How Big of a Benefit is the Doubling of the Standard Deduction and Child Credit?

On December 15th, the GOP released its final tax plan. The Committee on Rules has posted a Summary of the bill, a Joint Explanatory Statement, and the full bill. A fact sheet on the White House web site lists the following points, among others:

- The Tax Cuts Act nearly doubles the standard deduction.

- For individuals, the standard deduction will be increased from $6,500 to $12,000.

- For single parents, the standard deduction will be increased from $9,550 to $18,000.

- For married couples, the standard deduction will be increased from $13,000 to $24,000.

- The vast majority of American families will now be able to file their taxes on a single page because they lower taxes by claiming the standard deduction.

- American families will see their Child Tax Credit doubled to $2,000 per child under age 17.

- Families will receive a new $500 tax credit for dependents age 17 or older.

- The full Child Tax Credit will now be available for families with incomes of up to $200,000 for single households and incomes of up to $400,000 for married households.

- Lower and Middle-Income families will benefit from a 40 percent increase in the refundable portion of the Child Tax Credit.

Effect of the Change in the Brackets

The following tables show the decrease in the tax rates for single, head of household, and married couples filing jointly under the final bill:

SINGLE FILER HEAD OF HOUSEHOLD FILER MARRIED FILING JOINTLY FILER

Bracket Current Final Bracket Current Final Bracket Current Final

N Start 2018 Bill Change N Start 2018 Bill Change N Start 2018 Bill Change

-- ------- ------- ------- ------ -- ------- ------- ------- ------ -- ------- ------- ------- ------

