Are the 52 Months of Job Growth Under Bush Significant?

To build a prosperous future, we must trust people with their own money and empower them to grow our economy. As we meet tonight, our economy is undergoing a period of uncertainty. America has added jobs for a record 52 straight months, but jobs are now growing at a slower pace.

On February 1st, the Bureau of Labor Statistics released new jobs figures for January, showing a loss of 17,000 jobs. This ended the streak but Bush continued to mention the record of 52 consecutive months, often crediting it to his tax cuts. For example, on February 8th, Bush said the following during remarks to the Conservative Political Action Conference:

Despite these dire predictions, the tax cuts we passed contributed to a record 52 months of job creation. (Applause.) They helped produce strong economic growth -- and the increased revenues from that growth have put us on track to a balance our budget by 2012. (Applause.) Here is the bottom line: tax relief works. (Applause.)

Bush similarly mentioned the 52 month record and the role that his tax cuts played in bringing it about on February 25th and March 12th as did Vice President Cheney on March 10th and April 25th. It was of course mentioned by a number of other sources as well.

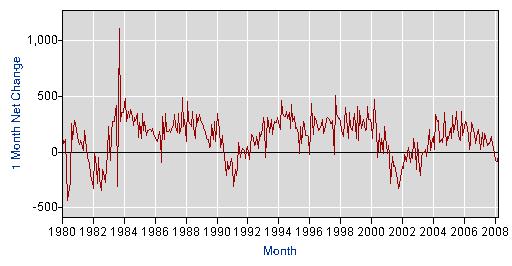

Was this 52 month record truly a significant achievement, surpassing the oft-mentioned job creation under Reagan and Clinton? Following is a graph generated on the Bureau of Labor Statistics website showing the monthly job growth in total nonfarm jobs since 1980:

Monthly Growth in Total Nonfarm Employment, Seasonally Adjusted (in thousands)

The actual numbers and sources are at http://www.econdataus.com/jobgro50.html. As can be seen, there were 52 consecutive months of job growth under Bush, from September 2003 to December 2007. However, Clinton missed having 86 months of consecutive job growth (from April 1993 to May 2000) by just three slight monthly declines of 16, 18, and 19 thousand jobs. And Reagan (combined with H.W. Bush) missed having 82 months of consecutive job growth (from September 1983 to June 1990) by just one monthly decline of 93 thousand jobs.

Did Bush's tax cut provide some special protection against small monthly declines? To answer this, one must first be aware of the fact that the job numbers are "seasonally adjusted". Without seasonal adjustment, the numbers would show a loss every January, at the end of the holiday season. In fact, they show a loss in every January on record (since 1940) and losses of over 2 million in every January since 1990.

Secondly, the method for calculating the seasonal factors changed in June 2003, just 3 months before the 52 month record started. The following explanation can be found on the Bureau of Labor Statistics website:

Concurrent seasonal adjustment

Beginning in June 2003, the CES program converted from its current practice of updating seasonal factors twice a year to updating them every month. Concurrent seasonal adjustment is technically superior to semiannual updates because it uses all available monthly estimates, including those for the current month, thereby eliminating the need to project the seasonal factors. With the introduction of concurrent seasonal adjustment, BLS no longer publishes seasonal factors for CES national estimates. For more information, please read the following paper on concurrent seasonal adjustment. (HTML) (PDF 182K)

Following is an excerpt from the first link:

As Table 1 illustrates, concurrent adjustment produces a smoother seasonally adjusted series for Total Nonfarm plus all nine industry divisions. Taken with the results from Figure 1, this indicates that CES will benefit from a switch to concurrent seasonal adjustment by producing employment series with less variability in the over-the-month changes.

