Debt outlook

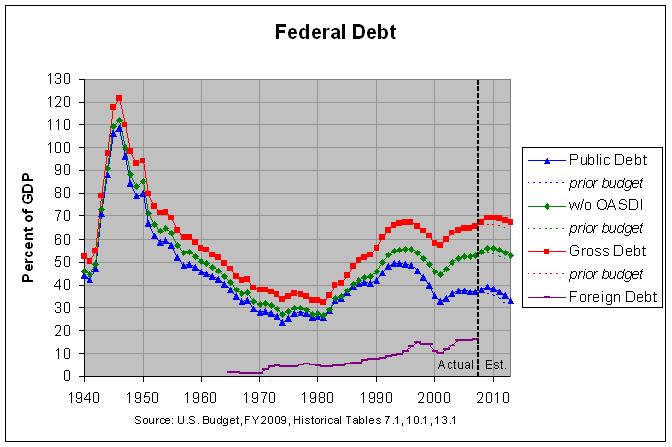

The red line is the "gross federal debt" and the blue line is the "debt held by the public". These debts are currently about 9.3 trillion dollars and 5.2 trillion dollars, respectively, and are related in that the gross federal debt is equal to the debt held by the public plus "intragovernmental holdings". This intragovernmental debt is chiefly held by trust funds with a bit more than half of it being held by the Social Security trust fund. A list of these trust funds, along with the actual numbers and sources for the graph above can be found at http://www.econdataus.com/debt09.html.

There is some dispute about whether the gross federal debt or the debt held by the public are better measures of the nation's fiscal health. Pages 230 and 231 of the Analytical Perspectives in the just-released budget compares the two debts and gives the following conclusion:

For all these reasons, debt held by the public is a better gauge of the effect of the budget on the credit markets than gross Federal debt.

Page 16 of the chapter titled "The Nation's Fiscal Outlook" in the budget states the following:

To understand the Nation’s fiscal outlook, it is helpful to consider both the budget deficit and the amount of debt held by the public. Debt held by the public reflects the amount of money that the Government has borrowed from outside the Government to finance current and past deficits. Debt held by the public has ranged from 33 to 49 percent of GDP over the past 20 years and averaged 35.6 percent over the past 40 years. At the end of 2007, debt held by the public was $5.035 trillion, or 36.8 percent of GDP, falling from 37.1 percent in 2006. For 2012, debt held by the public is projected to be 35.1 percent, below the long-term historical average. Declining deficits and reductions in the debt held by the public demonstrate that the President’s pro-growth policies, coupled with spending restraint, are working to improve the Nation’s fiscal outlook.

A search of this chapter shows that it does not even mention the gross federal debt. In any event, it does seem that the debt held by the public does not tell the whole story about the nation's fiscal outlook. If the Baby Boomers were just now entering the workforce rather than starting to retire, our fiscal outlook would arguably be much better. Hence, the gross federal debt may give a better indication (though an imperfect one) of our pending liabilities. As can be seen, it is projected to peak at 69.4 percent of GDP in 2010, its highest level since 1955.

Comments

Post a Comment