Do Publications Have Any Responsibility to Screen Their Editorials? (Part 2)

It will be interesting to see if Stephens or the Wall Street Journal publish a correction to this egregious mistake. That might give some indication as to whether they are concerned about their reputations or are simply pushing a point of view by whatever means possible.

As it happens, a correction written by Stephens titled "About Those Income Inequality Statistics" was posted on January 3rd. In it, he admits his error in using data that had not been corrected for inflation, stating:

In my Dec. 31 column on income inequality, I used a data set from the U.S. Census Bureau to make the case that incomes in the U.S. have been growing across the board, even if the incomes of the wealthy have grown faster than those of others further down the income scale. But I wrote those lines looking at a set of numbers that had not been adjusted for inflation.

Professor Krugman, in a post on his New York Times blog, takes me to task for this. Had I done so looking at the inflation-adjusted table, it would have shown the incomes of the bottom 20% essentially stagnating since 1979 (and long before then, too), though it also would have shown incomes for the top 20% rising far less dramatically.

He goes on to mention that Krugman accuses him, not of making an honest mistake, but of "pulling a fast one". He then continues:

My mistake is all the more unfortunate because the basic point I was making is right: Americans are getting richer across the entire income spectrum, even if they are getting richer at very different rates. That much is confirmed by data from the Congressional Budget Office. The CBO finds that between 1979 and 2007 income for poor households grew by 18%, for the middle classes by nearly 40%, and for the top 81-99% by 65%. It's the top 1% who have made out very handsomely, with a jump of 275% over nearly three decades.

Hence, Stephens feels that his basic point is still right despite the fact that he was forced to switch from using Census data to CBO data to maintain it. He feels this despite the fact that he goes on to admit that the differences between Census and CBO data is complicated and ultimately subjective. In any event, the CBO numbers calculate that the income of the bottom 20 percent of households increased by 18% over the 28 years from 1979 to 2007. That works out to about 0.6 percent per year compounded.

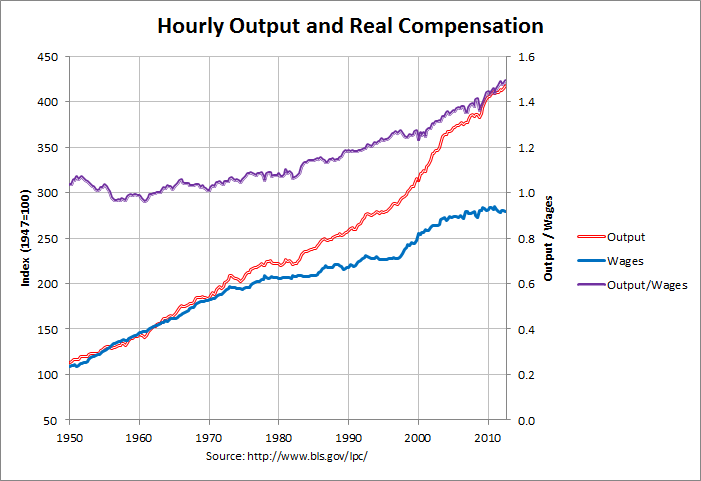

The idea that this shows that "Americans are getting richer across the entire income spectrum" is highly debatable. As mentioned, Stephens had to go with CBO data instead of Census data. In addition, he is basing this statement on a mere four categories. The CBO data gives no indication as to the variation of income increases in the bottom 20 percent. This is especially the case when you consider the variation in inflation. Those who have been hit by high inflation in health care and higher education likely do not feel "richer". In addition, you would expect incomes to rise faster than inflation due to productivity and the real growth in the GDP. The following graph shows the growth in output and wages since 1950:

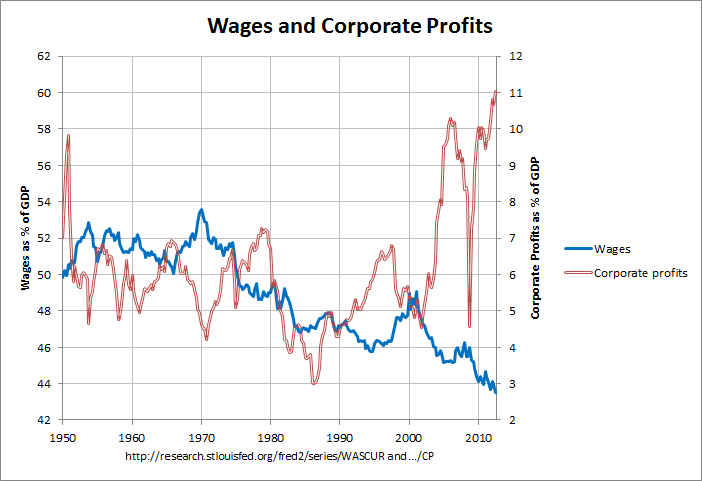

As can be seen, wages generally kept up with productivity gains until the 70s but have generally lagged since. The following graph shows wages and corporate profits as a percent of GDP since 1950:

As can be seen, wages as a percent of GDP stayed fairly level to the mid-70s but have generally declined since. Meanwhile, corporate profits as a percent of GDP have risen sharply since about 2001. The actual data and sources for both of these graphs can be found at this link.

In addition to Stephen's correction, the Wall Street Journal has posted a correction that reads as follows:

Inflation-adjusted income data from the U.S. Census Bureau show that incomes declined by 2.6% for the bottom quintile between 1979 and 2012, increased by 5.7% for the middle class (third quintile), and by 42% for the top quintile. Bret Stephens's column of Dec. 31 (Global View, "Obama's Envy Problem") used non-inflation adjusted income figures.

However, there is one major problem remaining. If you look at the original editorial, you'll see that nothing appears to have changed! The Wall Street Journal website is still displaying the same editorial with the same non-inflation-corrected numbers that they have posted a correction for! What is the point of the correction if you're not going to correct the original posting?

It was a positive step for Stephens and the Wall Street Journal to post corrections to this story. However, it will now be interesting to see if the Wall Street Journal corrects their original editorial. That might give some indication as to whether they are truly concerned with correcting their mistakes and limiting their effects or are simply going through the motions.

Do Publications Have Any Responsibility to Screen Their Editorials? (Part 3)

Comments

Post a Comment