Do Tax Cuts Increase Revenue?

On November 7th, David Stockman and Mike Pence appeared on This Week with Christiane Amanpour to debate tax cuts. David Stockman was a budget director for President Ronald Reagan and Mike Pence is a Congressman and has been the Chairman of the House Republican Conference for the past two years. A video of the tax cut debate can be found on the This Week website and a transcript can be found at this link. Following is an excerpt from that transcript:

PENCE: Before we get -- look, David Stockman is, you know, he's a really famous guy and a thoughtful guy. I just disagree with him vehemently and I, frankly, have for about 30 years. David believes that every tax increase equals a revenue increase, but that's not true. Anybody who is familiar with the historical data from the IRS knows that raising income tax rates will likely actually reduce federal revenues.

AMANPOUR: Let me ask David...

PENCE: So if we raise taxes, the American people are very likely going to -- the top 1 percent are going to send less money to Washington, D.C., and that will never get us out of this...

(CROSSTALK)

STOCKMAN: I just have to respectfully disagree. You will have some loss of revenue because some activity or transactions won't happen, but if you raise taxes on paper by $100 billion, maybe you'll get $90 billion or $85 billion. But it's just common sense fact that, when you raise the rates, you get more revenue. Normally, it's a bad thing to do. But we are in such dire shape that we have no choice but to accept the negative trade-off of some harm to the economy to start paying our bills. Otherwise, we're dependent on the Chinese, we're dependent on OPEC, we're dependent on a bunch of hedge fund guys to buy our debt, and this game is about over.

Pence states that "raising income tax rates will likely actually reduce federal revenues". This is in reference to the proposal to let all or part of the Bush tax cuts expire at the end of this year. The logical companion to this argument is the old supply-side claim that tax cuts increase revenues above what they would have been otherwise. I have looked at this argument and posted an analysis of it at this link. I could find nothing in the actual numbers to support this claim. In fact, I have asked supply-siders for years to provide the link to one credible economic study that purports to give evidence that supports this claim. As of yet, I have received none.

So far, every economic study that I have found that addresses the issue refutes the claim that tax cuts increase revenue. For example, there is a study titled "Dynamic Scoring: A Back-of-the-Envelope Guide" that was done by N. Gregory Mankiw and Matthew Weinzier. Mankiw was the chairman of President Bush's Council of Economic Advisors from 2003 to 2005. You can find a summary of the study at this link. It gives the following key quote at the top:

"In the long run, about 17 percent of a cut in labor taxes is recouped through higher economic growth. The comparable figure for a cut in capital taxes is about 50 percent."

This pretty much agrees with Stockman's statement that 10 or 15 percent of the revenue expected from a tax increase might be lost due to a decrease in activity or transactions. Both Stockman's statement and the quote above agree with the usual concept that a cut in the tax rate will lose that same percentage of revenue but that some of that loss will be recouped by higher economic growth. However, there are additional effects of tax cuts, negative as well as positive. Following is an excerpt from page 115 of the book "The Coming Generational Storm", co-written by economist Laurence Kotlikoff:

...For tax cuts to raise revenues, pretax labor earnings have to rise by a larger percentage than the tax rate falls.

There are two competing forces at play in determining whether pretax earning rise, stay the same, or fall. On the one hand, workers may say to themselves, "Boy, now that taxes are lower, I can work less and still receive the same after tax pay. I'm going to cut back my workweek." On the other hand, they may say, "Boy, now's a good time to work more and earn more because taxes are lower on every extra dollar I earn". Economists call the first of these reactions the income effect. They call the second reaction, the substitution or incentive effect.

Some of the best labor economists in the country have spent their lifetimes measuring the income and substitution effects. The broad consensus of these experts is that the two effects are roughly offsetting. This means that if wage tax rates are cut by, say 15 percent, tax revenues will fall by 15 percent.

