Federal Reserve Balance Sheet

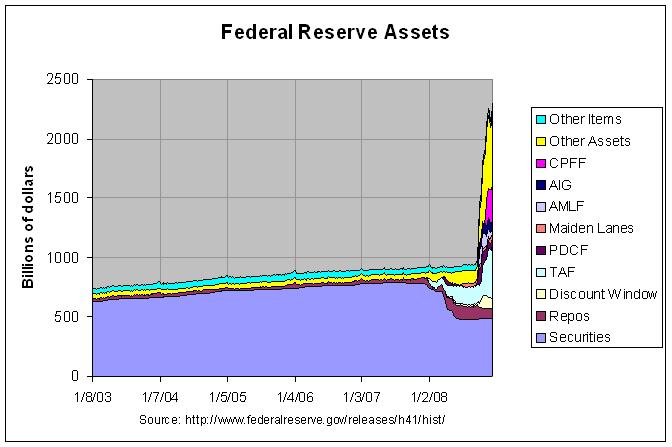

In addition to the weekly release, the Federal Reserve posts historical data going back to December 18, 2002. Tables 1 through 7 contain the weekly averages and tables 8 through 14 contain the corresponding data for each Wednesday. The weekly averages are the data that is most often referenced in the weekly H.4.1 release and elsewhere so that is what I look at in the remainder of this post. The following graph shows the composition of assets on the Federal Reserve Balance Sheet from 2003 through 2008:

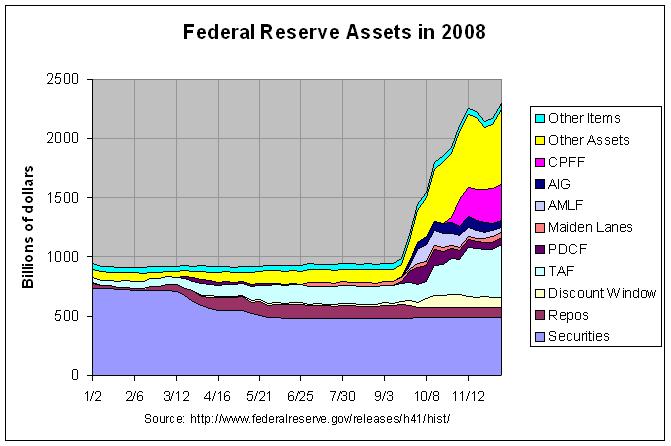

The actual numbers and sources for this and the following graph can be found at this link. As can be seen, the total assets rose slowly but steadily through 2007 and consisted chiefly of securities. The numbers at the above link show that those securities, in turn, consisted chiefly (currently over 97 percent) of U.S. Treasuries. Starting in early 2008, many of these securities began to be replaced by other assets, most notably those in the TAF (Term Auction Facility), Repos (Repurchase Agreements) and other assets. This can be seen in more detail in the following graph showing just 2008:

As can be seen, total assets began to increase rapidly in September of 2008. The largest contributors to this increase were TAF, CPFF (Commercial Paper Funding Facility), and Other Assets. According to the aforementioned Econbrowser post, currency swaps are probably the biggest single item of "other Federal Reserve assets". In any event, the above graph shows the confusing array of acronyms signifying programs which are now making significant contributions to the Federal Reserve Balance Sheet. Following is a list of those and some related acronyms with links to following text that describe them:

Key to Acronyms and Terms

-------------------------

AIG American International Group

AMLF Asset-Backed Commercial Paper (ABCP) Money Market Mutual Fund (MMMF) Liquidity Facility

CPFF Commercial Paper Funding Facility

Discount Window

ML Maiden Lane LLC

ML III Maiden Lane III LLC

MMIFF Money Market Investor Funding Facility

PDCF Primary Dealer Credit Facility

Repos Repurchase Agreements

RP Repurchase Agreements

RRP Reverse Repurchase Agreements

TAF Term Auction Facility

TALF Term Asset-Backed Securities Loan Facility

TARP Troubled Assets Relief Program

TSLF Term Securities Lending Facility

Note: Securities currently consist almost entirely (over 97 percent) of U.S Treasuries.

