Will the Fed selling Treasuries affect interest rates?

Note: In the following charts, click on the chart to see its data and sources.

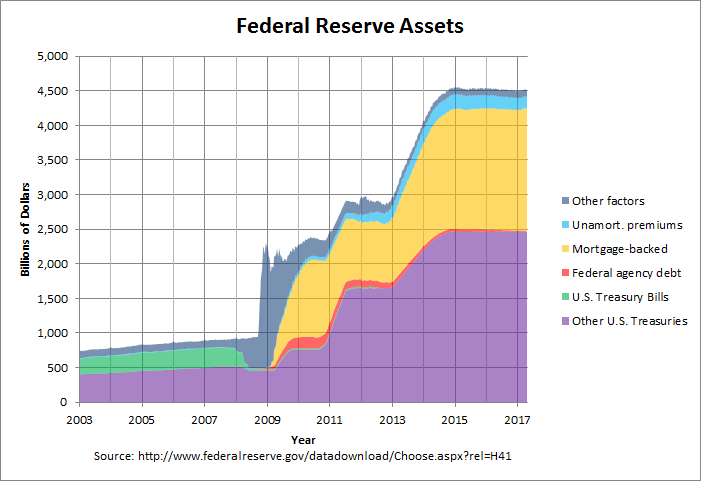

As can be seen from the purple area in the chart, about 2.5 of the 4.5 trillion in assets are Treasuries. Also visible is that these levels have remained stable since the end of 2014, when QE3 ended. In any event, there has been much discussion on what will happen when the Fed starts selling its Treasuries. More specifically, who will step in and buy the Treasuries that the Fed is selling plus any additional debt being created? To judge this, it helps to look at how the holders of Treasuries have changed over time. The following chart shows the holders of Treasury securities since 1970:

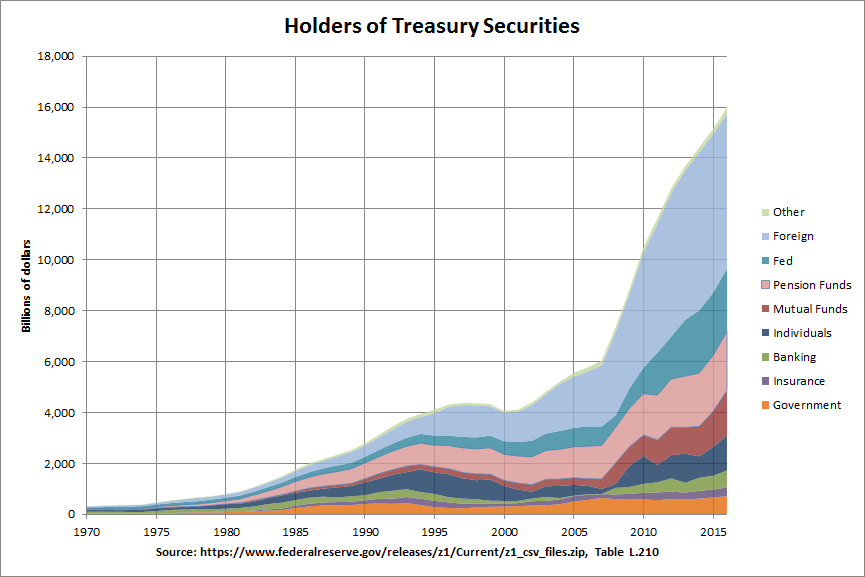

As stated below the table on this page, this includes marketable and nonmarketable Treasury securities held by the public (net of premiums and discounts) and Treasury securities held by federal government employee retirement funds. Hence, it does not include the $2.8 trillion of special-issue treasuries held by the Social Security trust fund. In any event, it's worth noting how the total value of Treasuries has increased sharply since the financial crisis. Hence, there is likely to be a great deal of new Treasuries that need to be bought in addition to those being sold by the Fed.

The chart does show that the value of Treasuries held by individuals and mutual funds increased sharply after the 2008 financial crisis. It would seem likely that this was in response to the fact that Treasuries were one of the few asset classes that did not go down sharply during the crisis. The value of Treasuries held by banking institutions also increased somewhat, possibly due to the improvement in their balance sheets. Treasuries held by government (state and local) and insurance companies seemed to remain fairly stable. Pension funds (including government retirement funds) did increase somewhat but were already major holders of Treasuries. Of course, as shown in the first chart in this post, the value of Treasuries held by the Fed increased sharply starting in 2011.

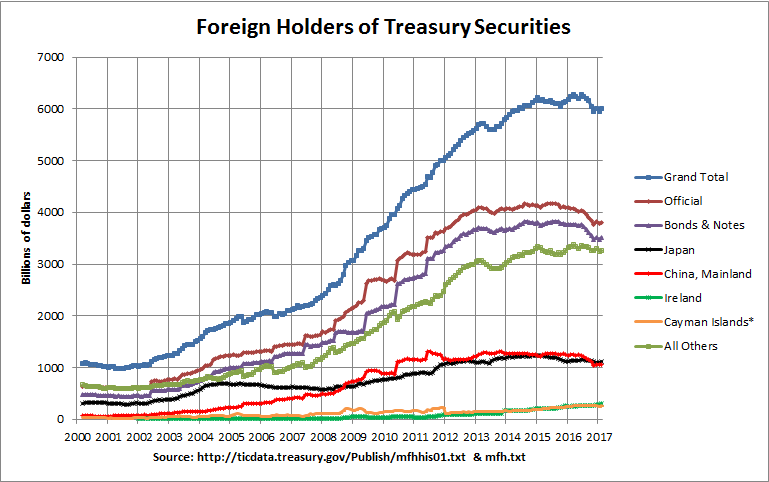

The one other major holder of Treasuries were foreign holders and they likewise can be seen to have increased after the crisis. The composition of this group can be seen in the following chart:

As can be seen, Japan and Mainland China are the two countries with the largest holdings of Treasuries at just over $1 trillion each. The chart shows that the holdings of both countries have decreased over the past three years. The next two largest holdings are in Ireland and the Cayman Islands. This may initially seem surprising but the reason is that both are regional financial centers. The holdings in both of those countries have increased sharply since the financial crisis. Finally, the olive-colored line shows that the holding of all other countries have remained about the same over the past two years. As a result, the blue line at the top shows that the holdings of all countries has decreased slightly over the past two years.

Judging from the above chart, it would not seem that foreign holders of Treasuries can be counted on to buy many of the new Treasuries being created or sold by the Fed. One exception would be if those Treasuries pay higher interest rates. Another exception might be if there is another global financial crisis and U.S. Treasuries are seen as a safe harbor. The same may be true for Treasuries bought by individuals and mutual funds. Higher interest rates and/or a major market correction could motivate more investors to buy Treasuries.

There is no agreement on the effect of all this on future interest rates. For example, one blog suggests that "[i]n addition to actual rate hikes, this would put further upward pressure on interest rates, and downward pressure on bond prices." However, another blog reminds readers that "[a]s the Fed ceased QE1 and all economists knew rates must rise...rates shocked 100% of economists and fell by a third." It concludes "I don't think the Federal Government nor the Federal Reserve are about to let a "so called free-market" determine the yields paid on America's debt." Of course, the Federal Government and Federal Reserve may not be able to do anything to avoid higher interest rates. However, it is true that higher interest rates will cause the interest payments to increase, putting additional pressure on the U.S. budget. This will certainly be a motivation to keep interest rates low if that is possible.

Comments

Post a Comment