Similarly, there are studies that suggest that certain tax increases can actually promote an increase in economic growth. An example is a study titled "The Macroeconomic Effects of Tax Changes: Estimates Based on a New Measure of Fiscal Shocks" by Christina and David Romer. Christina Romer recently resigned as the chairwoman of President Obama’s Council of Economic Advisers but will become a member of the President's Economic Recovery Advisory Board. The study found that "deficit-driven tax increases" have had a positive effect on economic growth. The following excerpt from page 14 describes these increases:

The figure makes clear that while deficit-driven tax increases have occurred throughout the postwar era, they were most prevalent in the early and mid-1980s. Many of these deficit-driven tax actions were related to Social Security: of the 26 actions in the category, 15 were designed to deal with the long-run solvency of the Social Security system. The Social Security Amendments of 1977 and 1983, in particular, were major tax actions that raised taxes in a number of steps and did not simultaneously increase benefits. The largest deficit-driven tax increases not related to Social Security were those contained in the Tax Equity and Fiscal Responsibility Tax Act of 1982, and the Omnibus Budget Reconciliation Acts of 1987, 1990, and 1993. The first two of these were Reagan-era measures; the third was the Bush tax increase that defied his famous "Read my lips: no new taxes" campaign speech; and the fourth was the Rubinomics-defining tax increase of the early Clinton administration.

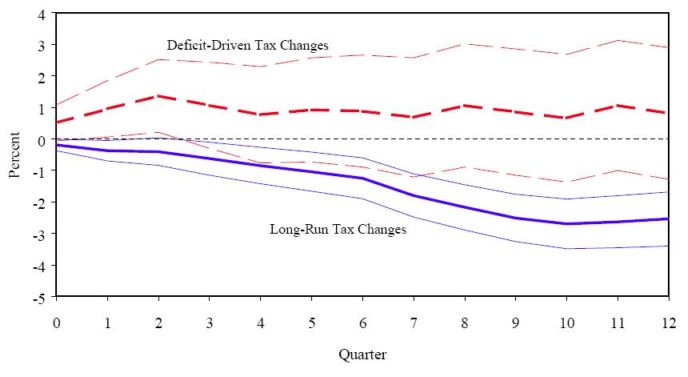

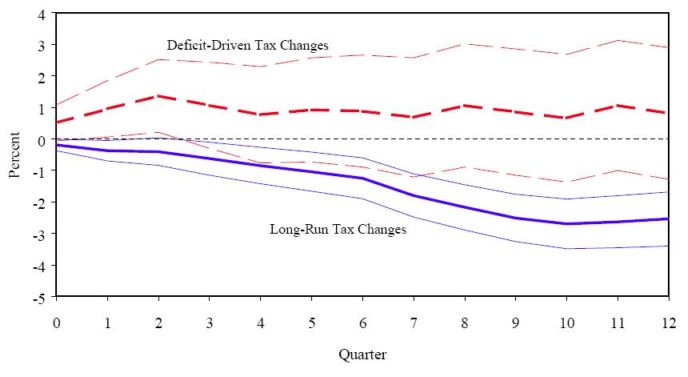

The following graph from page 59 shows the estimated impact of a tax increase of 1% of GDP on GDP using long-run and deficit-driven tax changes:

The following excerpt from page 23 refers to this figure:

Panel (b) of Figure 6 shows the results for the two types of exogenous changes. For long-run changes, which make up most of this category, the results are quite similar to those for all exogenous changes. For tax increases to deal with an inherited budget deficit, the results are more interesting. The point estimates imply that output does not fall at all following deficit-driven tax increases. The estimated effect peaks at 1.4 percent after two quarters, and then fluctuates around 1 percent. However, there are too few tax changes of this type for the effects to be estimated very precisely. The maximum t-statistic, for example, is just 1.2. Nonetheless, the estimates are suggestive that tax increases to reduce an inherited deficit may be less costly than other tax increases, and they provide no evidence that they have substantial output costs.

The following excerpt from page 38 summarizes these effects:

In Section III, we found that the responses of real GDP to the two subcategories of exogenous tax changes appear to be quite different. The response to a long-run tax increase is negative, large, and highly statistically significant. In contrast, the response to a deficit-driven tax increase is positive, though not significant.

Finally, the following excerpt from the conclusions on page 41 expands on this positive effect:

Finally, we find suggestive evidence that tax increases to reduce an inherited budget deficit do not have the large output costs associated with other exogenous tax increases. This is consistent with the idea that deficit-driven tax increases may have important expansionary effects through expectations and long-term interest rates, or through confidence.

As I mentioned, I am yet to find a single economic study that purports to show evidence that any income tax cut has ever paid for itself. If anyone who reads this should know of one, please leave a comment with a link to that study. Thanks.