1 0 10 10 0.0 1 0 10 10 0.0 1 0 10 10 0.0

2 9525 15 12 -3.0 2 13600 15 12 -3.0 2 19050 15 12 -3.0

3 38700 25 22 -3.0 3 51800 15 22 7.0 3 77400 25 22 -3.0

4 82500 25 24 -1.0 4 51850 25 22 -3.0 4 156150 28 22 -6.0

5 93700 28 24 -4.0 5 82500 25 24 -1.0 5 165000 28 24 -4.0

6 157500 28 32 4.0 6 133850 28 24 -4.0 6 237950 33 24 -9.0

7 195450 33 32 -1.0 7 157500 28 32 4.0 7 315000 33 32 -1.0

8 200000 33 35 2.0 8 200000 28 35 7.0 8 400000 33 35 2.0

9 424950 35 35 0.0 9 216700 33 35 2.0 9 424950 35 35 0.0

10 426700 39.6 35 -4.6 10 424950 35 35 0.0 10 480050 39.6 35 -4.6

11 500000 39.6 37 -2.6 11 453350 39.6 35 -4.6 11 600000 39.6 37 -2.6

12 500000 39.6 37 -2.6

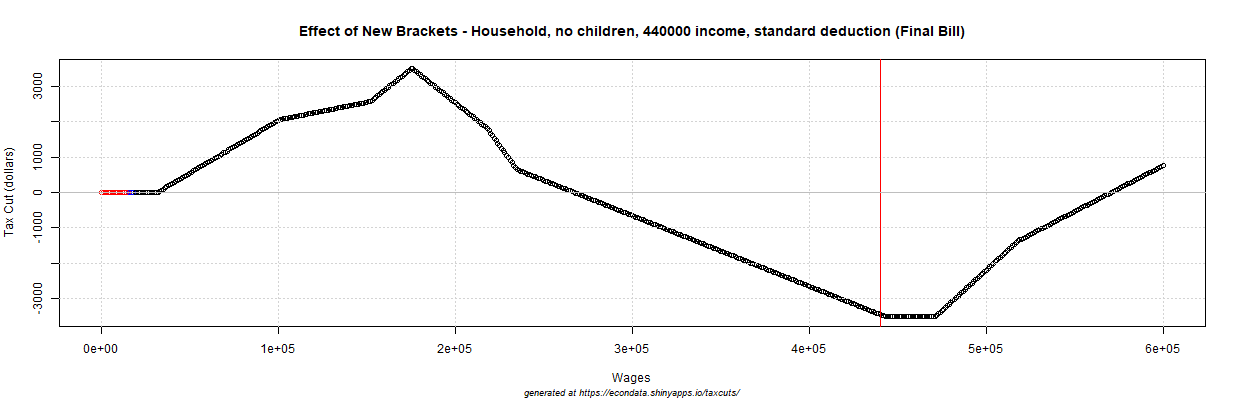

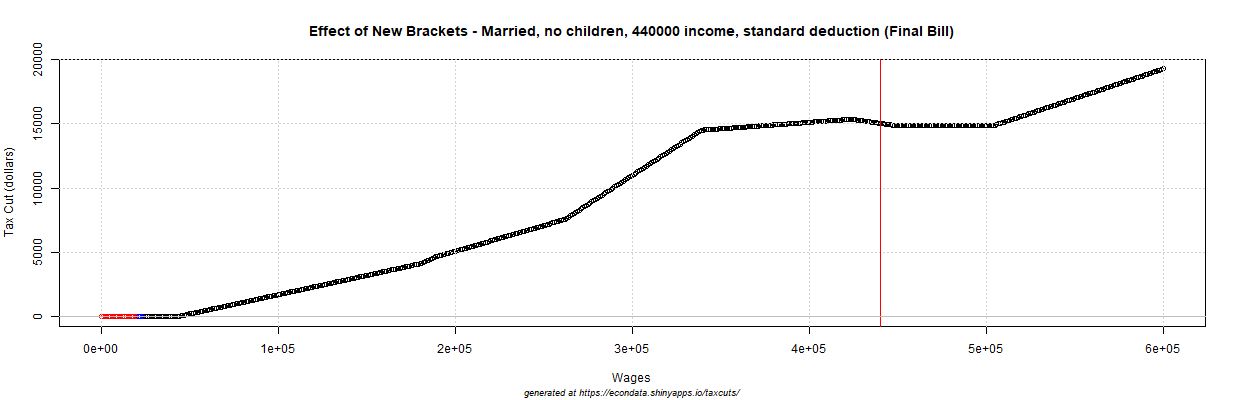

The above tables were created by merging the brackets under current law and the Senate bill. The tables and following plots were generated by the interactive application at this link. As can be seen, the new rates are generally lower except for a few brackets (such as $157,500 to $195,450 for single filers) where the tax rate is slightly higher. These would seem to generally be more than compensated by lower rates in the brackets below them. However, the final bill does give single and head of household filers higher rates over all or most of the incomes from $157,500 to $424,950. This can be seen in the following plots:

Clicking on any of the above or following plots to enlarge them to full size. Red points indicate taxes for which the taxpayer receives a refund under both the current and new laws and black points indicate taxes for which the taxpayer pays taxes under both the current and new laws. The blue points are taxes for which the taxpayer pays taxes under the current law but receives a refund (or pays nothing) under the new law or vice-versa.

As can be seen, single and household filers actually see a tax increase in the area around $440,000 due to these higher rates. On the other hand, married filers tend to see progressively larger tax cuts over this entire range. Still, it does appear that single and head of household filers will likewise see gains (though somewhat smaller) up to $160,000.

