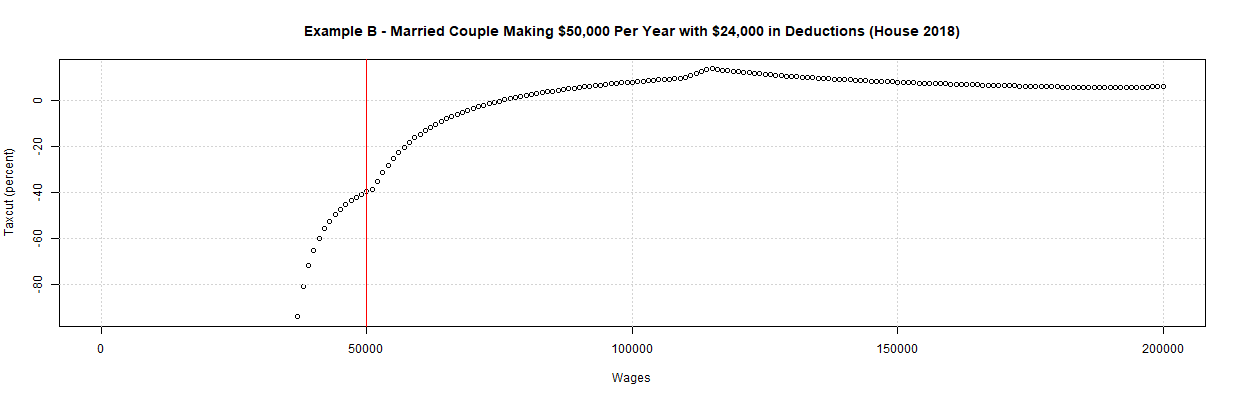

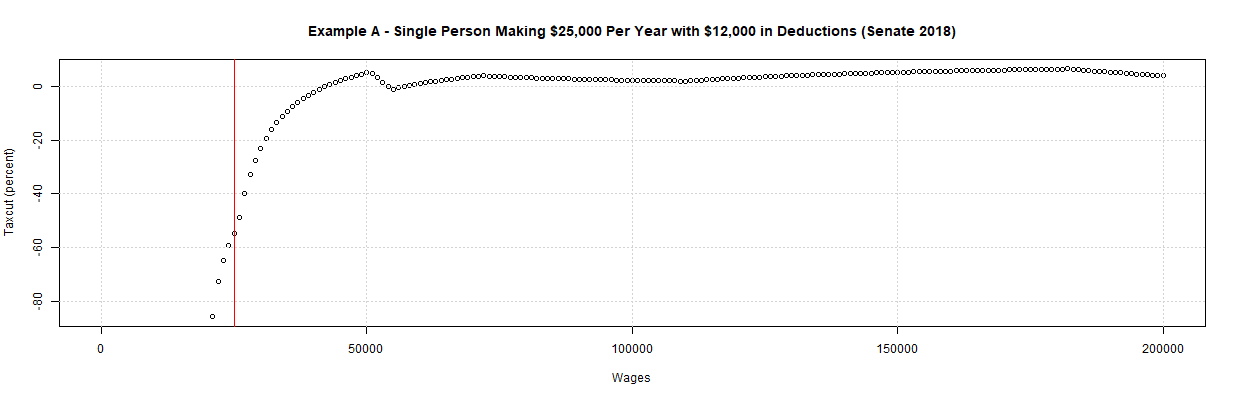

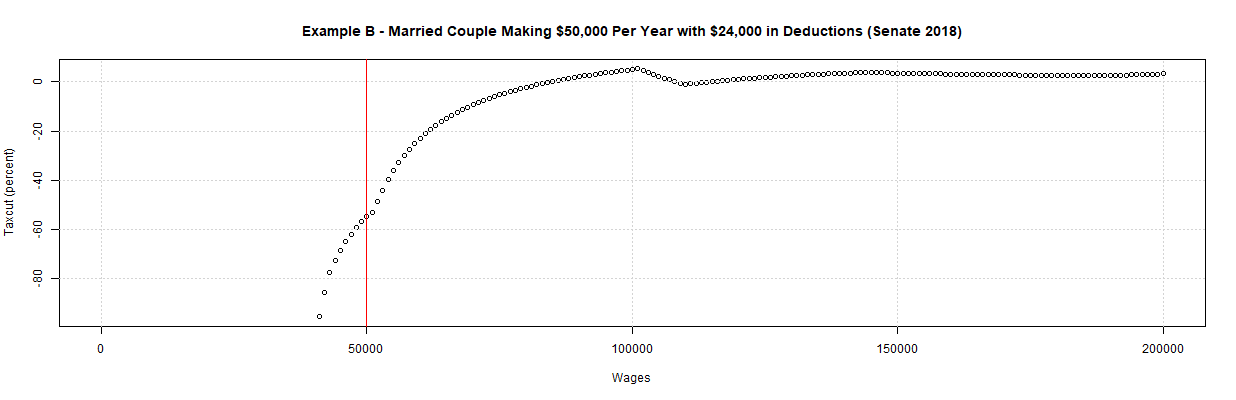

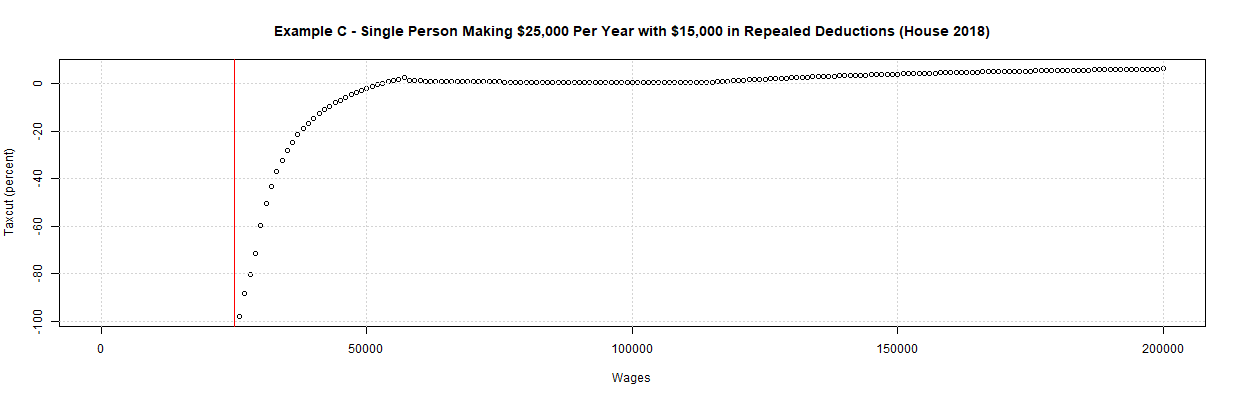

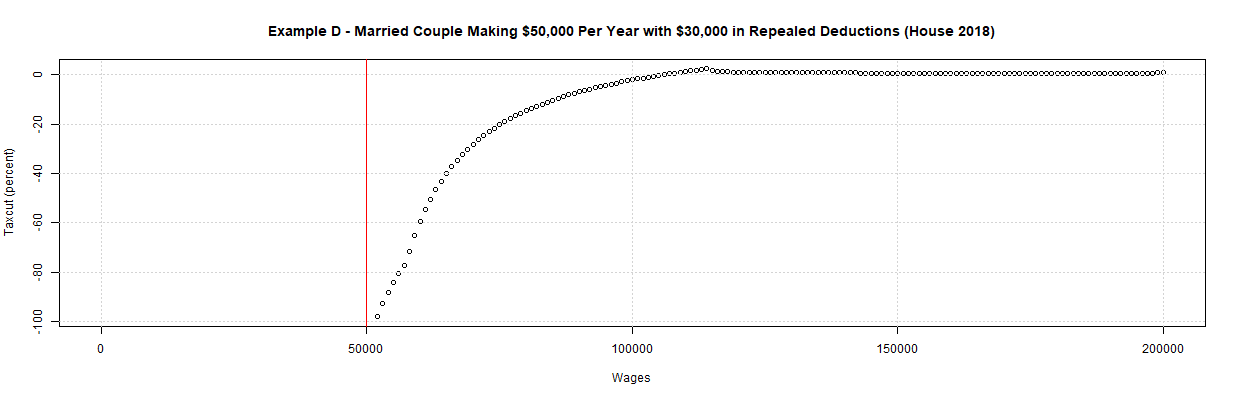

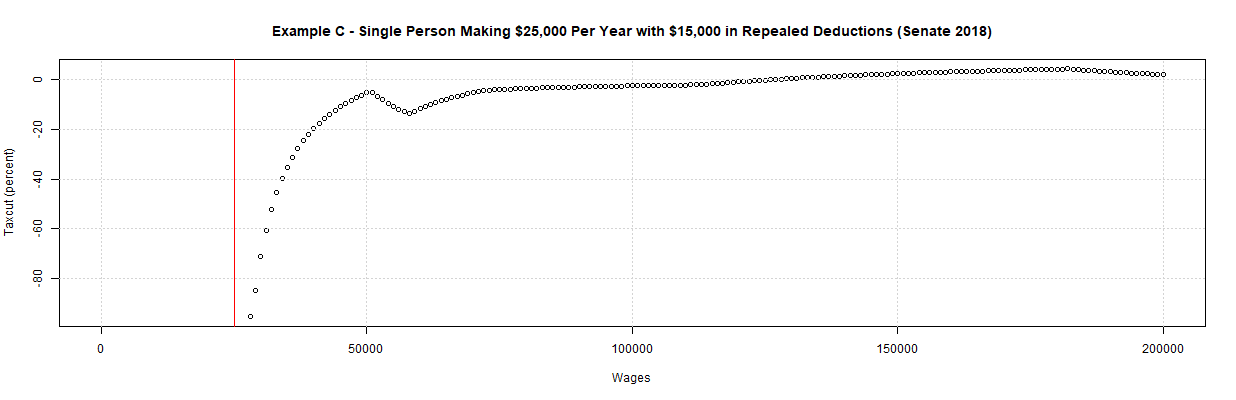

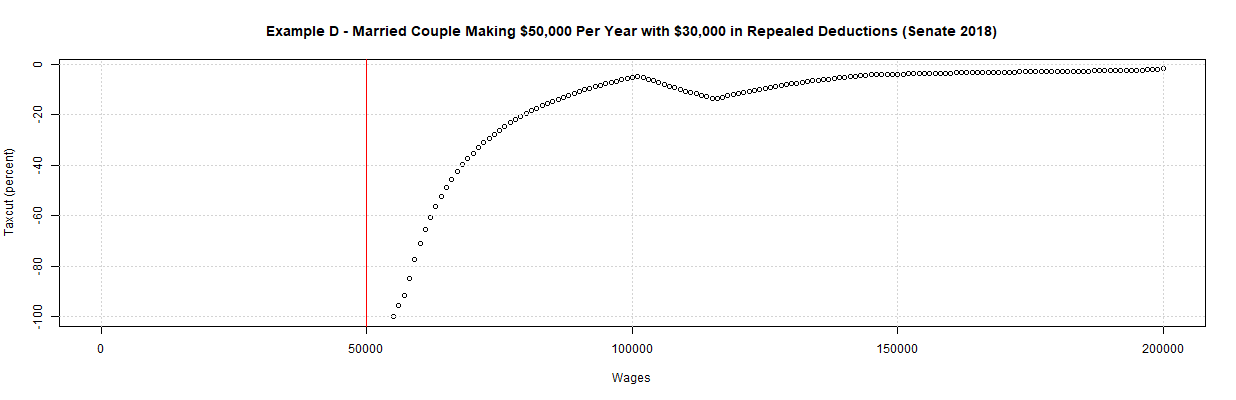

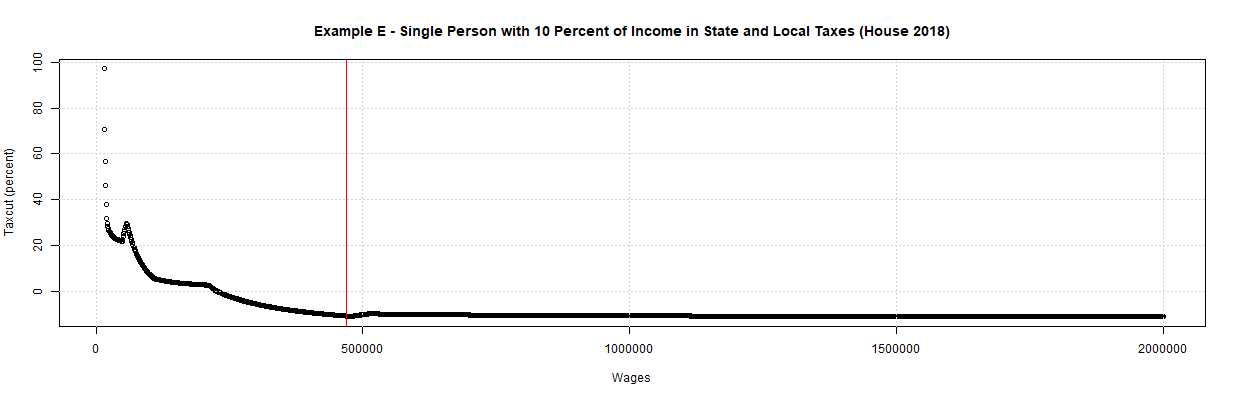

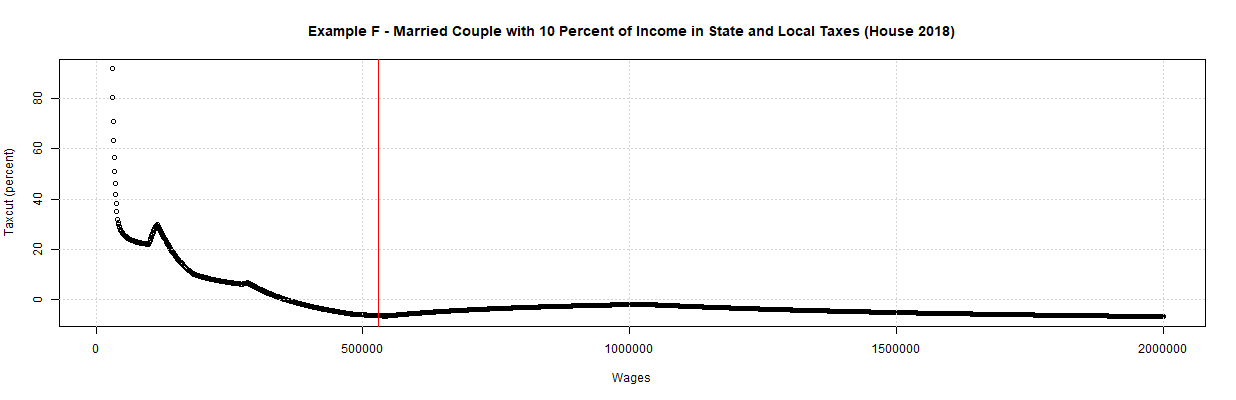