Other Items include Gold Stock, Special drawing rights certificate account,

Treasury currently outstanding, and Float.

American International Group

The Federal Reserve Board on Tuesday, [September 16, 2008] with the full support of the Treasury Department, authorized the Federal Reserve Bank of New York to lend up to $85 billion to the American International Group (AIG) under section 13(3) of the Federal Reserve Act. The secured loan has terms and conditions designed to protect the interests of the U.S. government and taxpayers.

The Board determined that, in current circumstances, a disorderly failure of AIG could add to already significant levels of financial market fragility and lead to substantially higher borrowing costs, reduced household wealth, and materially weaker economic performance.

The purpose of this liquidity facility is to assist AIG in meeting its obligations as they come due. This loan will facilitate a process under which AIG will sell certain of its businesses in an orderly manner, with the least possible disruption to the overall economy.

Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility

The Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility is a lending facility that provides funding to U.S. depository institutions and bank holding companies to finance their purchases of high-quality asset-backed commercial paper (ABCP) from money market mutual funds under certain conditions. The program is intended to assist money funds that hold such paper in meeting demands for redemptions by investors and to foster liquidity in the ABCP market and money markets more generally.

Commercial Paper Funding Facility

The Federal Reserve created the Commercial Paper Funding Facility (CPFF) to provide a liquidity backstop to U.S. issuers of commercial paper. The CPFF is intended to improve liquidity in short-term funding markets and thereby contribute to greater availability of credit for businesses and households. Under the CPFF, the Federal Reserve Bank of New York will finance the purchase of highly rated unsecured and asset-backed commercial paper from eligible issuers via eligible primary dealers.

When the Federal Reserve System was established in 1913, lending reserve funds through the Discount Window was intended as the principal instrument of central banking operations. Although the Window was long ago superseded by open market operations as the most important tool of monetary policy, it still plays a complementary role. The Discount Window functions as a safety valve in relieving pressures in reserve markets; extensions of credit can help relieve liquidity strains in a depository institution and in the banking system as a whole. The Window also helps ensure the basic stability of the payment system more generally by supplying liquidity during times of systemic stress.

On June 26, 2008, the Federal Reserve Bank of New York (FRBNY) extended credit to Maiden Lane LLC under the authority of section 13(3) of the Federal Reserve Act. This limited liability company was formed to acquire certain assets of Bear Stearns and to manage those assets through time to maximize repayment of the credit extended and to minimize disruption to financial markets. Payments by Maiden Lane LLC from the proceeds of the net portfolio holdings will be made in the following order: operating expenses of the LLC, principal due to the FRBNY, interest due to the FRBNY, principal due to JPMorgan Chase & Co., and interest due to JPMorgan Chase & Co. Any remaining funds will be paid to the FRBNY.

On November 25, 2008, the Federal Reserve Bank of New York (FRBNY) began extending credit to Maiden Lane III LLC under the authority of section 13(3) of the Federal Reserve Act. This limited liability company was formed to purchase multi-sector collateralized debt obligations (CDOs) on which the Financial Products group of the American International Group, Inc. (AIG) has written credit default swap (CDS) contracts. In connection with the purchase of CDOs, the CDS counterparties will concurrently unwind the related CDS transactions. Payments by Maiden Lane III LLC from the proceeds of the net portfolio holdings will be made in the following order: operating expenses of Maiden Lane III LLC, principal due to the FRBNY, interest due to the FRBNY, principal due to AIG, and interest due to AIG. Any remaining funds will be shared by the FRBNY and AIG.

Money Market Investor Funding Facility

The Money Market Investor Funding Facility (MMIFF), authorized by the Board under Section 13(3) of the Federal Reserve Act, will support a private-sector initiative designed to provide liquidity to U.S. money market investors. Under the MMIFF, the New York Fed will provide senior secured funding to a series of special purpose vehicles to facilitate an industry-supported private-sector initiative to finance the purchase of eligible assets from eligible investors.

