Ben Bernanke and the Federal Reserve Balance Sheet

DATES AND DESCRIPTIONS OF FEDERAL RESERVE ACTIONS

Program Start End Securities purchased

------- -------- -------- --------------------

QE1 Dec 2008 Mar 2010 agency mortgage-backed securities (MBS) and agency debt, up to $600 billion total

Mar 2009 Mar 2010 expanded to $1.25 trillion in MBS, $175 billion in agency debt, and $300 billion in treasuries

QE2 Nov 2010 Jun 2011 longer dated treasuries, at a rate of $75 billion per month for a total of $600 billion

Twixt Sep 2011 Dec 2012 longer dated treasuries with funds from selling shorter dated treasuries, total of $400 billion

QE3 Sep 2012 Present agency mortgage-backed securities (MBS) at a rate of $40 billion per month

Dec 2012 added longer dated treasuries, at a rate of $45 billion per month (same rate as Twixt)

Jan 2014 cut back to $35 billion MBS and $40 billion in treasuries per month

Feb 2014 cut back to $30 billion MBS and $35 billion in treasuries per month

Mar 2014 cut back to $25 billion MBS and $30 billion in treasuries per month

Apr 2014 cut back to $20 billion MBS and $25 billion in treasuries per month

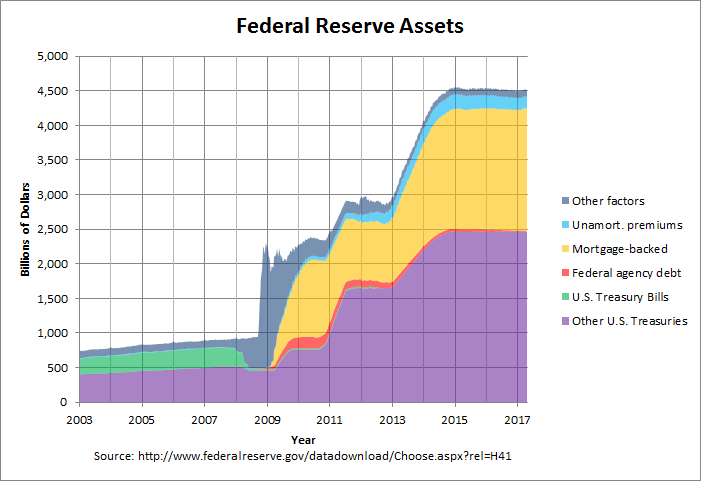

The effect of these programs on the federal reserve balance sheet can be seen in the following graph:

As can be seen, federal reserve assets jumped sharply toward the end of 2008 in response to a number of Fed programs. These programs are shown in more detail in graphs and tables at this link. Then, mortgage-backed securities (MBS) are seen to grow sharply from early 2009 to early 2010 in response to Quantitative Easing 1 (QE1). Then, treasuries are seen to grow sharply from then end of 2010 to mid-2011 in response to Quantitative Easing 2 (QE2). Operation Twixt, which went from late 2011 to the end of 2013 is not visible because the changes occurred entirely within the purple area of "Other U.S. Treasuries" where longer dated treasuries were bought with the funds from selling shorter dated treasuries. However, both mortgage-backed securities (MBS) and treasuries are seen to grow sharply from the end of 2012 to the present in response to Quantitative Easing 3 (QE3).