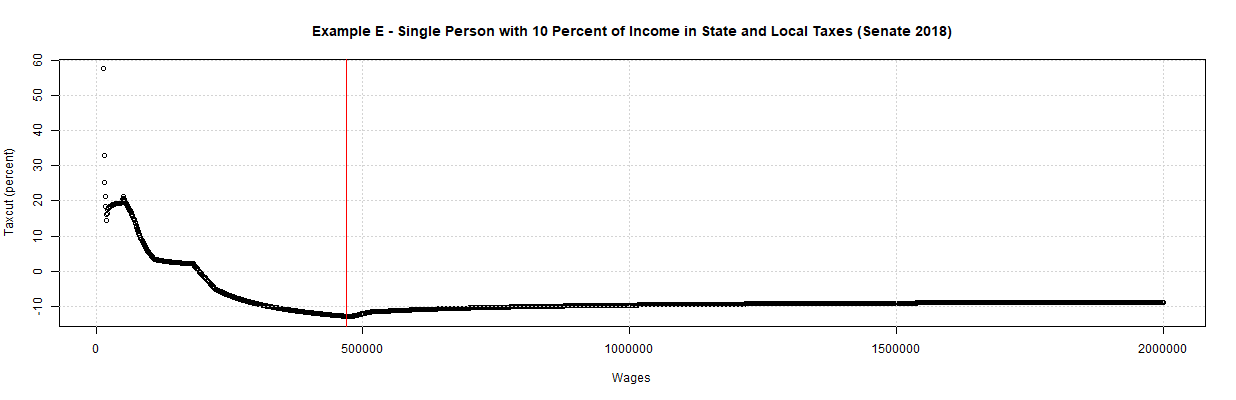

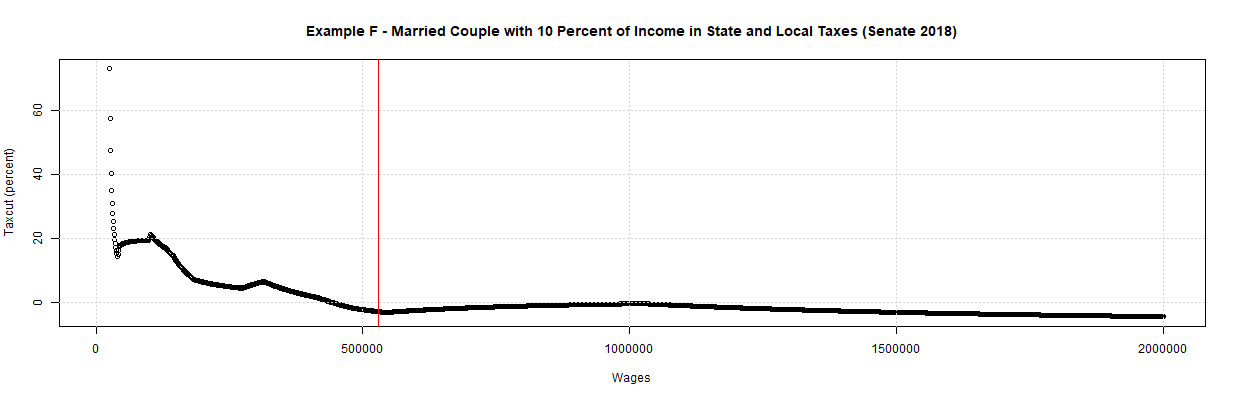

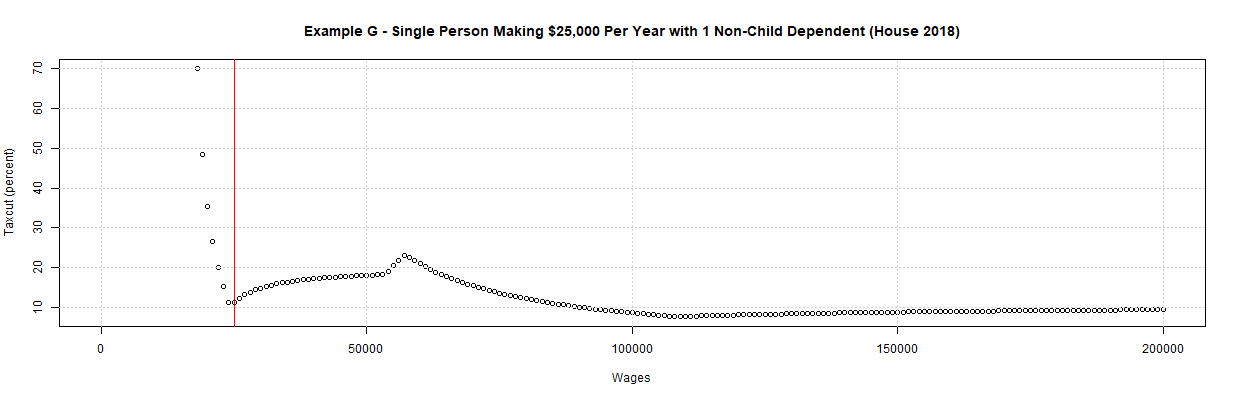

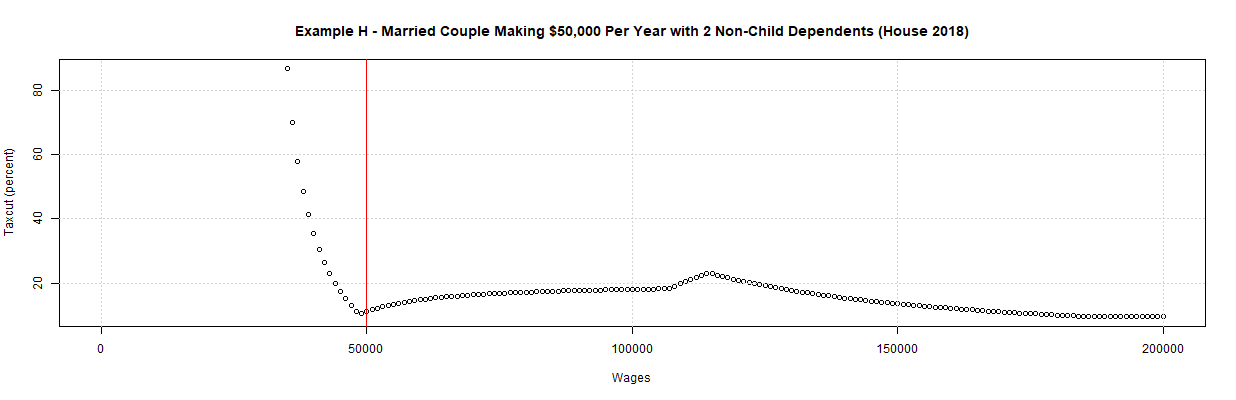

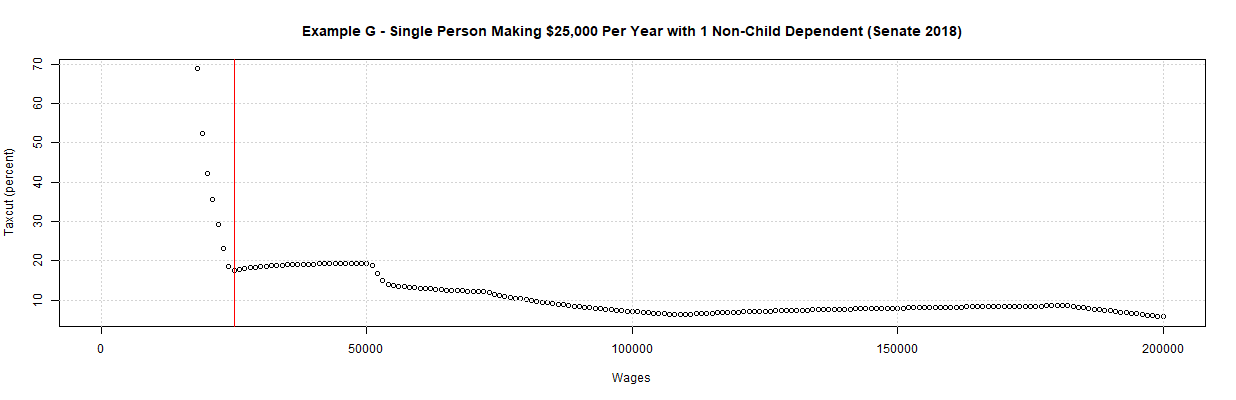

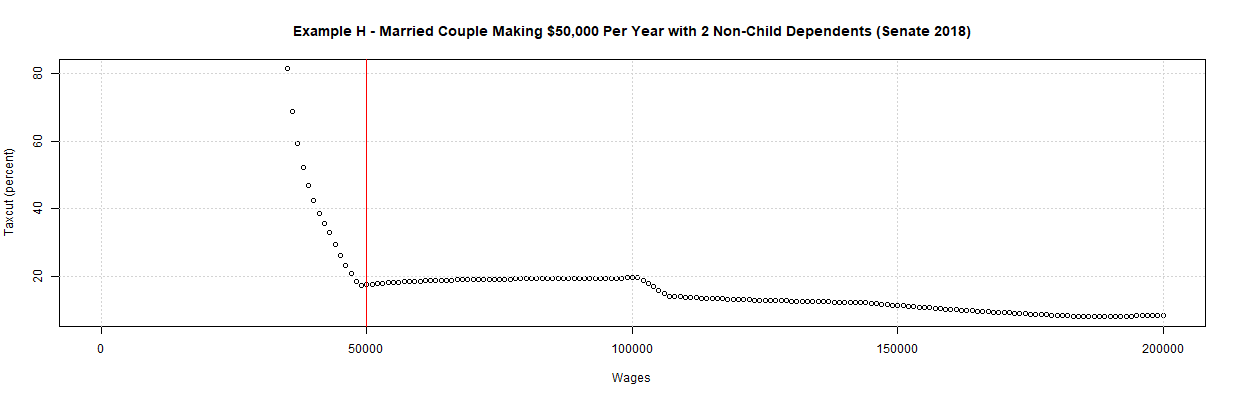

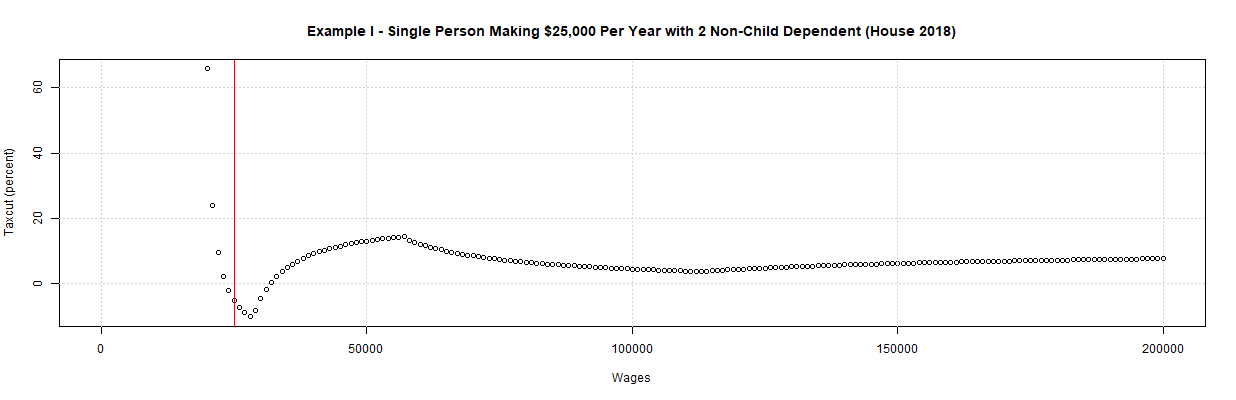

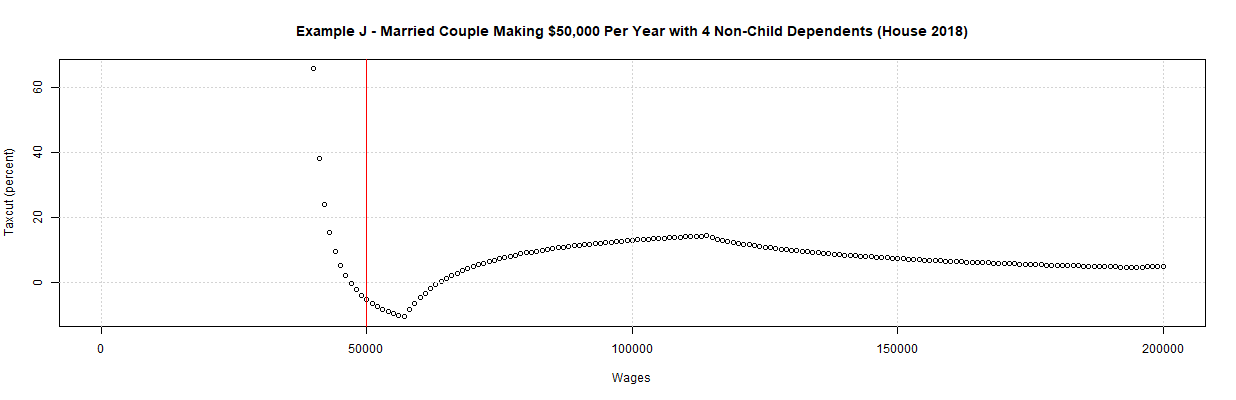

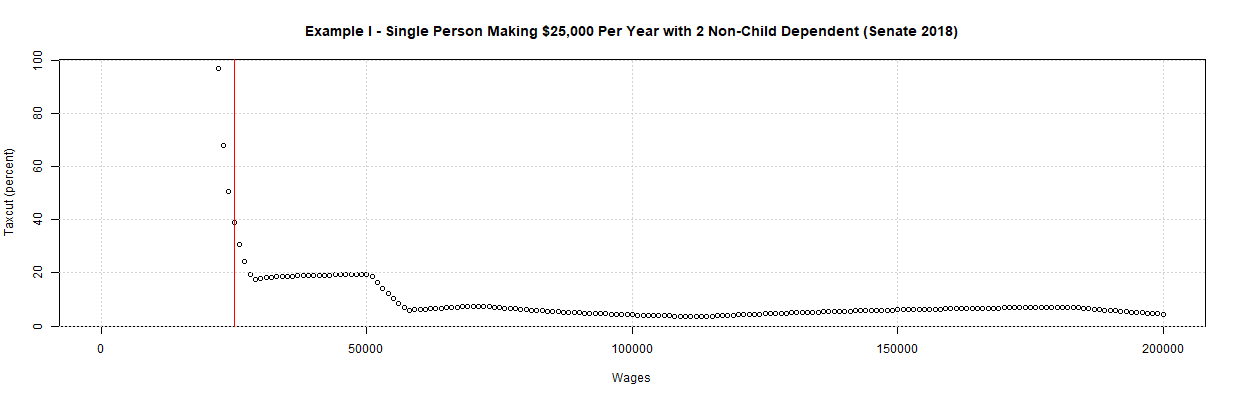