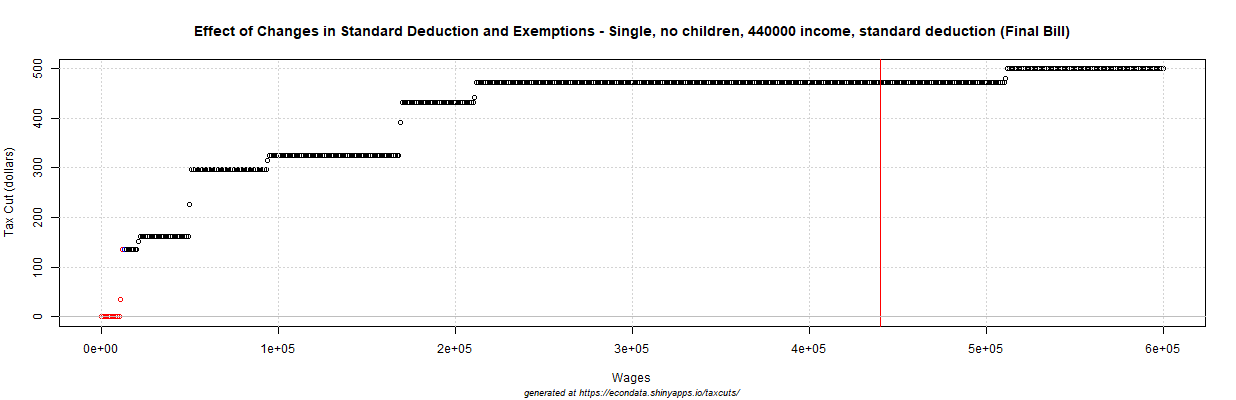

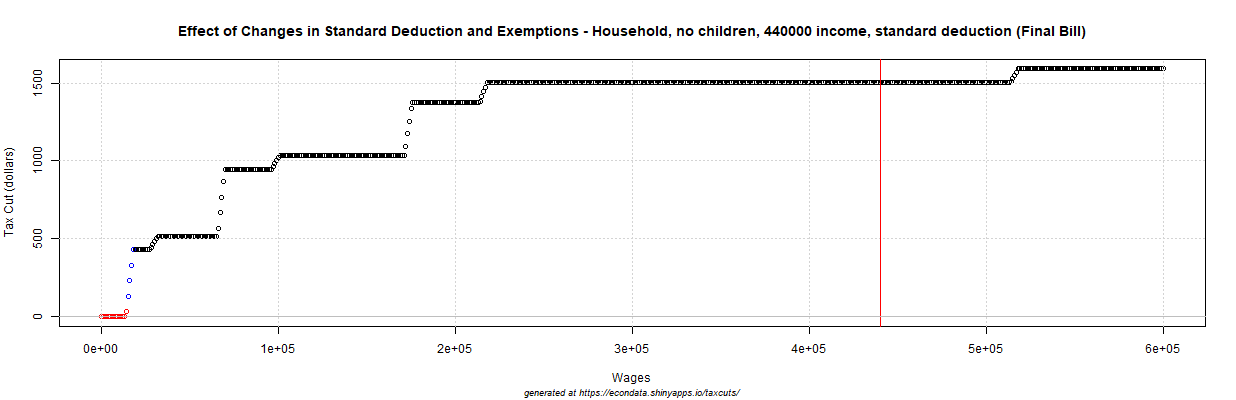

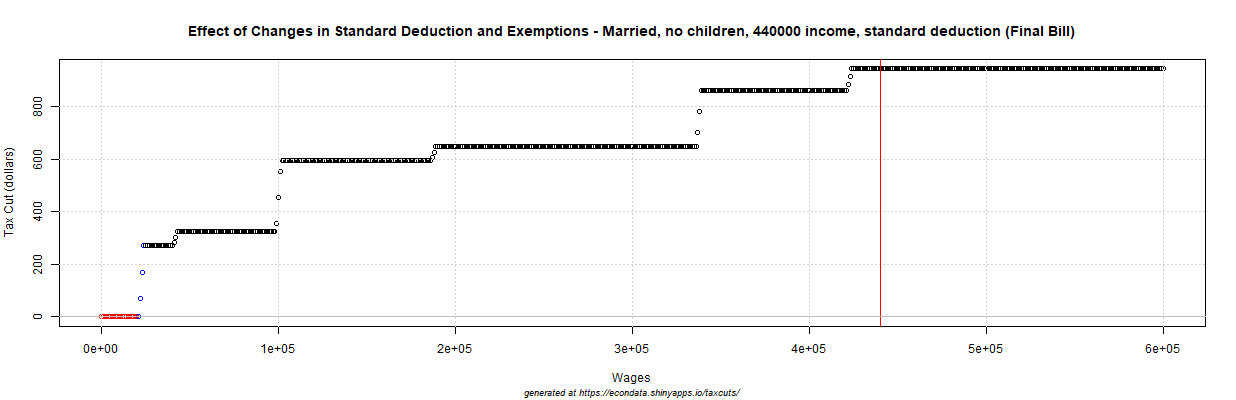

Effect of the Near Doubling of the Standard Deduction and the Elimination of the Personal Exemption

