Do Only The Rich Pay Taxes?

Rush begins the article as follows:

This is the data for calendar year 2003 just released in October 2005 by the Internal Revenue Service. The share of total income taxes paid by the top 1% of wage earners rose to 34.27% from 33.71% in 2002. Their income share (not just wages) rose from 16.12% to 16.77%. However, their average tax rate actually dropped from 27.25% down to 24.31%

Think of it this way: less than 3-1/2 dollars out of every $100 paid in income taxes in the United States is paid by someone in the bottom 50% of wage earners. Are the top half millionaires? Noooo, more like "thousandaires." The top 50% were those individuals or couples filing jointly who earned $29,019 and up in 2003. (The top 1% earned $295,495-plus.) Americans who want to are continuing to improve their lives, and those who don't want to, aren't.

The above statistics could well have the effect of angering anyone who makes more than $29,019 since it implies that they are helping to pay for the lower 50 percent of wage-earners. In fact, this is an example of the misleading use of averages. Following is a summary of the IRS data being cited by Rush:

PERCENT OF INCOME EARNED AND TAXES PAID BY SELECTED CUMULATIVE PERCENTILES

Top 50 Top 25 Top 10 Top 5 Top 1

Percent share of... Total Percent Percent Percent Percent Percent

----------------------------------------------------------------------------

Adjusted gross income 100.00 86.01 64.86 42.36 31.18 16.77

Total income tax..... 100.00 96.54 83.88 65.84 54.36 34.27

Population........... 100.00 50.00 25.00 10.00 5.00 1.00

AGI floor ($thousand) N/A 29.02 57.34 94.89 130.08 295.50

As can be seen, the upper 50 percent of wage earners, who earn about $29 thousand and above, did pay 96.54% of all income taxes. Now, following are the same numbers, divided up into distinct percentile groups:

PERCENT OF INCOME EARNED AND TAXES PAID OF SELECTED DISTINCT PERCENTILES

0-50 50-75 75-90 90-95 95-99 Top 1

Percent share of... Percent Percent Percent Percent Percent Percent

----------------------------------------------------------------------------

Adjusted gross income 13.99 21.15 22.50 11.18 14.41 16.77

Total income tax..... 3.46 12.65 18.04 11.48 20.09 34.27

Population........... 50.00 25.00 15.00 5.00 4.00 1.00

AGI floor ($thousand) N/A 29.02 57.34 94.89 130.08 295.50

As can be seen, the lower half of this "oppressed group", the 50 to 75 percentile, actually pays only 12.65 percent of all income taxes despite the fact that they make up 25 percent of the population. The next group, the 75 to 90 percentile, pays about 18 percent of all income taxes, slightly more than their 15 percent share of the population. However, the 18 percent is still less than their 22.5 percent share of income and is therefore less than they would pay under a flat tax. The next group, the 90 to 95 percentile, pays 11.48 percent of all income taxes, slightly more than their 11.18 percent share of income. Hence, it is primarily the top five percent of taxpayers, those making over $130 thousand, who pay more than they would under a flat tax, making up for the lower 90 percent, who pay less. This is a far cry from the upper half of taxpayers, those making over $29 thousand, referred to by Rush.

Rush goes on to list the share of income taxes paid and adjusted gross income earned by each cumulative percentile listed in the first table above. He also gives the prior year's figures in parentheses. As mentioned above, the cumulative percentiles do not give any information about what is going on in the distinct percentiles since every cumulative percentile contains the top one percent. In addition, it is a somewhat laborious task to then compare the share of income taxes paid and income earned by each distinct percentile as I did in the last paragraph. An easier method is to look at the average tax rate, also given in the IRS statistics. This is computed by dividing the total income tax paid by the total income earned of each percentile and hence takes both numbers into account. One can then compare these the average tax rate of each percentile to the average tax rate of all taxpayers to see which percentiles are paying more and which are paying less than the average.