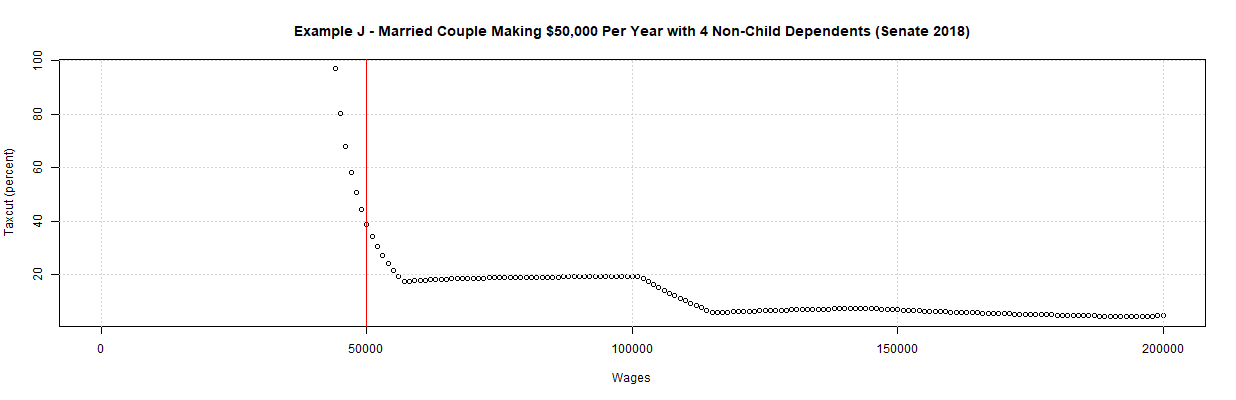

These cases are covered in my prior post. Examples A and B look at taxpayers who have no child credits and who itemize up to the approximate level of the new standard deduction. Examples C and D look at such taxpayers who also have an additional several thousand dollars of deductions which have been eliminated. Examples E and F look at