Laffer on the Ineffectiveness of Stimulus

Policy makers in Washington and other capitals around the world are debating whether to implement another round of stimulus spending to combat high unemployment and sputtering growth rates. But before they leap, they should take a good hard look at how that worked the first time around.

It worked miserably, as indicated by the table nearby, which shows increases in government spending from 2007 to 2009 and subsequent changes in GDP growth rates. Of the 34 Organization for Economic Cooperation and Development nations, those with the largest spending spurts from 2007 to 2009 saw the least growth in GDP rates before and after the stimulus.

Regarding this nearby table, monetary economist David Glasner says the following in a critique of the Laffer editorial:

So how did Laffer perform his calculation? He doesn’t say. All he does is cite the IMF as the source for his table. Thanks a lot, Art; that was really helpful, but unfortunately, not helpful enough to figure out what you are talking about.

Glasner is referring to the fact that the table gives the source of the data simply as "International Monetary Fund". It does seem that many discussions in the political arena are hamstrung (perhaps purposely) by the failure of the author to give a usable source, much less to explain his calculations. I've therefore taken the time to do what Laffer arguably should have done to begin with. I found this spreadsheet on the IMF site which appears to contain the numbers used by Laffer. The following two tables show how these numbers can be used to calculate Laffers figures:

Gross domestic product, constant prices

Percent change (08+09)

minus

Country 2006 2007 2008 2009 2010 2011 (06+07)

