Effect of the Bush Tax Cuts on Revenues and GDP (updated)

There have been three major tax cuts under Bush. Briefly, the 2001 tax cut created a new 10% individual tax rate and phased in the lowering of individual tax rates. It also phased in an increase in the child tax credit, marriage penalty relief provisions, an increase of the estate tax exemption, an increase in the IRA contribution limit, and the repeal of limits on itemized deductions and personal exemptions. The 2002 tax cut was chiefly aimed at business, creating 30% expensing for certain capital asset purchases, extending the exception under Subpart F for active financing income, and increasing the carryback of net operating losses to 5 years. Finally, the 2003 tax cut lowered the top individual income tax rate on dividends and capital gains and accelerated most of the phased-in provisions of the 2001 tax cut. For a more complete description of the tax cuts, see page 14 of Revenue Effects of Major Tax Bills.

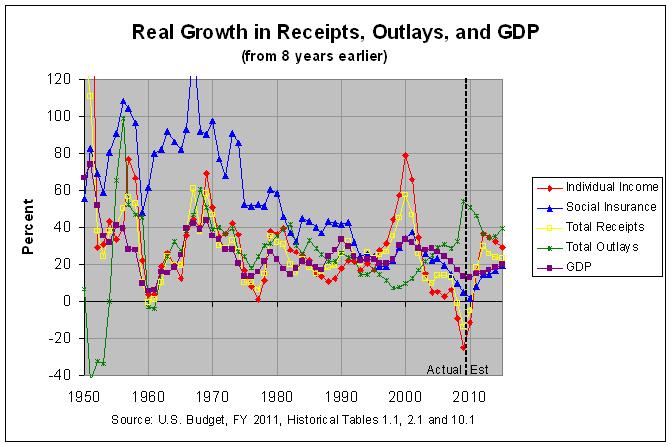

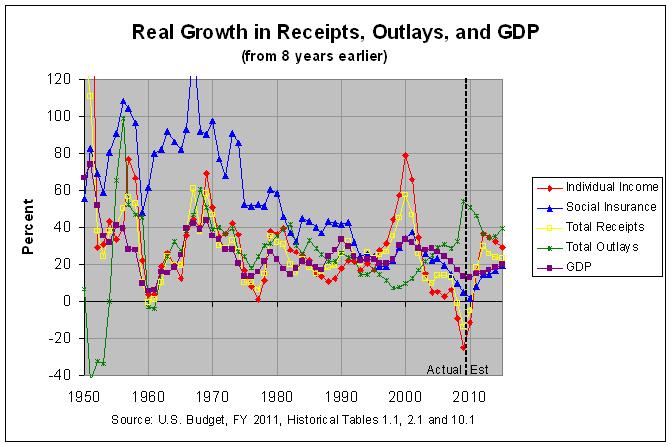

Enough time has now passed that it's possible to take a look at the effect of these tax cuts on government revenues. The growth of receipts by source, outlays, and GDP over every 8-year period since 1940 is shown in the following graph:

The actual numbers and sources can be found at recgro8y.html. As can be seen in the graph and second table, real (corrected for inflation) individual income tax receipts declined 25.06% from 2001 to 2009. Even real total receipts declined 13.93% over that period. Finally, real GDP grew just 13.36% from 2001 to 2009. This was the lowest real GDP growth over any 8-year span since 13.33% from 1966 to 1976. Hence, although it's been just about eight years since the 2001 tax cut and six years since the 2003 tax cut, the evidence to this point is that the Bush tax cuts decreased revenues over what they would have been, at least over the short term. This was true even in my prior analysis based on data through 2007, before the financial crisis of 2008.

Enough time has now passed that it's possible to take a look at the effect of these tax cuts on government revenues. The growth of receipts by source, outlays, and GDP over every 8-year period since 1940 is shown in the following graph:

The actual numbers and sources can be found at recgro8y.html. As can be seen in the graph and second table, real (corrected for inflation) individual income tax receipts declined 25.06% from 2001 to 2009. Even real total receipts declined 13.93% over that period. Finally, real GDP grew just 13.36% from 2001 to 2009. This was the lowest real GDP growth over any 8-year span since 13.33% from 1966 to 1976. Hence, although it's been just about eight years since the 2001 tax cut and six years since the 2003 tax cut, the evidence to this point is that the Bush tax cuts decreased revenues over what they would have been, at least over the short term. This was true even in my prior analysis based on data through 2007, before the financial crisis of 2008.

Comments

Post a Comment