The Problems with "Taxpayer Examples" (Part 3)

1. (0:50:09) Mr. Speaker, I would point out that a family of four in Michigan’s Ninth District will save over $1,700 each and every year.

2. (0:55:31) Mr. Speaker, I would note that the average family of four making $59,000 a year in the 35th District of Texas will see a tax cut of over $1,100.

3. (1:00:20) Mr. Speaker, I would point out that the average family of four in the Fifth District of California will see a tax cut of over $2,370.

4. (1:06:03) Mr. Speaker, I am proud to remind the House that a family of four in Connecticut’s First District will see a tax cut of $3,858 each and every year.

5. (1:11:12) Mr. Speaker, I would note that a family of four in Oregon’s Third District will see tax savings of $2,256.

6. (1:12.53) Mr. Speaker, that family of four in New Jersey’s Ninth District making $90,000 a year, two workers, will see a tax cut of $2,044.

7. (1:14:52) Mr. Speaker, I am pleased to report that the median family of four in New York’s 14th District making $63,000 a year working hard will see a tax cut of $1,251.

8. (1:16:38) Mr. Speaker, I am proud to report that that median family of four with two kids in the Seventh District of Illinois making $73,000 really working hard where every dollar counts will see a tax cut of $1,546.

9. (1:18:31) Mr. Speaker, I am proud to report that that median family of four making $74,000, blue-collar workers in the 26th District of New York, will see a tax cut of $1,562.

10. (1:20:14) Mr. Speaker, I would point out that the median family of four making $65,000 in Alabama’s Seventh District would see a tax cut of $1,311.

11. (1:22:05) Mr. Speaker, I point out that a median family of four with two kids in Washington’s First District will see a tax cut of $5,008.

12. (1:23:43) Mr. Speaker, I would point out that that hardworking family of four in California’s 38th District would see a tax cut of $1,870.

13. (1:25:23) Mr. Speaker, I would point out that that hardworking family of four in the 27th District of California will see a tax cut of $2,249.

14. (1:30:19) Mr. Speaker, I point out that a middle class family making $74,000, in the Fifth District of South Carolina, will see a tax cut of $1,568.

15. (1:36:27) Mr. Speaker, I am proud to report that a median, hardworking, middle class family in the Fifth District of Maryland, will see a tax cut of $4,158.

16. (1:49:42) I would point out that a hardworking middle class family in the 12th District of California will see a tax cut of $5,508.

The following table summarizes these 16 examples:

HOUSE DIFFERENCE SENATE

N FAMILY DESCRIPTION CONGRESSIONAL DISTRICT INCOME TAX CUT 2018 AMOUNT PERCENT 2018

-- -------------------------- -------------------------------- ------- ------------ ------ ------ ------- ------

1 family of four Michigan’s Ninth District over $1,700*

2 average family of four 35th District of Texas $59,000 over $1,100 1105.5 5.5 0.500 1638.5

3 average family of four Fifth District of California over $2,370

4 family of four Connecticut’s First District $3,858*

5 family of four Oregon’s Third District $2,256

6 family of four New Jersey’s Ninth District $90,000 $2,044 2035.5 -8.5 -0.416 2568.5

7 median family of four New York’s 14th District $63,000 $1,251 1225.5 -25.5 -2.038 1758.5

8 median family of four Seventh District of Illinois $73,000 $1,546 1525.5 -20.5 -1.326 2058.5

9 median family of four 26th District of New York $74,000 $1,562 1555.5 -6.5 -0.416 2088.5

10 median family of four Alabama’s Seventh District $65,000 $1,311 1285.5 -25.5 -1.945 1818.5

11 median family of four Washington’s First District $5,008

12 family of four California’s 38th District $1,870

13 family of four 27th District of California $2,249

14 middle class family Fifth District of South Carolina $74,000 $1,568 1555.5 -12.5 -0.797 2088.5

15 median middle class family Fifth District of Maryland $4,158

16 middle class family 12th District of California $5,508

* each and every year

The first four columns come from Brady's examples. As can be seen, every single one of the first 13 is a "family of four" though two are described as "average" and 5 are described as "median". The last 3 examples are described as "middle class family". It appears that Brady was likely referring to a family of four since the first of the three examples seem to match the numbers for a family of four under the House plan. The remainder of this analysis will assume that the last three examples are for a family of four but there's no way to be sure, especially for the last two.