Primary Dealer Credit Facility

The Primary Dealer Credit Facility (PDCF) is an overnight loan facility that provides funding to primary dealers in exchange for a specified range of eligible collateral and is intended to foster the functioning of financial markets more generally.

Repurchase and Reverse Repurchase Agreements

The Fed uses repurchase agreements, also called "RPs" or "repos", to make collateralized loans to primary dealers. In a reverse repo or “RRP”, the Fed borrows money from primary dealers. The typical term of these operations is overnight, but the Fed can conduct these operations with terms out to 65 business days.

The Fed uses these two types of transactions to offset temporary swings in bank reserves; a repo temporarily adds reserve balances to the banking system, while reverse repos temporarily drains balances from the system.

Repos and reverse repos are conducted with primary dealers via auction. In a repo, dealers bid on borrowing money versus various types of general collateral. In a reverse repo, dealers offer interest rates at which they would lend money to the Fed versus the Fed’s Treasury general collateral, typically Treasury bills.

Under the Term Auction Facility (TAF), the Federal Reserve will auction term funds to depository institutions. All depository institutions that are eligible to borrow under the primary credit program will be eligible to participate in TAF auctions. All advances must be fully collateralized. Each TAF auction will be for a fixed amount, with the rate determined by the auction process (subject to a minimum bid rate). Bids will be submitted by phone through local Reserve Banks.

Term Asset-Backed Securities Loan Facility

The Term Asset-Backed Securities Loan Facility (TALF) is a funding facility that will help market participants meet the credit needs of households and small businesses by supporting the issuance of asset-backed securities (ABS) collateralized by student loans, auto loans, credit card loans, and loans guaranteed by the Small Business Administration (SBA). Under the TALF, the Federal Reserve Bank of New York (FRBNY) will lend up to $200 billion on a non-recourse basis to holders of certain AAA-rated ABS backed by newly and recently originated consumer and small business loans. The FRBNY will lend an amount equal to the market value of the ABS less a haircut and will be secured at all times by the ABS. The U.S. Treasury Department--under the Troubled Assets Relief Program (TARP) of the Emergency Economic Stabilization Act of 2008--will provide $20 billion of credit protection to the FRBNY in connection with the TALF.

Troubled Assets Relief Program

Treasury today [October 14, 2008] announced a voluntary Capital Purchase Program to encourage U.S. financial institutions to build capital to increase the flow of financing to U.S. businesses and consumers and to support the U.S. economy.

Under the program, Treasury will purchase up to $250 billion of senior preferred shares on standardized terms as described in the program's term sheet. The program will be available to qualifying U.S. controlled banks, savings associations, and certain bank and savings and loan holding companies engaged only in financial activities that elect to participate before 5:00 pm (EDT) on November 14, 2008. Treasury will determine eligibility and allocations for interested parties after consultation with the appropriate federal banking agency.

Term Securities Lending Facility

The Term Securities Lending Facility (TSLF) is a weekly loan facility that promotes liquidity in Treasury and other collateral markets and thus fosters the functioning of financial markets more generally. The program offers Treasury securities held by the System Open Market Account (SOMA) for loan over a one-month term against other program-eligible general collateral. Securities loans are awarded to primary dealers based on a competitive single-price auction.

All but one of the above descriptions come from the Federal Reserve. That one exception is TARP since it is in fact a Treasury program. Of course, it would make sense to also read commentary from outside sources on these programs. However, it seems that the institutions that are running the programs are the logical place to start.

The 1913 Fed Reserve act (and Bagehot's Lombard) allow patient nursing of just about any troubled assets. Why is it any different if the Fed holds them, or if demagogic frivolities like RFC, RTC or TARP do so? It all goes back to Joseph's Pharaoh or Confucius ever-normal granary holding on to underpriced grain until famine. It is just Chinese casuistry to bicker about the junk being on the Fed or Treasury books.

ReplyDeleteThis comment has been removed by the author.

ReplyDelete