PENCE: Before we get -- look, David Stockman is, you know, he's a really famous guy and a thoughtful guy. I just disagree with him vehemently and I, frankly, have for about 30 years. David believes that every tax increase equals a revenue increase, but that's not true. Anybody who is familiar with the historical data from the IRS knows that raising income tax rates will likely actually reduce federal revenues.

AMANPOUR: Let me ask David...

PENCE: So if we raise taxes, the American people are very likely going to -- the top 1 percent are going to send less money to Washington, D.C., and that will never get us out of this...

(CROSSTALK)

STOCKMAN: I just have to respectfully disagree. You will have some loss of revenue because some activity or transactions won't happen, but if you raise taxes on paper by $100 billion, maybe you'll get $90 billion or $85 billion. But it's just common sense fact that, when you raise the rates, you get more revenue. Normally, it's a bad thing to do. But we are in such dire shape that we have no choice but to accept the negative trade-off of some harm to the economy to start paying our bills. Otherwise, we're dependent on the Chinese, we're dependent on OPEC, we're dependent on a bunch of hedge fund guys to buy our debt, and this game is about over.

Pence states that "raising income tax rates will likely actually reduce federal revenues". This is in reference to the proposal to let all or part of the Bush tax cuts expire at the end of this year. The logical companion to this argument is the old supply-side claim that tax cuts increase revenues above what they would have been otherwise. I have looked at this argument and posted an analysis of it at this link. I could find nothing in the actual numbers to support this claim. In fact, I have asked supply-siders for years to provide the link to one credible economic study that purports to give evidence that supports this claim. As of yet, I have received none.

So far, every economic study that I have found that addresses the issue refutes the claim that tax cuts increase revenue. For example, there is a study titled "Dynamic Scoring: A Back-of-the-Envelope Guide" that was done by N. Gregory Mankiw and Matthew Weinzier. Mankiw was the chairman of President Bush's Council of Economic Advisors from 2003 to 2005. You can find a summary of the study at this link. It gives the following key quote at the top:

"In the long run, about 17 percent of a cut in labor taxes is recouped through higher economic growth. The comparable figure for a cut in capital taxes is about 50 percent."

This pretty much agrees with Stockman's statement that 10 or 15 percent of the revenue expected from a tax increase might be lost due to a decrease in activity or transactions. Both Stockman's statement and the quote above agree with the usual concept that a cut in the tax rate will lose that same percentage of revenue but that some of that loss will be recouped by higher economic growth. However, there are additional effects of tax cuts, negative as well as positive. Following is an excerpt from page 115 of the book "The Coming Generational Storm", co-written by economist Laurence Kotlikoff:

...For tax cuts to raise revenues, pretax labor earnings have to rise by a larger percentage than the tax rate falls.

There are two competing forces at play in determining whether pretax earning rise, stay the same, or fall. On the one hand, workers may say to themselves, "Boy, now that taxes are lower, I can work less and still receive the same after tax pay. I'm going to cut back my workweek." On the other hand, they may say, "Boy, now's a good time to work more and earn more because taxes are lower on every extra dollar I earn". Economists call the first of these reactions the income effect. They call the second reaction, the substitution or incentive effect.

Some of the best labor economists in the country have spent their lifetimes measuring the income and substitution effects. The broad consensus of these experts is that the two effects are roughly offsetting. This means that if wage tax rates are cut by, say 15 percent, tax revenues will fall by 15 percent.

Similarly, there are studies that suggest that certain tax increases can actually promote an increase in economic growth. An example is a study titled "The Macroeconomic Effects of Tax Changes: Estimates Based on a New Measure of Fiscal Shocks" by Christina and David Romer. Christina Romer recently resigned as the chairwoman of President Obama’s Council of Economic Advisers but will become a member of the President's Economic Recovery Advisory Board. The study found that "deficit-driven tax increases" have had a positive effect on economic growth. The following excerpt from page 14 describes these increases:

The figure makes clear that while deficit-driven tax increases have occurred throughout the postwar era, they were most prevalent in the early and mid-1980s. Many of these deficit-driven tax actions were related to Social Security: of the 26 actions in the category, 15 were designed to deal with the long-run solvency of the Social Security system. The Social Security Amendments of 1977 and 1983, in particular, were major tax actions that raised taxes in a number of steps and did not simultaneously increase benefits. The largest deficit-driven tax increases not related to Social Security were those contained in the Tax Equity and Fiscal Responsibility Tax Act of 1982, and the Omnibus Budget Reconciliation Acts of 1987, 1990, and 1993. The first two of these were Reagan-era measures; the third was the Bush tax increase that defied his famous "Read my lips: no new taxes" campaign speech; and the fourth was the Rubinomics-defining tax increase of the early Clinton administration.