The last four columns give the tax cuts according to the latest House and Senate plan according to this tax cut calculator. As can be seen, Brady only stated the income for 7 of his 16 examples. It's unclear whether this is an oversight or whether he attempted to use the median or average income for the districts in question. In any case, the tax cuts for the 7 examples for which he does give incomes appear to be much closer to those given by the House plan than the Senate plan. The largest discrepancy is $25.5 and 2.038 percent.

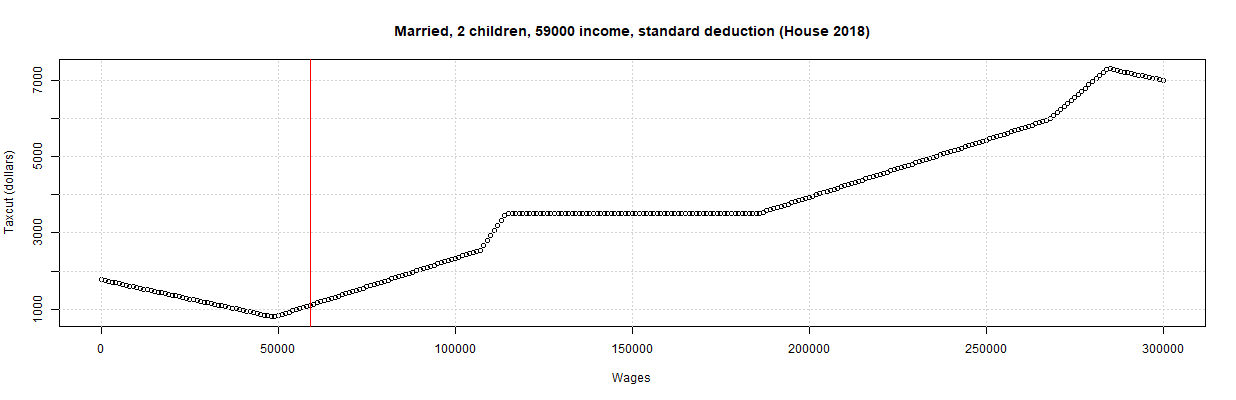

The following plot shows the dollar amount of all tax cuts under the current House plan for incomes under $300,000:

This plot was generated by going to the tax cut calculator, selecting "Example 1 - Family of Four (House)" for "Tax Examples", selecting "Current 2018" and "House 2018" for "Tax Plan 1" and "Tax Plan 2", and setting "Wage Maximum" to 300000. As can be seen, the plot shows tax cuts ranging from about $1,000 to $8,000. This can be used to estimate the incomes for the tax cuts for which Brady provided none. For example, the last tax cut of $5,508 appears to be for an income of about $250,000.

In fact, it happens that all of the tax cuts missing incomes in the table above are in the second and fifth segments of the above plot. For the second and fifth segments, the income can be calculated using the following two formulas, respectively:

2nd segment: income = (taxcut * 100/3) + 22150 5th segment: income = (taxcut * 100/3) + 68833.33Using this second formula for the last tax cut of $5,508 gives (5508 * 100/3) + 68833 which equals $252,433. Using these formulas to fill in the above table gives the following:

HOUSE DIFFERENCE SENATE HOUSEHOLD INCOME

N FAMILY DESCRIPTION CONGRESSIONAL DISTRICT INCOME TAX CUT 2018 AMOUNT PERCENT 2018 MEDIAN MEAN

-- -------------------------- -------------------------------- ------- ------------ ------ ------ ------- ------ -------- --------

1 family of four Michigan’s Ninth District 80,000 over $1,700* 1735.5 35.5 2268.5 $56,582 $78,160

2 average family of four 35th District of Texas $59,000 over $1,100 1105.5 5.5 0.500 1638.5 $48,490 $61,107

3 average family of four Fifth District of California 101,200 over $2,370 2371.5 1.5 2904.5 $73,006 $94,695

4 family of four Connecticut’s First District 197,500 $3,858* 3860.0 2.0 4916.0 $70,215 $92,139

5 family of four Oregon’s Third District 97,350 $2,256 2256.0 0.0 2789.0 $63,231 $83,699

6 family of four New Jersey’s Ninth District $90,000 $2,044 2035.5 -8.5 -0.416 2568.5 $64,964 $91,675

7 median family of four New York’s 14th District $63,000 $1,251 1225.5 -25.5 -2.038 1758.5 $53,512 $70,658

8 median family of four Seventh District of Illinois $73,000 $1,546 1525.5 -20.5 -1.326 2058.5 $54,147 $88,912

