According to

this link, Frederick C. Thayer, a professor of Public Administration at George Washington University, wrote an article titled "Do Balanced Budgets Cause Depressions?" for The Washington Spectator on January 1, 1996. Following is an excerpt:

Even though the sequence that begins with budget-balancing and ends with depression has been common in American history, the question of a linkage has been ignored. The following paragraphs include all the basic data:1817-21: In a period of five consecutive years, the national debt was reduced by 29 percent, to $90 million. The first acknowledged major depression began in 1819.1823-36: In a period of 14 consecutive years, the national debt was reduced by 99.7 percent, to $38,000, a virtual wipeout. This didn’t help either. A major depression began in 1837.1852-57: In a period of six consecutive years, the national debt was reduced by 59 percent, to $28.7 million. A major depression began in 1857.1867-73: In a period of seven consecutive years, the national debt was reduced by 27 percent, to $2.2 billion. A major depression began in 1873.1880-93: In a period of 14 consecutive years, the national debt was reduced by 57 percent, to $1 billion. A major depression began in 1893.1920-30: In a period of 11 years the national debt was reduced by 36 percent, to $16.2 billion. The sixth real depression -- the Great Depression -- began in 1929.As opposed to many less important downward “business cycles” or recessions, these six collapses have been the only major depressions in U.S. history. The batting average is perfect -- six sustained periods of reducing the national debt followed by six major crashes.Since 1791, these debt reduction crusades have colored 57 of the 93 years in which debt was reduced. The debt was increased in each of the 112 years, an indication that federal deficit spending has been anything but unusual. We have almost chronic deficits since the 1930s, and there has been no new depression since then -- the longest crash-free period in our history.Other articles by Thayer from about the same time and containing the same numbers can be found

here and

here. According to

this link, Thayer passed away in 2006 at the age of 82.

More recently, these same basic numbers have been posted by Rodger Malcolm Mitchell, author of the book "Free Money: Plan for Prosperity". Following is an excerpt from

his website:

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

1998-2001: U. S. Federal Debt reduced 9%. Recession began 2001

2004-2008: Deficit Growth reduced 40%. Recession began 2008.

The first six sets of numbers are the same as Thayer's except that the second lists a debt reduction of 99% instead of 99.7%. In addition, he adds a 9% reduction in federal debt from 1998 to 2001 followed by the recession of 2001. It should be noted that this 9% reduction appears to be a reduction in the federal debt held by the public. Mitchell's figures link to

this page which contains graphs showing Federal Debt Held by the Public (FYGFDPUN) and Federal Government Debt: Total Public Debt (GFDEBTN). According to the data for the series found

here and

here, the Debt Held by the Public went down by 11.3% but the Total Public Debt went up by 5.1% from 9/30/1998 to 9/30/2001. The difference is due to the fact that the Debt Held by the Public does not include the federal debt owed to Social Security and other federal trust funds. There are likely arguments in favor of using either of these two measures of debt. In any event, it's important to note the one that is being used.

Mitchell also adds a 40% reduction in deficit growth from 2004 to 2008. It is very interesting that he chooses to switch from "federal debt reduction" to "deficit growth" reduction. In fact, sticking with "federal debt reduction" would have resulted in data that would have run very much counter to his other data which shows depressions and/or recessions being preceded by reductions in debt. According to the

figures for Federal Debt Held by the Public, the debt increased from $4303 billion on 09/30/2004 to $5814 billion on 09/30/2008, an increase of 35 percent in just 4 years!