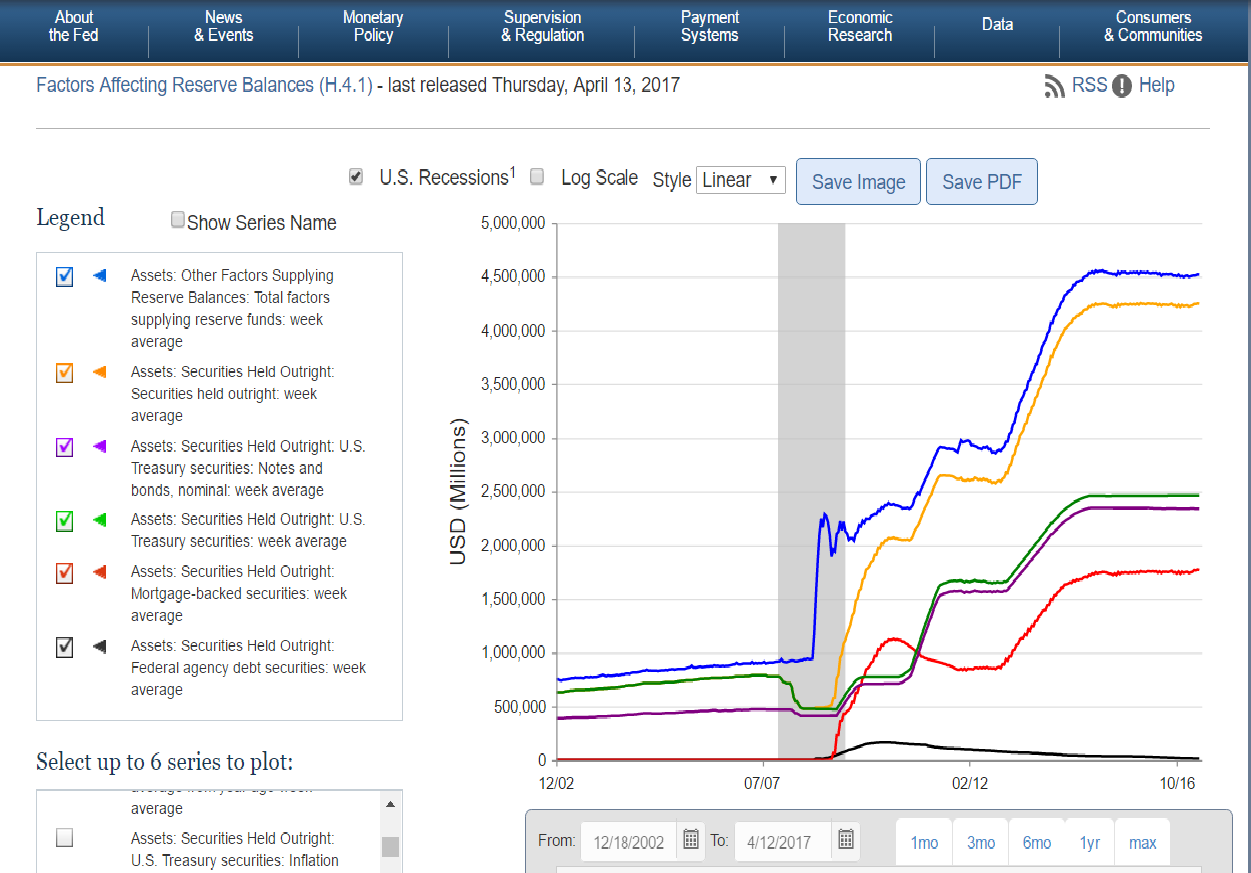

The Federal Reserve website has an excellent program for downloading and graphing this data at this link. The data for the above graph is posted at this link and was downloaded via this program. This program was also used to generate the following graph:

This graph looks very similar to the first graph but differs in that it is not a "stacked-area" graph. As a result, mortgage-backed securities (the red line) are shown separately from the U.S. Treasury securities (the green line). As can be seen, the Federal Reserve assets consisted chiefly of U.S. Treasuries before the financial crisis but its holdings of mortgage-backed securities briefly surpassed its treasury holdings in 2010 in response to QE1. However, the Fed's treasury holdings came back to surpass its MBS holdings with QE2 and that has continued as both have grown with QE3.

There is some disagreement as to the effects of these programs. On January 31st, the PBS Newshour had a segment titled "How economists grade Ben Bernanke’s Federal Reserve tenure". The following excerpt from the transcript shows a apparent disagreement between the conservative economist Charles Calomiris and Alan Blinder, a past vice chairman of the Fed, apparently over the wisdom of QE3:

CHARLES CALOMIRIS: The Fed under Bernanke in the last two years has created inflationary risk that could be hard for his successors to manage. What he created was a risk of inflation over the next five years, in exchange for getting very small potatoes in terms of improvement in the economy over the past two years.

PAUL SOLMAN: That risk is why Calomiris gives Bernanke a post-crash grade of incomplete.

But Alan Blinder calls inflation fears baseless.

ALAN BLINDER: For years, there was going to be inflation next year, inflation next year. Wrong, wrong, wrong, wrong. We haven’t had any inflation. Lately, since there’s no inflation, often, it’s the same people have started this, it’s causing speculative bubbles.

So let’s see, where? House prices? I don’t think so. They have recovered about one-third of what they lost, and it looks like they’re kind of leveling off. Can’t tell. Stock prices? Well, maybe, but, you know, we have extraordinarily high profits. We have extraordinarily low interest rates. On basic fundamentals, stock prices should be high. I don’t stay awake worrying about bubbles now.

On the other hand, Richard Fisher, President of the Federal Reserve Bank of Dallas, discussed what he believed to be the costs and benefits of the programs on a recent episode of EconTalk. In the following excerpt from the transcript, he discusses the costs:

And I'm worried about the long-term consequences of having all that money sitting out on the sidelines. These are in depository institutions as well as significant amounts of money sitting in private equity firms and sitting in hedge funds, etc., outside our purview. That's a lot of tender. If velocity were to pick up, how do we tamp it down so that it doesn't lead to inflationary impulses? Right now inflation is not an issue. But our charge, given to us by the Congress, says long run, long run, long run. And that's what I'm worried about. Those are the costs that I'm worried about.

He then goes on the discuss the benefits:

And the benefits? Well, I'll be blunt about this. Mr. Druckenmiller said this on television the other day: this is great for rich people; it's great for Warren Buffett. Bless his heart, he's a good investor. Good for Mr. Druckenmiller and others, they get money for free. It hasn't done what we wanted it to do, which is lead to greater job creation for the two middle income quartiles.

My impression is that there is general agreement that Bernanke handled the immediate aftermath of the financial crisis well. In the Newshour interview, both Blinder and Calomiris gave Bernanke an A for that period. However, there seems to be much less agreement on the Fed's recent policies. Much will likely depend on how things play out and whether the Federal Reserve is able to unwind its balance sheet without any major problems. As Paul Solman said at the end of the Newshour segment:

And so, as Ben Bernanke leaves office after what everyone agrees is an unforgettable eight years on the job, his final grade probably won’t come for years, during the tenure of successor Janet Yellen, or maybe even later than that.

Excellent description i have got what i am finding for last few days.

ReplyDeleteThis is an amazing post you have published with us . Keep continue sharing

ReplyDelete