9 median family of four 26th District of New York $74,000 $1,562 1555.5 -6.5 -0.416 2088.5 $47,358 $64,320

10 median family of four Alabama’s Seventh District $65,000 $1,311 1285.5 -25.5 -1.945 1818.5 $34,664 $50,729

11 median family of four Washington’s First District 235,770 $5,008 5008.1 0.1 6446.8 $91,018 $113,292

12 family of four California’s 38th District 84,480 $1,870 1869.9 -0.1 2402.9 $66,421 $83,039

13 family of four 27th District of California 97,120 $2,249 2249.1 0.1 2782.1 $71,223 $99,899

14 middle class family Fifth District of South Carolina $74,000 $1,568 1555.5 -12.5 -0.797 2088.5 $48,743 $66,232

15 median middle class family Fifth District of Maryland 207,430 $4,158 4157.9 -0.1 5313.2 $95,442 $109,200

16 middle class family 12th District of California 252,430 $5,508 5507.9 -0.1 7113.2 $105,918 $146,341

* each and every year

As can be seen, some of the calculated incomes are very high with 3 of them over $200,000 and one very nearly equal to it. The last example lists an income of $252,430 for the 12th District of California but the U.S. Census lists the median and mean household income to be $105,918 and $146,341, respectively, for this district. The following shows the corresponding incomes for all four of these high-income districts:

HOUSEHOLD INCOME

N FAMILY DESCRIPTION CONGRESSIONAL DISTRICT INCOME MEDIAN MEAN

-- -------------------------- -------------------------------- ------- -------- --------

4 family of four Connecticut’s First District 197,500 $70,215 $92,139

11 median family of four Washington’s First District 235,770 $91,018 $113,292

15 median middle class family Fifth District of Maryland 207,430 $95,442 $109,200

16 middle class family 12th District of California 252,430 $105,918 $146,341

As can be seen, all four have median and mean incomes far, far less than those implied by Brady's tax cuts. It's therefore unclear why Brady chose them unless it was to increase the reported tax cut. In any event, the table showing all 16 examples above shows that all of the incomes stated or implied by Brady were greater than the median and all but 5 were greater than the mean income reported by the U.S Census for that district.

Likely much more important, however, is the fact all of the examples are for a family of four. Following are the calculation shown on the "Calculation of Taxes" tab for Example 2 above:

Example 1 - Family of Four Making $59,000 Per Year

Tax Plan 2018 House 2018 Change

1 --------------------------- -------- -------- --------

2 Wages, salaries, tips, etc. 59000 59000 0

3 Tax-deferred contributions 0 0 0

4 Exemptions -16600 0 16600

5 Standard deductions -13000 -24400 -11400

6 Itemized deductions 0 0 0

7 --------------------------- -------- -------- --------

8 Medical 0 0 0

9 State and local taxes 0 0 0

10 Real estate taxes 0 0 0

11 Home mortgage interest 0 0 0

12 Charity 0 0 0

13 Misc. repealed deductions 0 0 0

14 --------------------------- -------- -------- --------

15 Taxable income 29400 34600 5200

16 --------------------------- -------- -------- --------

17 Tax on taxable income 3457.5 4152 694.5

18 Child credit -2000 -3200 -1200

19 Other dependent credit 0 0 0

20 Parent credit 0 -600 -600

21 Earned income tax credit 0 0 0

22 --------------------------- -------- -------- --------

23 Income tax 1457.5 352 -1105.5

As can be seen, the tax cut in this case is chiefly due to the increase in the child credit and the standard deduction. Hence, the families that will get the largest tax cuts will tend to be those which have children and which are currently using the standard deduction. It's likely no coincidence that this was the type of family used by Brady in every single one of this 16 examples. This is an obvious example of cherry-picking. To be consistent, Brady should propose that the tax bill be renamed "Tax Cut for the Family of Four using the Standard Deduction Act".

It's important that the Democratic party continue to point to distributional studies of the tax cut such as the recent CBO and JCT studies. However, it would seem that they also need to respond to the taxpayer examples that Republicans continue to mention, verifying that they are correct, calling out mistakes and/or cherry-picking, and coming up with reasonable counterexamples. The distributional studies may be more meaningful and complete in some ways but the taxpayer examples are easier to verify and understand by the media and the public. Hence, both need to be addressed.

The Problems with "Taxpayer Examples"

The Problems with "Taxpayer Examples" (Part 2)

Who Will See Their Taxes Go Up under the House and Senate Plans?

Comments

Post a Comment