Effect of the Bush Tax Cuts on Revenues

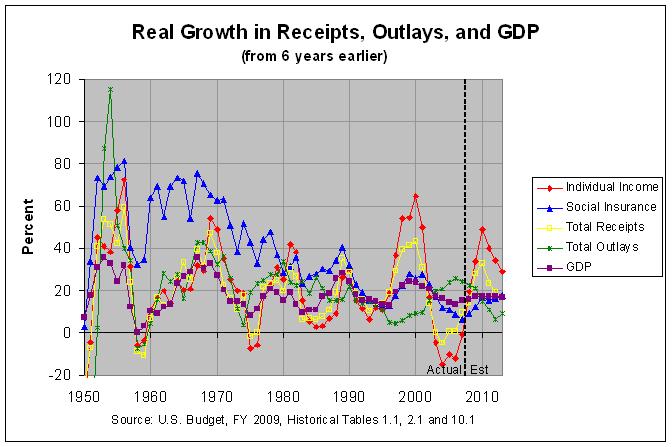

Enough time has now passed that it's possible to take a look at the effect of these tax cuts on government revenues. The growth of receipts by source, outlays, and GDP over every 6-year period since 1940 is shown in the following graph:

The actual numbers and sources can be found at http://www.econdataus.com/recgro6y.html. As can be seen in the second table and graph, individual income tax receipts actually declined slightly from 2001 to 2007. Even total receipts were up just 9.4% over that period. Finally, GDP growth has been no faster than usual since 2001. Hence, although it's been just about six years since the 2001 tax cut and four years since the 2003 tax cut, the evidence to this point is that the Bush tax cuts decreased revenues over what they would have been, at least over the short term.

For a look at the effect of the Reagan and Kennedy tax cuts on revenues, see the analysis at http://www.econdataus.com/taxcuts.html.

That's an excellent graph. Thanks very much for alerting me to it.

ReplyDeleteAs best as I can tell all your graphs seem to prove is that tax revenue loosely correlates to GDP. It does not prove or disprove whether lower tax rates drive GDP. In fact it would be entirely possible - though intuitively wrong, to argue that tax revenues are unrelated to tax rates based on your charts.

ReplyDeleteYou are a wide ranging researcher and thinker, a prolific writer/publisher. These efforts are praiseworthy. However, you are a poor salesman of your findings. Your work appears to come from out of nowhere like equations written as graffiti.

ReplyDeleteI invite you to contact me to join in a discussion and sharing of ideas of like minded people who want to have their ideas and presentations challenged by their peers. The coin of this realm is commenting on other’s ideas to get feedback on one’s own ideas. The goal of this realm is to achieve a better perspective on one’s own position and if possible consensus for joint publication. I have a fundamental belief that the greatest good can be achieved through challenge and cooperation.

Thank you for the publication of all your work.

Drop me a line at Gotothomas@aol.com if you are interested.

Best wishes,

Thomas

“Our earth is degenerate in these latter days; bribery and corruption are common; children no longer obey their parents; every man wants to write a book, and the end of the world is evidently approaching.” – From an ancient Assyrian tablet

I'm a physics junior, and I took an intermediate macroeconomic theory course two semesters ago. Unsurprisingly, the professor espoused Keynesian economics. I have been under the notion that tax rate reductions do prompt more investment by businesses. However, I was never sure if that actually increased federal revenues chiefly because I never cared. It was never a concern in my mind. Even if tax rate reductions conclusively lowered federal revenues, that's not necessarily a negative effect. The goal is not to maximize federal revenue. There are a myriad of non-economic arguments for allowing people to keep more of their earned money rather than increase government's unearned money. The problem stems from the federal government far exceeding its constitutional mandates and functions. When it does that, it creates new, unnecessary programs, new entitlements, and so forth, and this naturally would demand higher and higher tax revenues. The essential functions of government (law, order, defense, etc.) should of course be funded by its citizens who formed the government. I think the question should be do we have enough revenue to cover the essential functions of government and even the responsible, benevolent programs aimed at getting our citizens back on their feet to continue to become productive members of society and also helping those who are actually unable to take care of themselves (limited unemployment, disability, etc.). Thanks.

ReplyDeleteEven if tax rate reductions conclusively lowered federal revenues, that's not necessarily a negative effect. The goal is not to maximize federal revenue.

ReplyDeleteI agree that the sole goal is not to maximize federal revenue. However, lowering federal revenues is a negative effect that will have to made up for through higher future taxes and/or lower future spending. In any case, my analysis at this link was to address the argument that tax cuts pay for themselves. This is a dangerous argument in that it presents tax cuts as a free lunch that requires no analysis to weigh the advantages and disadvantages. In fact, such analysis is necessary for all tax cuts and increased spending. Both have their obvious benefits but they also have costs against which those benefits must be weighed.

There are a myriad of non-economic arguments for allowing people to keep more of their earned money rather than increase government's unearned money.

I agree that there are arguments in favor of tax cuts. However, I would be more careful about the use of "earned" and "unearned" money. As you say below, law, order, defense, etc. are essential functions of government. I would say that a government that provides these essential functions has "earned" the revenues required to pay for them.

The problem stems from the federal government far exceeding its constitutional mandates and functions. When it does that, it creates new, unnecessary programs, new entitlements, and so forth, and this naturally would demand higher and higher tax revenues. The essential functions of government (law, order, defense, etc.) should of course be funded by its citizens who formed the government. I think the question should be do we have enough revenue to cover the essential functions of government and even the responsible, benevolent programs aimed at getting our citizens back on their feet to continue to become productive members of society and also helping those who are actually unable to take care of themselves (limited unemployment, disability, etc.). Thanks.

I think that we have to fund "benevolent programs" like unemployment and disability. To my knowledge, every developed country in the world does so. Of course, every such program likely benefits many deserving people but is also taken advantage by some who are not so deserving. The goal is to structure such programs so as to maximize the former and minimize the latter.

In any case, the table at this link shows that the great majority of the increase in outlays that is projected through 2015 falls in two areas. The first area is entitlements, driven chiefly by health care costs but, to a lesser extent, by Social Security. The second area is net interest. Since interest is pretty much an unavoidable cost, this suggests that the chief focus needs to be on the rise in the cost of health care and other entitlements.