KEY DATES FOR THE TRUST FUNDS

OASI DI OASDI HI

----- ----- ----- -----

First year outgo exceeds income

excluding interest................ 2018 2005 2017 2007

First year outgo exceeds income

including interest................ 2028 2013 2027 2011

Year trust fund assets are exhausted 2042 2026 2041 2019

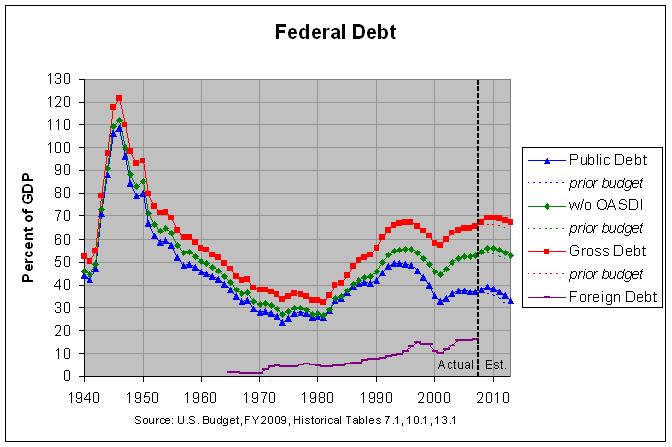

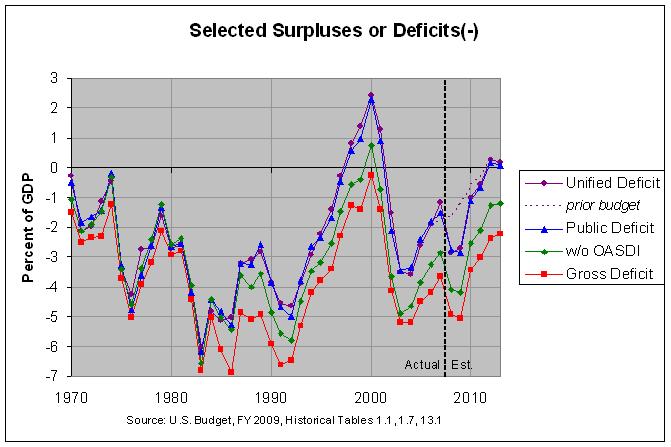

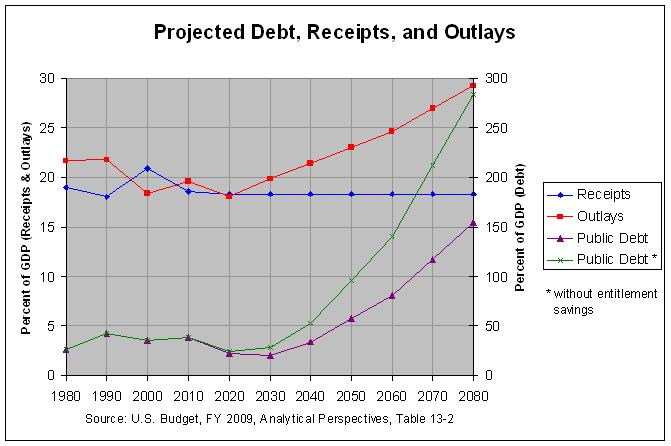

OASI refers to the Old-Age and Survivors Insurance Trust Fund, DI refers to the Disability Insurance Trust Fund, and OASDI refers to the combination of those two funds. Finally, HI refers to the Medicare Hospital Insurance Trust Fund, also referred to as Medicare Part A. As can be seen, the OASDI and HI trust funds are projected to run out of funds in 2041 and 2019, respectively. This is reflected in the following graph which is based on long-run budget projections from page 188 of the Analytical Perspectives in the recently-released budget:

The actual numbers and sources are at http://www.econdataus.com/pro2009.html. As can be seen, the debt held by the public is projected to reach 154.4% of GDP by 2080 if entitlement savings proposed in the just-release budget are implemented. This far surpasses the prior high of 108.6% of GDP reached at the end of the Second World War. If the proposed entitlement savings are not implemented, the debt held by the public is projected to reach a much higher 283.4% of GDP by 2080.

It is important to note these are projections, not predictions. The current law on which these projections are based would very likely have to change before the debt could reach such historic levels. Still, just as the gross federal debt measures some information that is missed by the debt held by the public, so do these projections measure some information that is missed by the gross federal debt. It is worth looking at all of these measures in trying to judge the financial condition of the federal government.