---------------- ------- -------- -------- -------- -------- -------- --------

United States 2.658 1.913 -0.337 -3.486 3.030 1.735 -8.4

Japan 1.693 2.192 -1.042 -5.527 4.435 -0.748 -10.5

Germany 3.889 3.394 0.809 -5.078 3.562 3.056 -11.6

France 2.658 2.234 -0.196 -2.631 1.382 1.715 -7.7

United Kingdom 2.607 3.466 -1.103 -4.373 2.092 0.655 -11.5

Italy 2.199 1.683 -1.156 -5.494 1.804 0.431 -10.5

Canada 2.823 2.200 0.689 -2.770 3.215 2.460 -7.1

Australia 2.682 4.676 2.500 1.373 2.544 2.035 -3.5

Spain 4.077 3.479 0.888 -3.740 -0.070 0.710 -10.4

Mexico 5.147 3.242 1.186 -6.275 5.543 3.967 -13.5

Korea 5.179 5.106 2.298 0.319 6.320 3.634 -7.7

Turkey 6.893 4.669 0.659 -4.826 9.006 8.460 -15.7

Netherlands 3.394 3.921 1.804 -3.479 1.633 1.266 -9.0

Switzerland 3.630 3.645 2.095 -1.878 2.714 1.851 -7.1

Sweden 4.557 3.431 -0.774 -4.845 5.845 3.991 -13.6

Poland 6.227 6.785 5.127 1.606 3.944 4.350 -6.3

Norway 2.443 2.652 0.009 -1.661 0.654 1.688 -6.7

Belgium 2.702 2.900 0.957 -2.841 2.266 1.893 -7.5

Austria 3.670 3.706 1.396 -3.810 2.315 3.107 -9.8

Denmark 3.395 1.583 -0.784 -5.834 1.296 1.050 -11.6

Chile 5.825 5.207 3.034 -0.860 6.137 5.924 -8.9

Greece 4.614 3.032 -0.137 -3.258 -3.507 -6.860 -11.0

Finland 4.411 5.335 0.294 -8.354 3.732 2.855 -17.8

Israel 5.594 5.497 4.028 0.837 4.846 4.707 -6.2

Portugal 1.448 2.365 -0.008 -2.908 1.383 -1.466 -6.7

Ireland 5.312 5.182 -2.972 -6.995 -0.430 0.705 -20.5

Czech Republic 7.020 5.735 3.099 -4.695 2.739 1.655 -14.4

New Zealand 0.997 2.840 -0.074 -2.071 1.215 1.441 -6.0

Hungary 3.900 0.100 0.900 -6.800 1.270 1.695 -9.9

Slovak Republic 8.345 10.494 5.751 -4.932 4.183 3.349 -18.0

Luxembourg 4.969 6.639 0.754 -5.300 2.678 1.004 -16.2

Slovenia 5.850 6.870 3.589 -8.008 1.380 -0.175 -17.1

Estonia 10.097 7.492 -3.671 -14.258 2.264 7.636 -35.5

Iceland 4.709 5.985 1.270 -6.807 -4.024 3.051 -16.2

General government total expenditure

Percent of GDP 2009

minus

Country 2006 2007 2008 2009 2010 2011 2007

---------------- ------- -------- -------- -------- -------- -------- --------

United States 35.852 36.672 39.196 43.981 42.142 41.397 7.3

Japan 34.489 33.312 35.730 39.982 39.002 40.675 6.7

Germany 45.559 43.506 44.046 48.104 47.869 45.625 4.6

France 52.934 52.595 53.329 56.725 56.668 56.321 4.1

United Kingdom 40.613 40.325 43.066 47.267 46.325 45.725 6.9

Italy 48.464 47.611 48.610 51.889 50.495 49.953 4.3

Canada 39.268 39.158 39.535 44.056 43.815 42.664 4.9

Australia 34.635 34.244 34.487 37.579 36.773 36.598 3.3

Spain 38.342 39.192 41.300 46.065 45.439 43.586 6.9

Mexico 22.818 23.148 24.606 28.314 26.928 26.211 5.2

Korea 21.535 21.886 22.387 23.030 20.999 21.658 1.1

Turkey 32.793 33.325 33.837 37.717 35.443 34.186 4.4

Netherlands 45.687 45.087 46.116 50.785 50.614 50.034 5.7

Switzerland 35.663 34.634 32.612 34.398 34.040 34.736 -0.2

Sweden 50.770 48.968 49.625 52.793 50.634 49.126 3.8

Poland 43.864 42.187 43.194 44.510 45.366 44.472 2.3

Norway 39.936 40.386 39.764 46.610 45.421 44.320 6.2

Belgium 48.603 48.320 49.900 53.828 52.942 53.450 5.5

Austria 49.141 48.602 49.335 52.893 52.603 50.449 4.3

Denmark 51.250 50.788 51.424 57.899 56.174 55.972 7.1

Chile 18.716 19.381 21.727 24.622 23.628 23.300 5.2

Greece 44.691 46.709 49.734 53.033 49.620 49.696 6.3

Finland 49.238 47.431 49.316 56.103 55.550 54.043 8.7

Israel 47.501 46.016 45.427 45.086 44.736 44.354 -0.9

Portugal 44.364 44.362 44.816 49.914 51.414 48.710 5.6

Ireland 33.406 36.194 42.301 47.937 65.637 44.143 11.7

Czech Republic 41.967 41.040 41.148 44.921 44.110 44.549 3.9

New Zealand 31.105 31.064 32.862 34.471 34.490 35.364 3.4

Hungary 52.164 50.641 49.205 51.380 49.453 48.441 0.7

Slovak Republic 36.521 34.210 35.049 41.704 41.100 38.375 7.5

Luxembourg 38.576 36.267 37.103 43.042 42.482 41.635 6.8

Slovenia 42.547 40.262 41.422 46.355 47.134 47.713 6.1

Estonia 34.573 34.853 41.037 47.654 44.713 43.123 12.8

Iceland 41.641 42.268 44.639 49.672 47.923 46.321 7.4

The numbers in the rightmost column of both tables exactly match the numbers in Laffer's table. Hence, first table shows that the change in real GDP growth in Laffer's table is equal to the annual GDP changes in 2008 and 2009 minus the annual GDP changes in 2006 and 2007. The second table shows that the change in government spending in Laffer's table is equal to the government spending in 2009 minus the government spending in 2007, both numbers taken as a percent of GDP.

Based on these numbers, Laffers editorial continues as follows:

The four nations—Estonia, Ireland, the Slovak Republic and Finland—with the biggest stimulus programs had the steepest declines in growth. The United States was no different, with greater spending (up 7.3%) followed by far lower growth rates (down 8.4%).

This statement is based on Laffer's calculations for these four nations, shown in bold in the rightmost column of the above tables. Regarding Laffer's calculation of public spending as a percent of GDP, economist Lars Christensen says the following in another critique of the Laffer editorial:

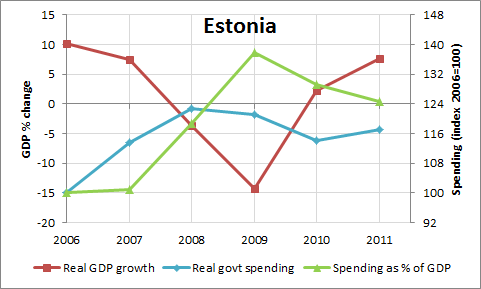

One major problem with Laffer’s numbers is that he is using public spending as share of GDP to analyze the magnitude of change in fiscal policy. However, for a given level of public spending in euro (the currency today in Estonia) a drop in nominal GDP will naturally lead to an increase in public spending as share of GDP. This is obviously not fiscal stimulus. Instead it makes more sense to look at the level of public spending adjusted for inflation and this is exactly what I have done in the graph below. I also plot Estonian GDP growth in the graph. The data is yearly data and the source is IMF.

Following is a similar graph, also showing public spending adjusted for inflation (blue line) and GDP growth (red line) for Estonia. It also shows public spending as a percentage of GDP (green line), the spending values used by Laffer.