taxpayers who pay 10 percent of their income in state and local taxes. Finally, Examples G through J look at taxpayers who have one or more non-child dependents.

As described there, Examples A through D show taxpayers with lower incomes who will end up paying higher taxes immediately whereas Examples E and F show taxpayers with higher income who will end up paying more. Examples G through J do not show any taxpayers with non-child dependents (but who use the standard deduction) who will pay higher taxes. This is likely because the Senate bill provides a credit of $500 for such dependents which appears to make up for the loss of the exemption.

As mentioned in my prior post, it should be noted that these examples don't include a number of major components that should greatly favor taxpayers with higher income. Those components include repeal of the alternative minimum tax, a large tax cut for some “pass-through” income of individual business owners, and the large corporate tax cut. There's also the repeal of the estate tax which will chiefly benefit taxpayers of great wealth, if not great income.

Still, the above information shows the severe limitations of the discrete examples released by the Senate Committee of Finance. It also shows how the examples can be examined over all incomes and additional examples can be found and examined to obtain a broader view of the effect of the Senate tax plan will have on taxpayers. Those who release discrete examples would do well to likewise broaden their analysis. At the very least, they would do well to show the calculations that lead to their results. This would serve to both verify the calculations and to show which tax measures are having the greatest effect on the results.

The Problems with "Taxpayer Examples"

The Problems with "Taxpayer Examples" (Part 3)

Who Will See Their Taxes Go Up under the House and Senate Plans?