As stated in the first point from the White House fact sheet, the standard deduction will nearly double, increasing by the amounts listed for single filers, heads of households, and married couples. However, the fact sheet makes no mention of the fact that personal exemptions are being eliminated. Factoring this in, a single taxpayer will lose $4,150 of the $5,500 increase in the standard deduction, resulting in a net gain of just $1,350 (12000-6500-4150). A head of household will lose $4,150 of the $8,450 increase in the standard deduction, resulting in a net gain of $4,300 (18000-9550-4150). Finally, a married couple will lose $8,300 (for 2 exemptions) of the $11,000 increase in the standard deduction, resulting in a net gain of just $2,700 (24000-13000-8300). Hence, the net gain in deductions will be about 20.7 percent (1350/6500 or 2700/13000) rather than the expected 84.6 percent (5500/6500 or 11000/13000) for single and married filers. For head of household filers, the net gain will be a bit larger 45 percent (4300/9550) rather than the expected 88.5 percent (8450/9550).

As mentioned above, the standard deduction will cause a net increase of $1,350, $4,300, and $2,700 for single, head of household, and married filers, respectively. However, this will be an increase in taxable income and will mean a larger dollar tax cut for taxpayers who have a higher top-marginal rate. This can be seen in the following plots:

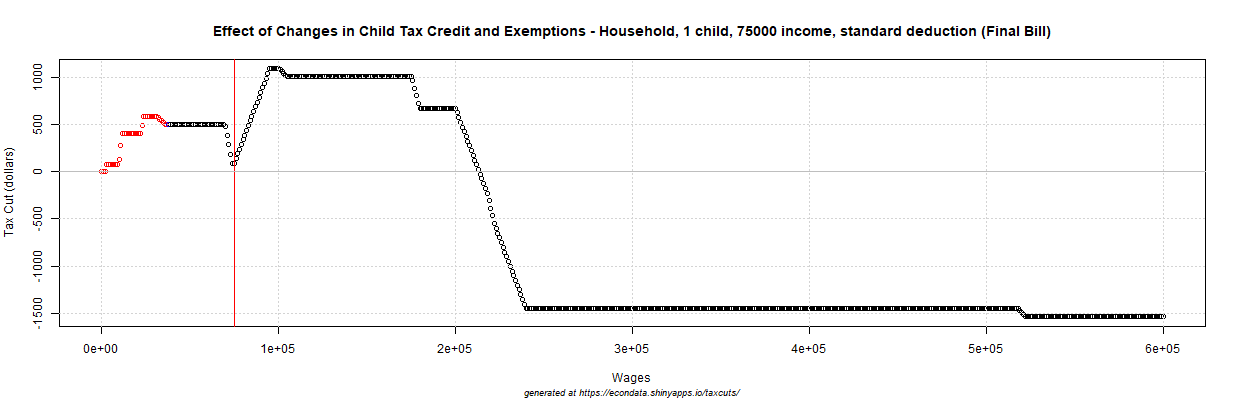

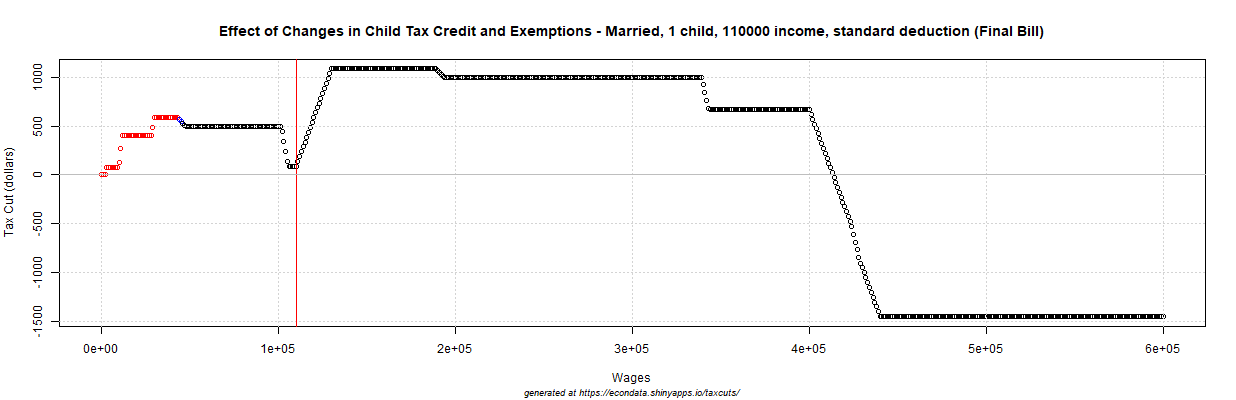

Effect of the Doubling of the Child Tax Credit and the Elimination of the Child Exemption