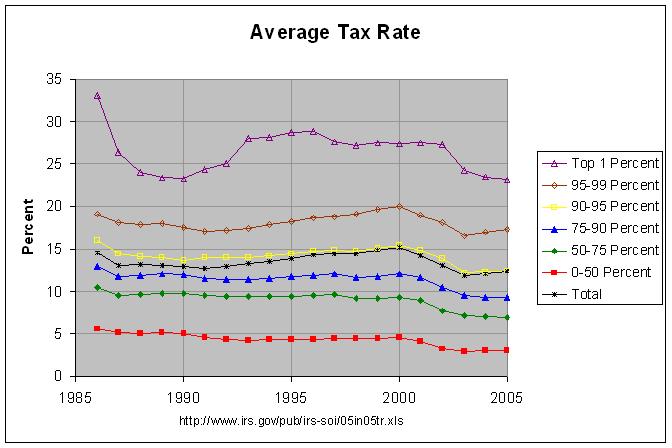

The following graph shows the average tax rate of all taxpayers and each distinct percentile from 1986 through 2005:

The actual numbers and sources are at http://www.econdataus.com/avgtax05.html. As can be seen, the top one percent and 95-99 percentile pay a clearly higher average tax rate and the 90-95 percentile pays a slightly higher average tax rate than the average tax rate of all taxpayers. All other percentiles pay a clearly lower average tax rate. This agrees with the analysis above. However, the graph shows that this general relationship has continued since at least 1986.

There are a couple of other items of interest apparent in the graph. One is that the average tax rate paid by the top one percent dropped sharply from 1986 to 1988. This followed the Tax Reform Act of 1986 which lowered the top marginal rate from 50 to 28 percent. Another item is that the average tax rates of all percentiles except for the top one percent dropped steadily from 2000 to 2003, following the tax cut of 2001 which phased in a lowering of individual tax rates. The average tax rate of the top one percent, however, stayed fairly steady through 2002 after which it dropped sharply. The explanation for this likely is due to the fact that the top one percent get a significant amount of income from capital gains which is taxed at a lower rate than ordinary income. Income from capital gains dropped sharply following the slump in the market starting in 2001 and this caused a higher percentage of the income earned by the top one percent to be taxed at the higher rate. This appears to have offset the affect of the phased-in cut in tax rates. However, by 2003 the market had begun to recover, increasing income from capital gains. In addition, the tax cut of 2003 lowered the top tax rate on capital gains and dividends.

So do only the rich pay taxes? Of course, the question is a bit misstated as the IRS data looks at taxpayers according to their income, not their wealth, and looks only at income taxes, not all taxes. Still, the data does show that those whose incomes are in the top 5 percent (and likely about half of those in the 90 to 95 percent category) pay more than the average tax rate. This is hardly surprising, however, since we have a progressive income tax with a top marginal rate of 35 percent. Even the top one percent (who make over $364 thousand per year) pay an average tax rate of just 23.13 percent. Hence, the statement that "only the rich pay taxes" is obvious hyperbole.

Best explaination I've read. I've always known Rush was a liar, and now you've proved it in black and white. Thanks.

ReplyDeleteThanks for the comment. You can find responses to some other prior Rush articles at http://home.att.net/~rdavis2/rush.html.

ReplyDeleteYour points regarding the difference between measuring income versus wealth are seldom stated but very important. You're obviously not a conservative as I am so please allow me to share with you some perspective.

ReplyDeleteMy wife and I earn well over $200K per year annually through ordinary income (a paycheck). If we lived in North Dakota we might be able to consider ourselves "rich" but since we live in California where our one bedroom condo cost us over $400K even a six figure salary doesn't go very far. We also have the privilege of being in the "top 5%" of income earners and the associated high tax rate but without any of the tax strategies available to a business owner or those that gain income through capital gains. We live a very modest life in our condo and instead of blowing money on expensive cars, vacations, or toys we save it. If we do lose our jobs, get sick, etc. we have sacrificed "immediate gratification" so that we don't have to depend on other tax payers to pay for the things for which we should and do take responsibility. So in essence we pay the most taxes and because we are responsible we use the least government services. There is no bail out for people like us who do the right thing - only to reward bad behavior and poor choices.

I'm just trying to make a point that having a higher than average salary, one that even falls into the top 5% does not make you rich. High net worth not income makes you rich. I am also making the point that most people are in the situation they are due to the choices they make. Obama has proven the conservative mantra that anyone can be a success in this country regardless of background or "at risk" environment. It just takes a lot of hard work - not a government program.

So your top 1% (lower end, $364K) pays about 23% income tax and 5% FICA (15% but only paid on the lower third of income) or 28% total. Someone making $90K pays 15% FICA (and research has shown that even if the employer pays half, that still comes out of the worker's pay) plus 13% income tax or the same 28% total federal tax, despite having only a quarter of the income.

ReplyDeleteWhen FICA was started, the high end incomes were taxed at over 70% so a cap on FICA seemed reasonable. Something is badly wrong when the people with much lower income are paying as high (or higher with capital gains) a tax rate. And the bottom end has no disposable income anyway, a much higher percentage of their income going to sales taxes on food and children's clothes, and other ad valorem taxes.