Major Foreign Holders of Treasury Securities (update)

Exerting its new influence as the U.S. government's largest creditor, China yesterday demanded that the Obama administration "guarantee the safety" of its $1 trillion in American bonds as Washington goes further into debt to combat the economic crisis.

Further on, the article states:

China surpassed Japan last year as the largest foreign holder of Treasury bonds. Any indication that it intends to cease those purchases -- or, worse, stage a sell-off -- could drive up the cost of borrowing for the U.S. government, as well as send mortgage rates higher for millions of Americans.

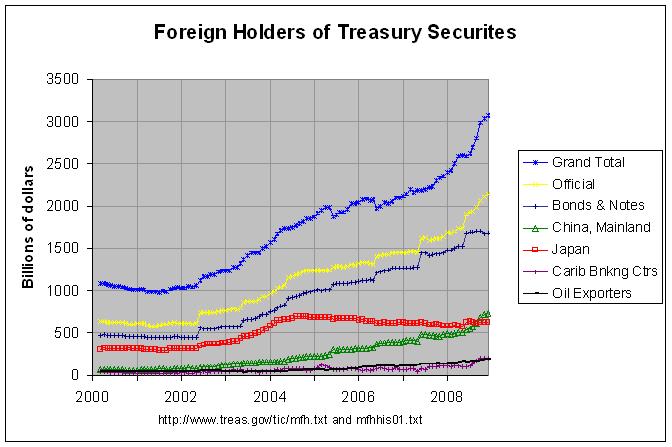

To my knowledge, the chief source for the amounts of Treasuries held by foreign countries is the Treasury Department. Each month, it posts updated estimates of the foreign holdings of U.S Treasuries by country at this link. It also posts estimates going back to March 2000 at this link. The following graph shows the totals for all countries by the type of treasury security and the totals for the four countries (or groups of countries) with the largest holdings at the end of 2008.

The blue line shows the grand total of all treasury securities held by all foreign countries, private and public. As can be seen, it has been increasing steadily since early 2002 and accelerated sharply at the end of 2008. The yellow line shows those securities held by "official institutions", defined on page 7 of the Report on U.S. Portfolio Holdings of Foreign Securities at End-Year 2004 as follows:

Official institutions consist primarily of national government and multinational institutions involved in the formulation of international monetary policy, but also include national government-sponsored investment funds and other national government institutions. Data on such institutions are collected separately because the motivations behind holdings of official institutions may differ from those of other investors.

The dark blue line just below the yellow line shows the totals for bonds and notes which are that portion of the total securities that are long-term debt securities, with an original

maturity of over one year. As can be seen, this long-term debt has not been increasing over the past half-year. Hence, the increase over this period appears to have been totally in short-term debt. More details on short-term and long-term debt securities can be found on page 7 of the Report on U.S. Portfolio Holdings of Foreign Securities at End-Year 2007.

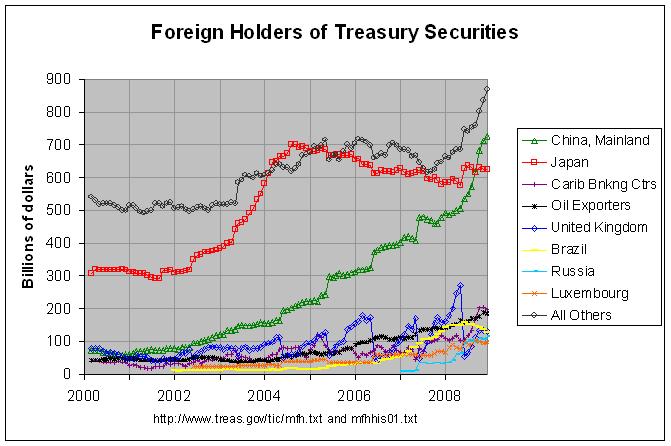

The other four lines show the holdings of the four categories of countries with the largest holdings. These can be seen in more detail in the following graph which shows the holdings of the eight countries with the largest holdings:

The actual numbers and sources for both of the above graphs can be found at this link. As can be seen, the holdings of Mainland China has risen steadily since early 2002, increasing nearly ten-fold from $76.5 billion in February of 2002 to $727.4 billion at the end of 2008. As mentioned in the article, China did surpass Japan as the largest foreign holder of Treasuries in September of 2008. In fact, Japan's holdings reached a maximum of $699.4 billion in August of 2005 and have fallen to $626 billion now. Also, I noticed a few other interesting things in the data. The United Kingdom's holdings soared from $50 billion in June of 2007 to $271.2 billion in May of 2008 and then dropped back to $55 billion in June of 2008. In fact, there appears to be a large continuing discontinuity between each annual survey for the United Kingdom causing a large saw-tooth effect in the graph. If anyone knows the reason for this, please leave a comment.

In any case, there are a number of other countries whose holdings have increased rapidly for some portion of the past eight years. The holding of Oil Exporters have more than quadrupled from $43.9 billion in January of 2004 to $186.2 billion now. The holdings of Brazil went up by more than a factor of ten from $14 billion in January of 2005 to $158 billion in June of 2008 but have sunk back somewhat to $127 billion now. The most recent rapid increase has been in the holdings of Russia which has gone up by more than a factor of fifteen from $7.4 billion in March of 2007 to $116.4 billion now. I would guess that most of this investment from Oil Exporters, Brazil, and Russia came from income from resources, chiefly oil. With oil having fallen from a high of $147 per barrel last July to the mid-forties now, it would have seemed likely that future investment in Treasuries by these nations would have fallen. However, only Brazil's investment had begun to decrease by the end of 2008. In addition, it would seem possible that China's future investment might slow due to it's own stimulus plans or for other reasons. The Washington Post article says the following on that topic:

Wen, however, stopped far short of saying China would cease purchasing Treasurys. Although analysts say China may already be moving to curb some purchases of U.S. debt, any move to sell off its current holdings would severely deflate their value on world markets -- hurting the Chinese as well as the Americans. Years of red-hot growth have allowed China to build up the world's largest reserves -- some $2 trillion. But analysts say almost half are held in U.S.-government-backed debt.

One final item of note is that the Washington Post article mentions Chinese holdings of "$1 trillion in American bonds". However, the Treasury figures show that China held just $727 billion in treasuries at the end of 2008. It seems likely that the $1 trillion figure includes holdings in Fannie Mae and Freddie Mac bonds. A September 18th New York Times article stated the following regarding China:

Its bond holdings of government-sponsored enterprises, estimated by credit rating agencies at $340 billion, rose in value by billions of dollars in a single day when the Bush administration made explicit the government guarantee of Fannie Mae and Freddie Mac bonds, causing their interest rate spreads compared with Treasury bonds to narrow by 5 to 35 basis points within hours.

The exact amount of China’s gain cannot be calculated without knowing the maturity and composition of its holdings of these bonds, which Chinese officials have not released, according to specialists in fixed-income securities.

Hi R Davis. I like your analysis. Independent from each other we have done exactly the same: going to the source of the news and looking at the bigger longer term picture. I think that every body involved (US, Japan, China) is maybe quite happy with the current division of foreign holdings of US Treasury Securities that looks more stable than the situation of 5 or 10 years ago. For my article on this topic, see:

ReplyDeletehttp://www.stocktrendinvesting.com/blog/foreign-holding-us-treasury-securities-10-year-historic-overview