The increase in the child tax credit has a similar problem due to the loss of the exemption for each child. For a taxpayer with a new top marginal rate of 22 percent, the loss of a $4,150 exemption will increase their taxes by $913 (4150*0.22), just $87 short of the increase in the child tax credit of $1,000. Hence, that taxpayer will gain just 87 dollars. For the new marginal rates of 10 and 12 percent, the gains will be $585 (1000-4150*0.10) and $502 (1000-4150*0.12), respectively. However, this only applies to single and head of household filers making up to $75,000 and married filers making up to $110,000. Above that, the child credit starts to phase out under current law but not under the Senate bill. This can be seen in the following plots:

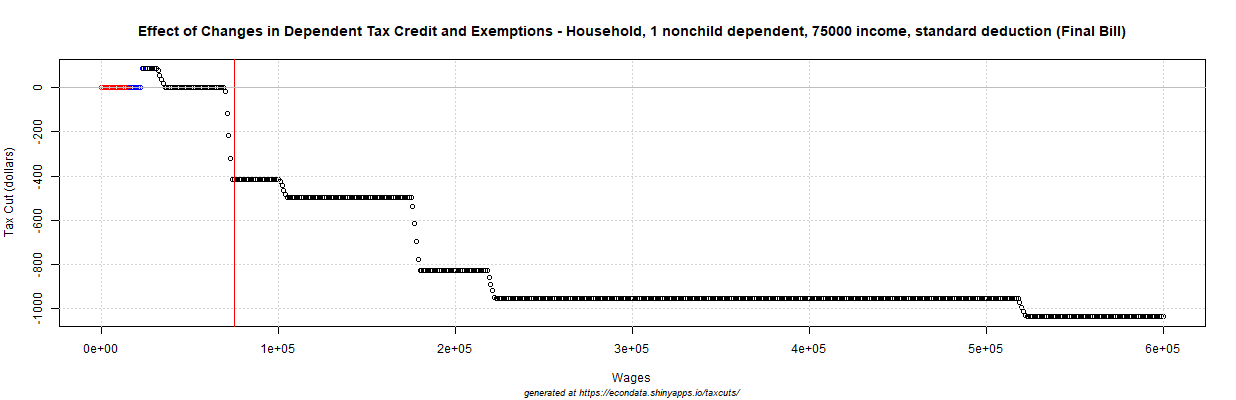

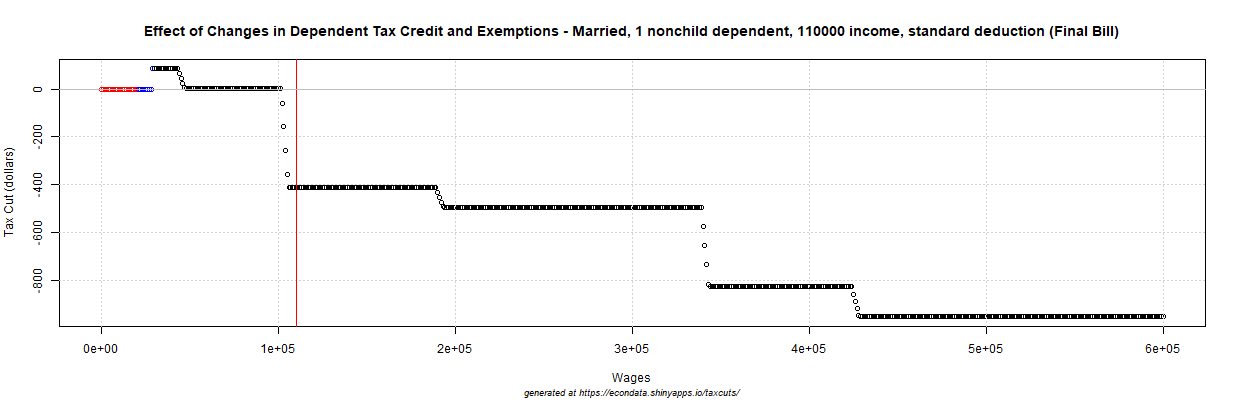

Effect of the New $500 Dependent Credit and the Elimination of the Dependent Exemption