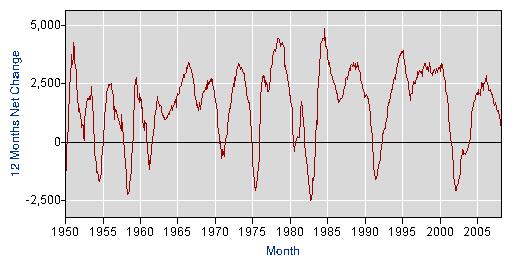

Hence, the 52 month record may be largely due to this change to concurrent seasonal adjustment. In any event, the above graph seems to show that the average monthly growth was higher under Reagan and Clinton. This can be seen much more clearly in the following graph which shows the 12-month growth in jobs since 1950:

12-Month Growth in Total Nonfarm Employment, Seasonally Adjusted (in thousands)

As can be seen, average job growth was clearly higher under Reagan and Clinton. This is also clear from my prior post of March 18th. In addition, the above graph shows that the length of positive job growth was much longer under Reagan and Clinton if one uses a longer unit of time (12 months in this case).

In summary, it seems clear that the record of 52 consecutive months of job growth is not indicative of superior job growth. Consecutive months of positive job growth is just one of many indicators and, in my opinion, one of the more flawed and least significant. Some would call the use of this statistic while ignoring other statistics to be cherry-picking. At the very least, it shows the importance of examining the data yourself and/or getting opposing views on any statistics that one comes across in the political arena.

Let's get off the "Bush" kick. The questions is: Does lowering income taxes help or hurt the economy.

ReplyDeleteThe fact is that Bush inherited a recession and only 8 months into office the U.S. suffered an economic loss of over a trillion dollars because of 9/11.

Despite those facts, there was a tax cut and the U.S. economy sustained 51 consecutive months of economic growth. Ergo, tax cutss work. (Regan did the same.)

To say that but for slight losses, Clinton would hold the record is ludicrous. If Joe DiMaggio didn't go hitless in the 57th game, his hitting streak would have been 73 games because he started another streak the next game. The fact is, he went hitless, the streak ended and the record stands at 56.

But again, the important thing is not that Bush has the record at 51, but that tax cuts work.

Good job John on nailing the real facts that matter.

ReplyDeleteWhat precisely are these "real facts"? John stated "there was a tax cut and the U.S. economy sustained 51 consecutive months of economic growth. Ergo, tax cutss work." Hence, he seems to be saying that tax cuts provide some sort of magical protection against a one-month decline in jobs but, as I clearly stated, that magical protection is only in the seasonally-adjusted numbers. Looking at the actual numbers, there's a job loss every January, at the end of the holiday season. In addition, this magical protection was helped by the "switch to concurrent seasonal adjustment by producing employment series with less variability in the over-the-month changes".

ReplyDeleteOr is the "real fact" simply that, as John says, "tax cuts work". As I state at http://www.econdataus.com/taxcuts.html: "There may well be valid arguments in favor of tax cuts. But higher tax revenues does not appear to be one of them". Do you and/or John concede that tax cuts do NOT work at raising revenue? If not, please tell me any specific numbers or conclusions in that analysis that you disagree with. Alternately, please provide a link to one serious economic study that purports to show evidence of any income tax cut that has ever paid for itself. Thanks.

First of all, John, Bush didn't "inherit a recession" he inherited a big fat surplus. And the fact that the economy tumbled after 9/11 only proves that 52 weeks of job growth is bogus because the economy had nowhere to go but up after 9/11

ReplyDeleteAnother myth there was no Clinton Surplus and as you remember Hillary was calling it the Bush Recession, when Bush wasn't in office long enough to change the drapes. You recall that Gore, wouldn't concede for months. http://www.craigsteiner.us/articles/16

ReplyDeleteIt is true that in 2001 when Bush took office the bubble was bursting and an economic downturn was beginning, so to blame GWB for that is probably unfair. Job growth was sluggish for pretty much his entire presidency as the blogger states but what I do remember is the Bush administration (looking for some good news to tout) proudly stated that home ownership was up. A "Ownership Society" they proclaimed. That was about the time that all the unscrupulous mortgage companies were pushing adjustable rate sub prime loans to people who had no chance of making the payments, and then the big banks bundled them up into bonds, sold them, and the rest is history. Obama inherited that and I think he and his people have done a pretty good job guiding us out of that catastrophe. Jobs are always the last aspect in a recovery.

ReplyDeleteThe same banks that were too big to fail under Bush have been allowed to grow by 25% since.

ReplyDeleteWells Fargo just paid a fine for not having enuff minority borrowers.

All the dominos that led up to the 2008 housing bubble are being put back in place.