The following graph from page 59 shows the estimated impact of a tax increase of 1% of GDP on GDP using long-run and deficit-driven tax changes:

The following excerpt from page 23 refers to this figure:

Panel (b) of Figure 6 shows the results for the two types of exogenous changes. For long-run changes, which make up most of this category, the results are quite similar to those for all exogenous changes. For tax increases to deal with an inherited budget deficit, the results are more interesting. The point estimates imply that output does not fall at all following deficit-driven tax increases. The estimated effect peaks at 1.4 percent after two quarters, and then fluctuates around 1 percent. However, there are too few tax changes of this type for the effects to be estimated very precisely. The maximum t-statistic, for example, is just 1.2. Nonetheless, the estimates are suggestive that tax increases to reduce an inherited deficit may be less costly than other tax increases, and they provide no evidence that they have substantial output costs.

The following excerpt from page 38 summarizes these effects:

In Section III, we found that the responses of real GDP to the two subcategories of exogenous tax changes appear to be quite different. The response to a long-run tax increase is negative, large, and highly statistically significant. In contrast, the response to a deficit-driven tax increase is positive, though not significant.

Finally, the following excerpt from the conclusions on page 41 expands on this positive effect:

Finally, we find suggestive evidence that tax increases to reduce an inherited budget deficit do not have the large output costs associated with other exogenous tax increases. This is consistent with the idea that deficit-driven tax increases may have important expansionary effects through expectations and long-term interest rates, or through confidence.

As I mentioned, I am yet to find a single economic study that purports to show evidence that any income tax cut has ever paid for itself. If anyone who reads this should know of one, please leave a comment with a link to that study. Thanks.

I'm not an economist of any flavor, but I was wondering what you thought of the article by Stephen J Entin from the Institute for Research on the Economics of Taxation that I've linked below. He appears to argue that increased capital gains tax should decrease net federal revenues.

ReplyDeleteAny thoughts appreciated.

http://iret.org/pub/CapitalGains-1.pdf

I believe there was one by the IMF in 2008:

ReplyDeletewww. imf .org/external/pubs/ft/wp/2008/wp0807.pdf

To Symplectic: I've posted the thoughts you requested at this link.

ReplyDeleteTo Anonymous: Thanks for the link. I'll take a look at it.

To Anonymous: I have taken a look at the IMF paper titled "Tax Rate Cuts and Tax Compliance-The Laffer Curve Revisited" which you posted a link to. As its title suggests, it is focused on tax compliance and the paper looks closely at the "Russian flat tax experiment". The following excerpt is from the Conclusion on pages 15 and 16:

ReplyDeleteThe theoretical model is potentially useful to think about tax policy. Most importantly, it identifies when this compliance based Laffer effect can arise, i.e. when tax rate cuts can increase revenues even on the short run. It is crucial to have medium strength tax authorities compared to the prevailing official tax rates. If tax authorities are relatively strong (at least relative to the prescribed taxes), then compliance is the best strategy for the overwhelming majority of taxpayers. Tax rate cuts or increases do not change compliance much, as audits ensure it. Similarly, if the tax authority is relatively weak, no tax rate changes will induce compliance. With medium level tax authority strength, however, tax rates can have a pivotal role.

As described in the paper, I believe that tax authorities are relatively strong relative to taxes in the United States. If this is the case, then the paper suggests that tax rate cuts would "not change compliance much, as audits ensure it". Tax rate cuts would only be expected to have such an effect in countries with weaker tax authorities (like Russia) or countries with a higher tax rate.

People try to use numbers to make their argument. There is a lot more to just the tax rate, and tax revenue. This site seems to favor higher taxes. Usually people who use the arguments I read here try to say they just want to tax the rich more.

ReplyDeleteI ask anybody to look up when taxe rates on the rich are lowered they still end up paying more taxes.