The loss of the exemption creates an even bigger problem for dependents who are not children. For each of these dependents, the Senate bill provides a $500 credit. This means that a taxpayer will experience a loss of $500 greater than they would if that dependent were a child. Hence, a taxpayer with a top marginal rate of 22 percent will see a tax increase of $413 (87-500) for each non-child dependent over what they would have seen otherwise. A taxpayer with a top marginal rate of 10 and 12 percent will see small decreases in their taxes of $85 and $2, respectively. At the top marginal rates of 22, 24, 32, 35, and 38.5 percent, it causes tax increases of $413, $496, $828, $953, and $1,098, respectively. These changes in taxes due just to the loss of the exemption and the new $500 credit can be seen in the following plots:

Summary

In summary, the Senate bill causes the following changes:

- The change in the brackets cause a general increase in the tax cut except for incomes from $157,500 to $424,950 for single and head of household filers.

- The increase in the standard deduction (along with the loss of the taxpayer exemptions) causes net decreases of $1,350, $4,300, and $2,700 in taxable income for single, head of household, and married filers, respectively. This results in tax cuts ranging from $135, $430, and $270 for single, head of household, and married filers with a top marginal rate of 10 percent to about $500, $1,591, $999 for those filers with top marginal rate of 37 percent.

- The increase in the child tax credit (along with the loss of the child exemption) causes tax cuts of $585, $502, and $87 for taxpayers with top marginal rates of 10, 12, and 22 percent, respectively. This jumps up to around the full $1,000 after $75,000 for single and head of household filers and after $110,000 for married filers due to the fact that the credit no longer phases out at that level under the Senate bill. However, this then declines to nearly a $1,600 tax increase at the top marginal rate of 37 percent where the credit phases out under the Senate bill.

- The new credit for nonchild dependents (along with the loss of the dependent exemption) causes tax cuts of $85, and $2 for taxpayers with top marginal rates of 10, 12 percent, respectively. At the top marginal rates of 22, 24, 32, 35, and 37 percent, it causes tax increases of $413, $496, $828, $953, and $1,036, respectively.