In any event, following is a critique of Thayer's original numbers:

In order to evaluate Thayer's claim, one needs to look at all of the major changes in the debt during this period. The following table attempts to do that:

FEDERAL DEBT (in millions of dollars) AND PERCENT CHANGE

High Debt Low Debt

---------------------------- Prior Low High Prior Low

Year Debt Year Debt to High to Low to Low Events

---------------------------------------------------------------------------------

1804 86.43 1812 45.21 -47.69 War of 1812 (1812-15)

1816 127.33 1821 89.99 181.65 -29.33 99.04 Panic of 1819

1822 93.55 1836 0.04 3.96 -99.96 -99.96 Panic of 1837

1843 32.74 1846 15.55 87184.08 -52.51 41352.78 Mex-Amer War (1846-48)

1851 68.30 1857 28.70 339.25 -57.98 84.56 Panic of 1857

1861 90.58 215.61 Civil War (1961-65)

1866 2773.24 1873 2234.48 2961.61 -19.43 2366.84 Panic of 1873

1879 2349.57 1893 1545.99 5.15 -34.20 -30.81 Panic of 1893

1915 3058.14 97.81 World War I (1914-18)

1919 27390.97 1930 16185.31 795.68 -40.91 429.25 Great Depression

Source: Treasury Department: 1791 to 1849, 1850 - 1899, 1900 - 1949

The first period that Thayer cites is the five years from 1816 to 1821, when the debt was reduced by 29 percent. What Thayer fails to mention, however, is that in the four years from 1812 to 1816 (which includes the War of 1812), the debt was increased by 182 percent. Hence, the debt in 1821 was still nearly double it's level when the War of 1812 began.

The second period that Thayer cites is the 14 years from 1822 to 1836, when the debt was reduced by over 99 percent, to $38,000. This is the one period that Thayer cites when a recently acquired debt was not simply being partially paid down. In fact, the debt was paid down to its lowest level on record.

The third period that Thayer cites is the six years from 1851 to 1857, when the debt was reduced by 58 percent. Once again, Thayer makes no mention of the fact that the debt had just increased 339 percent in the prior five years, driven largely by the Mexican-American War. Even after the 58% decrease, the debt was still 85 percent above where it had been just 11 years earlier.

The fourth period that Thayer cites is the seven years from 1866 to 1873, when the debt was reduced by 27 percent (19 percent by the Treasury numbers in the above table). Thayer makes no mention that this immediately followed the Civil War during which the debt increased by nearly 3000 percent! Even after the 19 percent decrease, the debt was still nearly 25 times its size at the beginning of the war.

The fifth period that Thayer cites is the 14 years from 1879 to 1893, during which the debt was reduced by 57 percent (34 percent by the Treasury numbers in the above table). In fact, this represented a further paying down of the tremendous debt run up during the Civil War. Even after this 34 percent decrease, the debt was still about 17 times its size at the beginning of the Civil War.

The final period that Thayer cites is the 11 years from 1919 to 1930, during which the debt was reduced by 36 percent (41 percent by the Treasury numbers in the above table). This followed another war which Thayer saw no need to mention, World War I. In the four years from 1915 to 1919, the debt had increased by 796 percent. Even after the 41 percent decrease, the debt was still over 5 times its size at the beginning of World War I.

Hence, four of the six periods of surpluses that Thayer mentions followed wars during which the debt rose far more than it was paid down during those periods. Another of the periods (1879 to 1893) was just a further paying down of the tremendous debt run up during the Civil War. Hence, only one of the periods represented a seemingly voluntary paydown of debt not recently acquired through war.

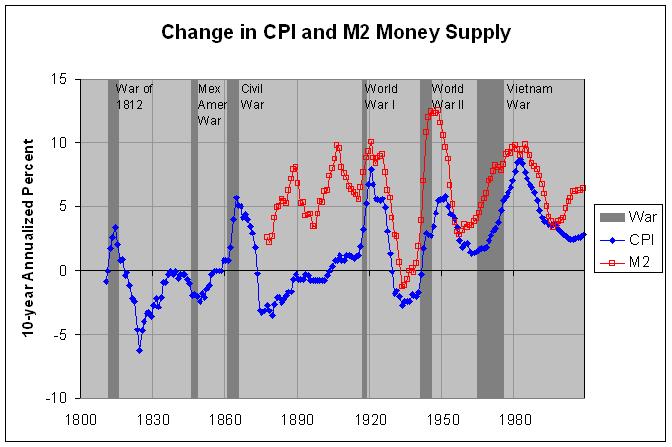

The above timeline suggests that the initial events that lead to financial crises are wars, not periods of paying down the resultant debt.