No where have I spoken in favor of higher taxes. I simply don't support the contention that tax cuts increase revenues when I have seen no credible evidence that they do. I looked at the numbers as objectively as I can and posted the results at http://www.econdataus.com/taxcuts.html. For years, I've asked supply-siders to tell me any specific numbers or conclusions in my analysis that they disagree with. Alternately, I've asked them to post a link to one serious economic study that purports to show evidence of any income tax cut that has ever paid for itself. I've received no serious responses.

ReplyDeleteIn any case, you ask people to look up how the rich end up paying more taxes when their tax rates are lowered. Why don't you provide a link to an article or study that shows that? If you do, I'll take a look at it myself.

Hello my name is Marshall and i have some issues with your blog "EFFECT OF REAGAN, KENNEDY, AND BUSH TAX CUTS ON REVENUES" I found some issues here mainly involving the Reagan Tax cuts.

ReplyDeleteyou say and i quote

"the GDP reached a high 10-year growth rate of 35.2% from 1983 to 1993. However, it reached higher highs of 37.5 from 1992 to 2002, 45.71% from 1947 to 1957, and 50.28% from 1958 to 1968. In fact, the above graph shows that the 10-year growth rate in the GDP has been relatively stable since 1975 to 1985 though it began to drop in 2008 and is projected to stay weak through 2015. Hence, these figures don't provide any strong evidence that the Reagan tax cuts permanently affected the GDP one way or the other."

now there are some issues with this:

yes GDP growth was very consistent from the 40's to the 70's (though there was a slight decline in the 70's)and the 80's (January 1980-December 1990) from what it seems didn't change the GDP rating all that much compared to any of these decades. However it's worth noting that the GDP growth of the 90's was no where in comparison really (January 1990-December 2000. When looking at the mean/avg the 80's number seems to be in the ballpark of about 4.6, 4.7 GDP, however for the 90's it seems to be about 3.8, 3.9 somewhere in between these numbers so overall looking at that it does seem that Reagan's tax cuts may not have had any real impact but Clinton's tax increases (along with Bush 41's increases) didn't seem to be all that beneficial to GDP growth. My overall point being that tax cuts may not be that bad especially when compared to tax increases.

here's the website displaying GDP growth rate it's interactive as well:

http://www.tradingeconomics.com/united-states/gdp-growth

now you also asked for examples of tax cuts being beneficial I have some links to provide but I'd like to say two things before hand

1. these links are obviously in favor of lower taxes they are the Heritage Foundation, a obviously Conservative site and also I believe it's called the Freedom and Prosperity Institute or so

2. I'm not sure if you've read them or not but they are worth looking in to also one of them is a video series which should be even easier though the video doesn't give any direct links it does refer to the IRS "SOI" which is something

that being said here are the links:

Heritage:

http://www.heritage.org/research/reports/2001/05/lowering-marginal-tax-rates, http://www.policyarchive.org/handle/10207/bitstreams/8333.pdf

Conservative site:

http://thedauntlessconservative.wordpress.com/2010/09/01/the-reagan-tax-cuts-lessons-for-tax-reform/ <--- this one I myself am a bit skeptic of but he/she does provide a lot of links

these are the videos they are a three series set about the Laffer Curve they also go into detail about the Reagan Tax Cuts (somewhat)

http://www.youtube.com/watch?v=fIqyCpCPrvU <--- the first video goes into detail mostly about the Laffer Curve theory but talks about Tax Cuts and some fantasies about them

http://www.youtube.com/watch?v=YsB_rnzBA08 <--- this one reviews Reagan's tax cuts more in depth though again not all that much but it's still worth looking into

the third video doesn't go into that much detail about the Tax cuts so i won't post it though if the links work then you should be able to find it rather easily in the "other videos" list

I myself am not very familiar with economics I'm only 18 though from what I have learned Tax Cuts DO NOT always pay for themselves but there are arguable examples of them doing so (i.e Reagan tax cuts) personally I think tax cuts only pay for themselves when the cut goes from 70 to 28 like it did with Reagan or when it goes from some obscenely high rate to a low rate regardless these are my sources if I find more I'll post them

To Marshall Abarca,

ReplyDeleteThanks very much for the long reply. It covered a lot of ground so I answered it in a blog post at http://usbudget.blogspot.com/2013/03/do-tax-cuts-increase-revenue-part-2.html . It's great to see such a searching and questioning mind for someone who's just 18. I really appreciate comments as that's the best way to test and improve one's analyses. Feel free to add any comments to that post and I'll answer them when I can.