You Can't Soak the Rich - A Response (Part 2)

effective_rate = k * (taxes_paid / GDP), where k is a constant

Putting in the CBO's definition of effective rate, this becomes

(taxes_paid / household_income ) = k * (taxes_paid / GDP)

which becomes

(household_income / GDP) = (1/k), where (1/k) is a constant

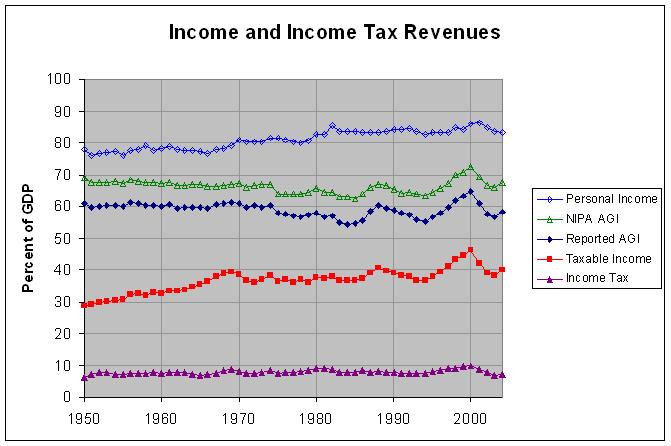

Hence, it would appear that household income as a percentage of GDP has remained relatively constant since 1980. This is verified by the following graph:

The actual numbers and sources are at http://www.econdataus.com/inctax04.html. As can be seen, personal income as a percent of GDP has been relatively stable since 1950 (especially since 1980). If you lower the rates on one part of that income, it would seem that you would have to raise rates on another part of the income or change the amount of personal income that is taxable in order to keep the same amount of revenue.

In fact, I believe that the relative stability of revenue is largely due to a purposeful strategy by those who implement tax changes. For example, the cut in the top marginal rate from 50 to 28 percent in the Tax Reform Act of 1986 represented a proportional cut of 44 percent. If all rates had been cut by this amount with no changes in deductions or other tax measures, revenue would have fallen by about 44 percent in the first year, even if positive effects began to kick in going forward. This would have likely had serious political, if not financial, consequences. Hence, our politicians never make quite that unbalanced a tax change. According to page 13 of this Treasury document, the Tax Reform Act of 1986 also included a number of tax hikes such as the repeal of the sales tax deduction for individuals. This made it close to revenue-neutral.

The 1981 tax cut, on the other hand, was estimated by the document to have a large negative effect on revenue. However, it was followed by the Social Security tax hike of 1983 and the Deficit Reduction Act of 1984, both of which were estimated to have a significant positive effect on revenue. Hence, the general stability of revenue as a percent of GDP appears to be largely the result of a conscious tax policy, not a magical "Hauser's Law".

Comments

Post a Comment