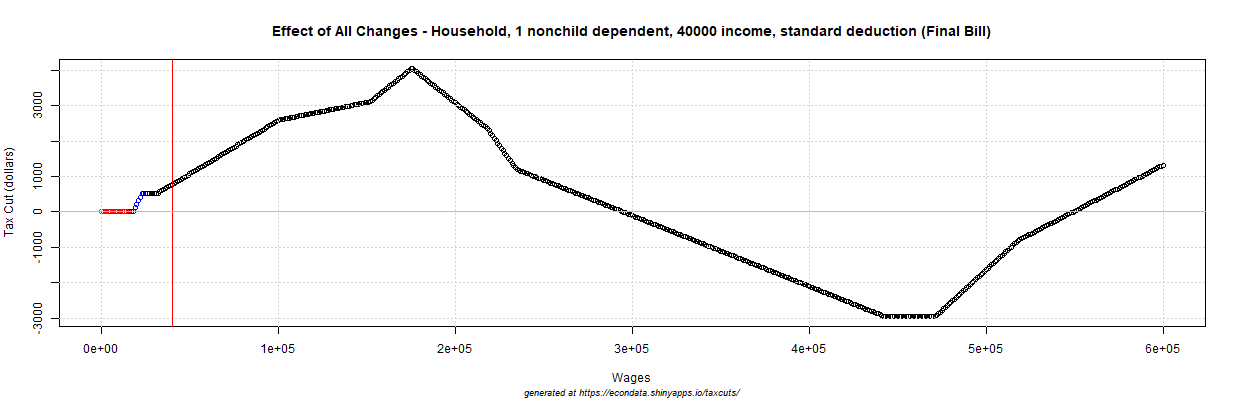

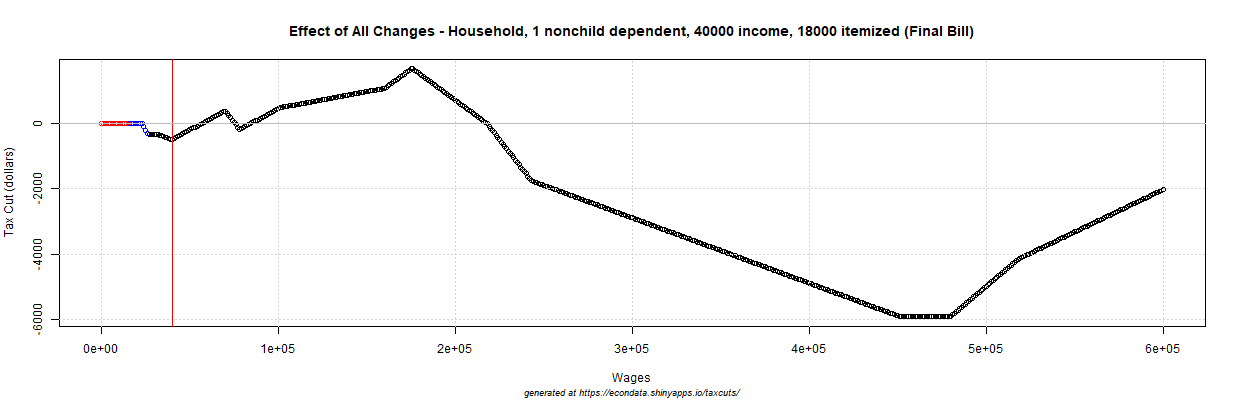

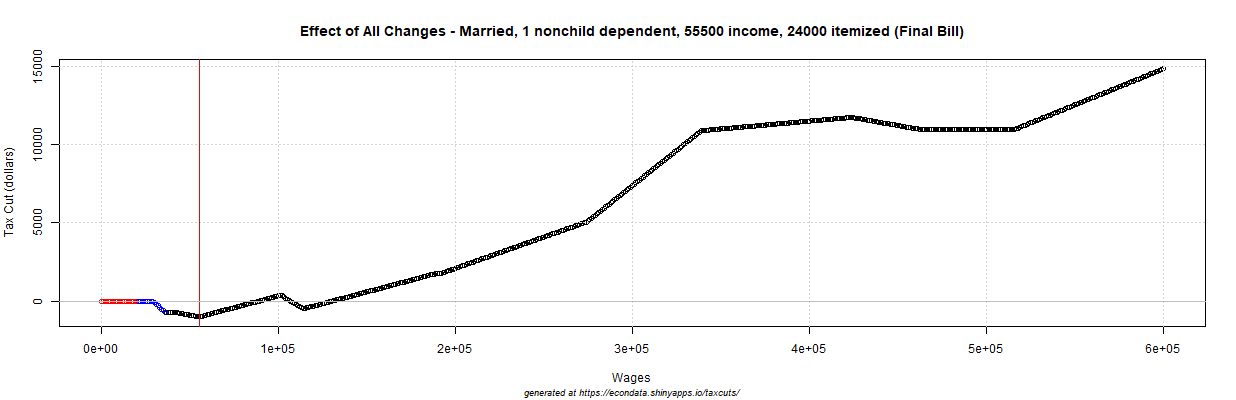

As can be seen, there are no tax increases except for head of household filers with incomes over $300,000 (caused by the increase in rates above $160,000). This is likely due to the benefit provided by the increase in the standard deduction. The following plots show the same filers with itemized deductions equal to the new standard deduction:

As can be seen, taxpayers now see an increase in taxes up to incomes of about $56,000 for head of household filers and $88,000 for married filers. This is as expected, given the preceding analysis of specific changes in Senate bill. Hence, this analysis aids in finding winners and losers that may not be apparent when simply looking at the assorted taxpayer examples that have been put out by various organizations. In addition, this analysis shows that the benefits of the doubling of the standard deduction and child tax credit is not as large as they appear once the loss of the taxpayer and child exemptions are included. Also, the benefit of the decrease in brackets reverses for incomes from $157,500 to $424,950 for single and head of household filers. Finally, it show that the benefit of the credit for nonchild dependents is more than offset by the loss of the dependent exemption.

Comments

Post a Comment