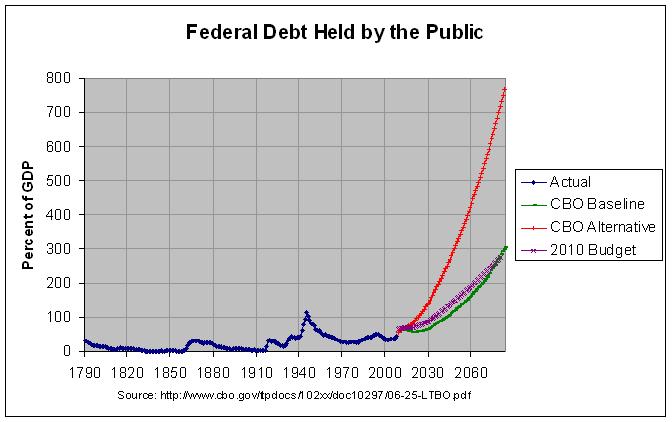

The actual numbers and sources for this and the following graph are at http://www.econdataus.com/pro2010.html. As can be seen, the CBO document provides two projections, one for the "extended baseline scenario" and one for the "alternative fiscal scenario". The former appears to be very close to 2010 Budget projections. Regarding these projections, the 2010 Budget states the following on page 190 of the Analytical Perspectives:

The long-run budget projections in this section extend the particular policies proposed in the 2010 Budget, but do not reflect the long-term impacts from slowing health care cost growth. Although the Budget offers major initiatives in many areas that are needed to put the economy on a sounder long-run footing, the Administration recognizes that not all of the needed policy initiatives have been formulated. In particular, the Administration’s plans for health reform are still under development in consultation with Congress. The budget projections in this chapter reflect the fact that simply extending current laws and policies would leave the budget in an unsustainable position.

Similarly, following is a description of the two sets of CBO projections from page 1 of the CBO document:

The “extended-baseline scenario” adheres most closely to current law, following CBO’s 10-year baseline budget projections for the next decade and then extending the baseline concept beyond that 10-year window.1 The scenario’s assumption of current law implies that many policy adjustments that lawmakers have routinely made in the past will not occur.

The “alternative fiscal scenario” represents one interpretation of what it would mean to continue today’s underlying fiscal policy. This scenario deviates from CBO’s baseline even during the next 10 years because it incorporates some policy changes that are widely expected to occur and that policymakers have regularly made in the past. Different analysts might perceive the underlying intention of current policy differently, however, and other interpretations are possible.

Hence, both the 2010 Budget and the CBO extended baseline projections are based on current law. The CBO alternative fiscal projections, on the other hand, are based on policies that are not written into current law but are "widely expected to occur and that policymakers have regularly made in the past". These assumptions are summarized in Table 1-1 in the CBO report. On the spending side, the main difference is that the alternative fiscal scenario assumes that physician payments from Medicare will be higher than under current law and that spending other than Social Security, Medicare, Medicaid, interest, and stimulus-related spending will remain at its projected 2009 share of GDP. On the revenue side, the main difference is that the alternative fiscal scenario assumes that the Bush tax cuts will be extended and that the AMT (Alternate Minimum Tax) parameters will continue to be adjusted for inflation as they have in the past.

The following table shows the estimated levels of spending and revenues (and the resulting deficits) in the year 2080 for all three sets of projections:

BUDGET PROJECTIONS FOR THE YEAR 2080 (percent of GDP)

2010 Extended Alternate Extended

Budget Baseline Fiscal - Alt

---------------- -------- -------- -------- --------

Primary Spending 27.0 31.7 34.4 2.7

Interest 11.2 11.9 30.3 18.4

---------------- -------- -------- -------- --------

Total Spending 38.2 43.7 64.7 21.0

Revenues 22.6 25.9 21.9 -4.0

---------------- -------- -------- -------- --------

Deficit -15.5 -17.8 -42.8 -25.0

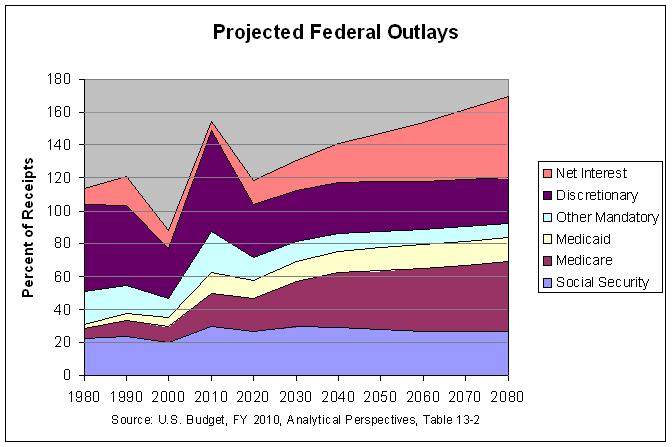

As can be seen from the last column, the difference in revenues between the two CBO scenarios is somewhat larger than the difference in non-interest spending. Hence, the extension of the Bush tax cuts and AMT fix is projected to have a significant effect on the deficit and debt. However, the table also shows that, once the debt starts growing rapidly, interest costs likewise start growing rapidly and become the predominant problem. This is similarly shown in the following graph which shows the projected growth in outlays according to the 2010 budget.

As can be seen, net interest costs start rising rapidly starting in about 2020, in response to the rapidly rising debt. The non-interest outlay that appears to grow the fastest is Medicare.

It is important to note that these are projections based on current law, not predictions of what will actually happen. It is likely that something will change well before the debt reached such historically high levels. On this topic, page 192 of the Analytical Perspectives states the following:

These rising deficits would drive publicly held Federal debt as a ratio to GDP to levels well above the previous peak level reached at the end of World War II and beyond. Before the debt reaches the levels shown in the table, there would likely be a financial crisis that would force budgetary changes, although the timing of such a crisis and its resolution are impossible to predict. Timely reforms, especially those that lowered the trend of health care costs, could go far to avoid such a crisis.