The following table shows the values for real public spending as calculated from the IMF data:

General government total expenditure

Constant national currency* (index 2006=100) 2009

minus

Country 2006 2007 2008 2009 2010 2011 2007

---------------- ------- -------- -------- -------- -------- -------- --------

United States 100.0 104.3 109.4 120.1 118.0 116.7 15.8

Japan 100.0 97.7 101.0 107.7 108.2 110.1 10.0

Germany 100.0 98.0 98.3 102.9 105.6 101.9 4.9

France 100.0 102.6 103.2 107.2 107.6 108.0 4.7

United Kingdom 100.0 102.7 107.9 112.7 112.3 109.3 10.1

Italy 100.0 100.2 100.2 102.4 100.2 98.0 2.2

Canada 100.0 103.0 106.4 112.8 117.1 117.2 9.8

Australia 100.0 105.5 111.3 121.1 124.5 127.6 15.6

Spain 100.0 106.2 111.0 119.6 116.0 110.2 13.4

Mexico 100.0 106.4 115.8 123.8 124.2 128.2 17.4

Korea 100.0 106.3 109.4 113.6 110.9 115.9 7.3

Turkey 100.0 103.9 107.7 113.2 113.5 121.5 9.3

Netherlands 100.0 102.8 107.0 112.2 114.0 112.9 9.3

Switzerland 100.0 102.4 98.5 102.6 103.6 108.2 0.1

Sweden 100.0 100.7 101.3 102.4 103.3 103.8 1.7

Poland 100.0 104.2 110.9 116.4 121.9 123.3 12.2

Norway 100.0 106.2 111.8 118.1 120.3 124.5 11.9

Belgium 100.0 102.8 104.8 111.2 111.3 113.0 8.4

Austria 100.0 102.4 103.9 107.8 109.8 107.0 5.4

Denmark 100.0 101.2 102.5 108.4 108.1 106.9 7.1

Chile 100.0 109.3 116.9 134.6 145.3 151.1 25.3

Greece 100.0 109.1 116.2 121.3 106.2 97.6 12.3

Finland 100.0 102.9 106.3 110.5 112.1 112.5 7.7

Israel 100.0 102.1 101.5 103.3 105.9 108.5 1.2

Portugal 100.0 102.8 102.7 113.1 117.7 107.1 10.4

Ireland 100.0 112.2 120.6 124.0 167.5 111.7 11.7

Czech Republic 100.0 103.9 102.9 108.0 105.6 105.5 4.2

New Zealand 100.0 104.9 110.0 114.0 117.2 121.1 9.1

Hungary 100.0 94.9 92.4 89.4 85.6 85.0 -5.6

Slovak Republic 100.0 102.7 110.1 122.0 125.0 117.8 19.3

Luxembourg 100.0 101.6 105.7 115.8 120.4 118.9 14.3

Slovenia 100.0 101.7 106.8 112.2 112.4 112.4 10.6

Estonia 100.0 113.5 122.8 121.2 114.2 117.0 7.7

Iceland 100.0 108.2 115.2 115.4 108.4 107.1 7.2

A careful comparison of Christensen's graph and the graph above shows that real public spending (blue line) increases slightly faster on the former, reaching about 122 in 2011 versus 117 in the latter. This is likely because the graph above is using "Inflation, average consumer prices" as given in the IMF data whereas Christensen's data is likely using an alternate measure of inflation. However, the shapes of the line are basically the same and Christensen's following statement holds true for both:

So what happened in 2009? Inflation adjusted public spending dropped! This is what makes Estonia unique. The Estonian government did NOT implement Keynesian policies rather it did the opposite. It cut spending. This is clear from the graph (the blue line). It is also clear from the graph that the Estonian government introduced further austerity measures and cut public spending further in 2010. This is of course what Laffer calls “fiscal stimulus”.

In fact, the four countries with the most fiscal stimulus as measured by the real increase in public spending from 2007 to 2009 were Chile (25.3), the Slovak Republic (19.3), Mexico (17.4), and the United States (15.8)! That includes only one of Laffer's choice of 4 countries with the least growth in GDP rates. The other three had much lower increases in public spending of 11.7 (Ireland) and 7.7 (Estonia and Finland).

In summary, Laffer makes a number of mistakes in his editorial. The first is to compare growth in GDP rates with government spending as a percent of GDP. He is testing for a relationship between two variables but expressing one of them (spending) in terms of the other (GDP). That is, he is linking them by design! As an example of this link, suppose that spending remains constant but GDP drops. By simple arithmetic, this will cause spending as a percentage of GDP to rise and be interpreted by Laffer as stimulus. This seems like an incredibly elementary mistake for a professional economist to be making.

The second mistake is to select one span of data and look at only that data. Laffer chooses to look at GDP growth from 2006 to 2009 and government spending from 2007 to 2009. The tables at this link show calculation for these same variables going out to 2011 instead of 2009. As can be seen, this causes the results to be very different. For example, the 4 nations with the highest drop in GDP growth rates are Slovenia (-23.1), the Slovak Republic (-22.0), Greece (-21.1), and Iceland (-19.7) if the span is increased from 2009 to 2011.

It's often a good idea to look at all of the available data in graphical format (such as the one above) to get a look over all possible time spans. Similar graphs for Finland, Ireland, and the Slovak Republic can be found at the aforementioned link.

Finally, Laffer makes the mistake of not giving a precise source that allows his calculations to be checked. This may be as much of a mistake of the Wall Street Journal as it is for Laffer. I believe that all publications should mandate that precise sources be given and, if possible, links be provided to background material that explains the author's calculations. Then, others will be able to check the author's work, especially in the case where the publications chooses not to do so or does a poor job of doing so.

Note: There is a discussion of this post at this link.

Comments

Post a Comment